I hope you’re getting accustomed to the markets falling in the past few weeks. It seems like there’s nowhere to hide.

You remember how I often tout gold as a good place in times of trouble.

Well, gold is taking a hit too. Last week, it was still holding the fort at US$1,800 an ounce (AU$2,630). Now it’s trading below US$1,740 (AU$2,550). Expect further selling pressure in the coming weeks.

Gold has held itself well during the last two and a half years as the world became more chaotic.

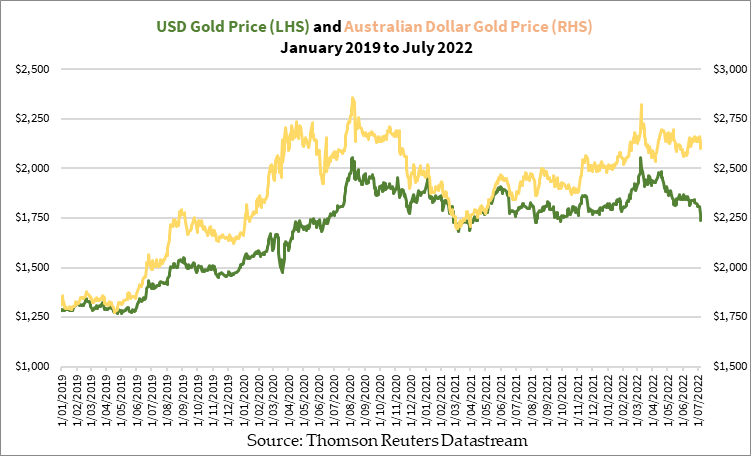

Let’s have a look at the gold price in US and Australian dollar terms in recent years:

|

|

| Source: Thomson Reuters Datastream |

The pattern seems to suggest gold could take a bigger dip if the trend continues. This is because the Federal Reserve has indicated that it will continue its aggressive path to control inflation. This means you should expect the July rate hike to lean more towards 0.75% rather than 0.5%.

Another sign that gold may not recover quickly is that the real yields are staying stubbornly above 1%. In other words, cash appears just a little more attractive now as it pays interest while gold does not.

Inflation is peaking, as suggested by the official rates and crude oil prices are showing us. So perhaps the Federal Reserve and central banks raising interest rates further will keep real yield up.

Have I suddenly turned bearish on gold? I should if I’m reading the trends correctly!

Sure, you hear about the gold price in US dollar terms. You’ll hear people say that gold hasn’t gone up much in the last 11 years. It topped at US$1,921 an ounce in early September 2011 and had a brief period in 2020, and late last year when it traded at more than US$2,000. It’s back down below US$1,800 an ounce. And maybe gold could fall below US$1,700 an ounce in the next two months, who knows?

But no, I’m not bearish on gold. Rather, I feel fine.

Following the bouncing ball of the US dollar

Let’s have a look at this figure below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

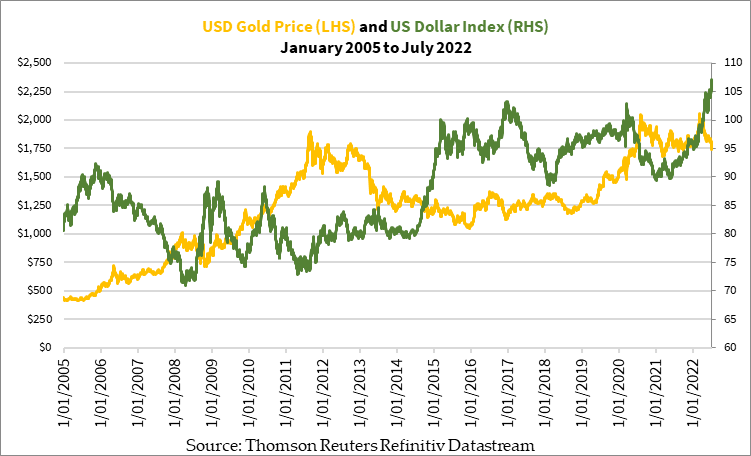

I’ve charted the gold price in US dollar terms and the US Dollar Index, which measures how the US dollar varies against six major world currencies (details here).

The gold price didn’t rise much in the last 11 years…correct. But the US Dollar Index has increased by almost 50% since its low in mid-2011. That happened during the US Government debt crisis when Congress almost shut down as it couldn’t cover its bills without increasing its borrowing limit.

The Federal Reserve came to the rescue in mid-2013 when it decided to play around with the short- and long-term bond markets and revived the markets (temporarily). The real yield rose significantly in April 2013, leading to gold taking a monumental smacking.

By early 2015, the Federal Reserve started talking about raising rates some time soon, which strengthened the US dollar. You can see that even though the price of gold didn’t fall much more in 2015, the US dollar strengthening meant that gold was actually increasing in value.

Then gold started making its amazing comeback from 2018, with the world noticing it in mid-2019. It started to break all-time record highs in almost every world currency.

Remember how gold traded at more than AU$2,000 an ounce for the first time in June 2019 and stayed above since?

Things are clearer when you look at this figure:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

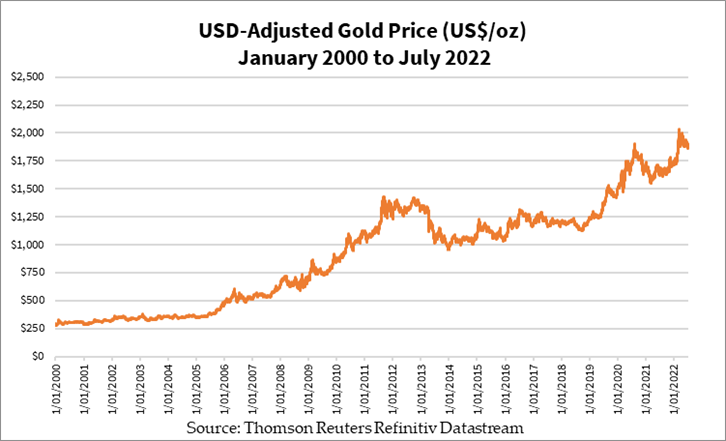

This is the price of gold after accounting for the changes in the US Dollar Index. You can say this is a good measure for the intrinsic value of gold. When the US dollar strengthens and the price of gold stays the same, gold has become more valuable and vice versa.

Has gold not gone anywhere the last 11 years, or even since the turn of the millennium?

It’s getting clearer now, right?

Central bank errors boost gold — before, now, and forever more

I took some time to think about how the Federal Reserve and central banks tinker with their monetary policy to try and fix the economy.

It’s an exercise in futility, and increasingly so.

That doesn’t mean they won’t stop anytime soon.

Gold happily rides along and gains value every step of the way. There are shakes and bumps.

Here’s another figure to put it into context:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

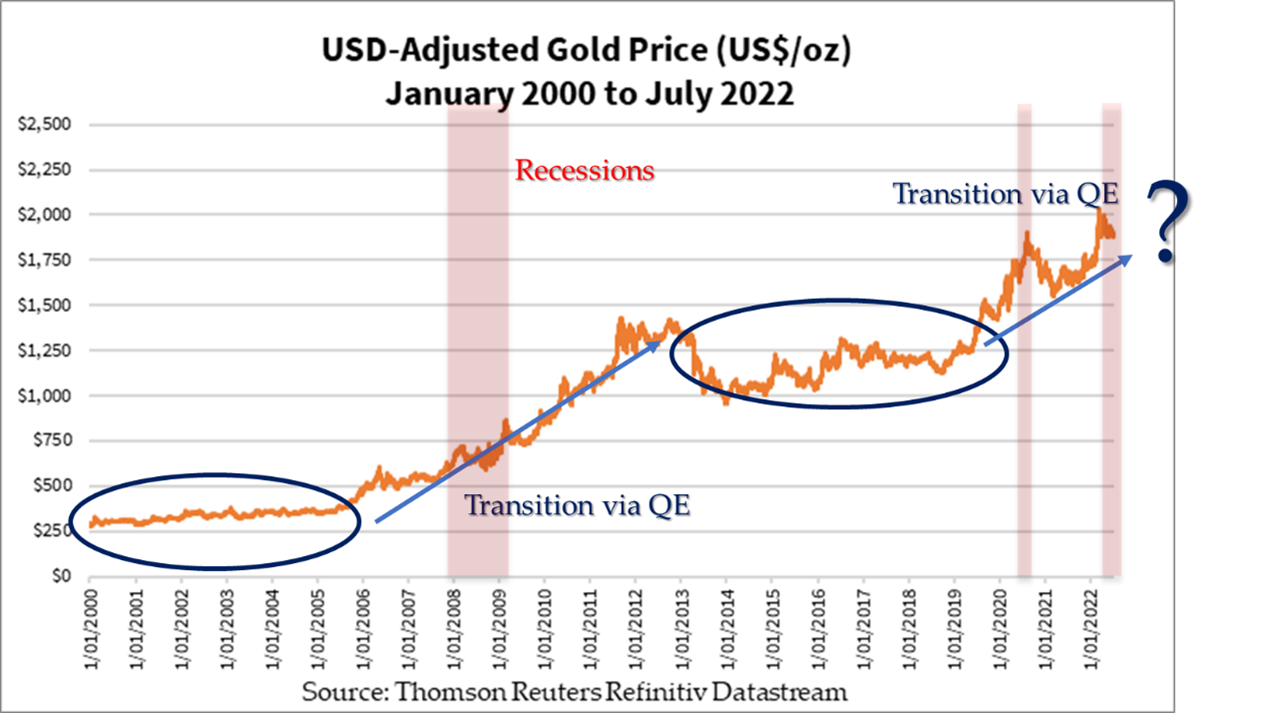

Gold trades in a rather tight range when the economy is stable. There’s little need to have an insurance policy when everything is fine. But it’s useful when things get rocky, that’s why you pay a higher premium for your home if you live in a bad neighbourhood.

Gold is the same.

Central bankers took seven years, from 2006–13, to get their economic ‘stability’. That lasted for five years or so.

We are now three and a half years into the next transition phase.

You expect them to fix it up quickly this time round? These rate hikes will magically work?

I doubt it. Not when the world is in increasing turmoil as people worldwide rally together to take on their corrupt government and business leaders.

Tongue in cheek, while the world is ‘burning down’, I feel fine with gold.

But more seriously, will they burn down the world?

I certainly hope not. But things will get rough so be prepared.

I’m at peace with my refuge in gold. I hope you find something for yourself.

We have something to get you started, if you’re unsure. Check out our model portfolio solution for troubling times here.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

Comments