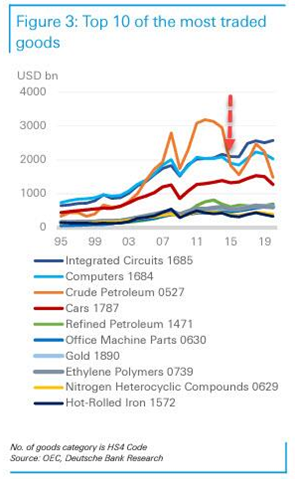

Here’s a trick question for you, what was the most traded global good in 2020?

Gold is a decent guess, but no…

Cars are still a relatively strong contender, but also no…

Oil is a close second and has long been in the number one spot…

The correct answer is, in fact, semiconductors.

Take a look for yourself:

|

|

| Source: Deutsche Bank/OEC |

In fact, since 2015, 15% of all globally traded goods have been tied to semiconductors. These increasingly tiny and powerful electronic chips are rapidly becoming a prized commodity.

When you think about it, that shouldn’t really be a big surprise. Almost everything has some sort of semiconductor in it nowadays — whether it be the obvious electronic devices or even things like fridges and washing machines.

Our homes, our offices, and our cars are all filled with semiconductors. They have become as integral to our society and lives as the raw materials that make up everything else.

And that’s why now, more than ever, governments are scrambling to secure and develop their own production of these important chips. After all, just like we’re seeing in a range of industries, the race to move supply chains away from China is a big factor…

Tech arms race

Now, if you’ve been a regular Money Morning reader, this topic won’t exactly be new to you.

I first started talking about this stuff back in September. And my colleague, Kiryll, broached the subject a little over two weeks ago as well.

But in the time since, there’s been yet more major developments.

For instance, the UK recently blocked a Chinese takeover of a Welsh semiconductor plant. Citing ‘a risk to national security’, it is clear that the British government isn’t willing to let this deal go through.

This, of course, comes after the US issued its own ban of US chipmakers exporting to China. The clearest and most direct escalation of this growing tech arms race.

At the same time, the EU is plowing ahead with a €43 billion plan to amp their own semiconductor production. That should put them firmly in control to reach their stated goal of making 20% of the world’s semiconductors by 2030.

And then, possibly most telling of all, was a move from Warren Buffett. The oracle of Omaha’s company, Berkshire Hathaway, is investing US$4.1 billion in TSMC — the biggest and most notable semiconductor manufacturer in the world.

As a Taiwanese company, you can no doubt understand why TSMC is important to both China and the US. But, with expansion plans already underway in Arizona, it is clear where TSMC’s allegiances lie.

What matters to investors like yourself is what this all means for markets.

Because aside from trade disputes and geopolitical conflict, this game of cat and mouse over semiconductor production is going to be huge for investors.

Not only is demand going up, but the underlying manufacturing process itself is also progressing rapidly.

What comes next

One article from Semiconductor Engineering perfectly summarises the situation:

‘The build-out of a duplicate supply chain that can guarantee capacity and essential electronic components is the most concentrated and costly technology buildout ever during a time of relative peace.

‘But it is raising concerns about talent shortages, duplicative inefficiencies, and a potential glut at some point in the future that will spawn price wars and inventory write-downs.

‘On the positive side, at least for the near future, it is creating one of the biggest booms in semiconductors and related services and equipment in the history of technology.

‘…Alongside of the larger economic changes, there is a seismic shift underway on the technology side, as well. A reduction in power, performance, and cost benefits from scaling, and the disaggregation of SoCs into heterogeneous packages, are creating significant churn throughout the chip industry.

‘For the past couple of process nodes, one of the biggest drivers for scaling has been the size of a reticle, which has been limited to 858mm². That, in turn, limits the number of functions that can be included on a single planar die.

‘This is basically a real-estate problem, and chipmakers are starting to circumvent this issue by using various types of advanced packages, bridges, and new ways to connect various dies and partition functionality.

‘But it is being compounded by an explosion in data and the need to process that data more quickly, and with the falloff in Moore’s Law benefits, solutions are becoming more complex, more customized, and much more difficult to design.’

In other words, this isn’t just about moving supply chains. It’s about evolving the entire industry.

Everyone involved realises that we need new solutions and new ideas to push semiconductors into a new era. That’s why all this incentivisation is being directed toward localised production.

Every nation or regional bloc wants to ensure they are self-sufficient in terms of manufacturing whilst also staying at the cutting edge of the technology. That isn’t going to be easy or cheap, but it is going to open a huge need for investment that you should be looking out for.

After all, if you can pick the right producers, designers, or engineers, then you can profit.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.