Dear Reader,

The development in Ukraine has appeared to have taken a turn for the worse in the last 24 hours, at least according to the news headlines.

The markets reacted very quickly to this, with the global share markets falling almost 3% in a matter of hours.

Gold and oil caught a bid, rising almost 2% and 5%, respectively. Gold edged towards US$2,000 an ounce, and oil almost surpassed the US$100 mark.

Then, just as fast as people were adjusting to war, the markets reversed. It gave back almost all of its moves. Gold and oil are now at levels of before the missiles went flying.

It’s anyone’s guess where the market trades by the time you read this article.

Personally, I have many questions surrounding the events leading up to what is happening now.

There are so many pieces that don’t add up.

Sure, a war doesn’t have to make sense. There’s a lot of smoke and mirrors.

But there are aspects of what is going on that should make you go ‘hmm’.

One has to place a lot of pieces together and let the picture fit together. You cannot expect the nightly news or the wall-to-wall coverage of these outlets to inform you.

For one, leading up to the news of Russia declaring that it will conduct special military operations in Ukraine, both leaders said that they’re not going to war.

I’ve said this before; you would expect that the leader of Ukraine would become increasingly alarmed about the impending invasion by a much more powerful neighbour. You wouldn’t expect the Ukrainian government to put up troll posts mocking Western media about calling the invasion date wrong and asking for other predictions.

War is not a laughing matter. It is not like the Scottish troops pulling up their kilts and turning around and showing their bare bottoms to the English Army and then beating each other’s heads in, like the movie Braveheart.

So what exactly is going on?

I’m focusing more on the surrounding stories to help me make sense of it.

Wag the dog…start a war

Remember the movie Wag the Dog that came out in 1997 that was supposed to be a thinly veiled send-up of the Bill Clinton–Monica Lewinsky sex scandal?

There is nothing better to divert attention away from your scandals than to provoke an enemy and start a war.

And it’s not just about the scandal-ridden Biden administration either.

This time it’s about the entire Western governance system and the media complex. You may recall I wrote about this back in early December.

It appears things ar/the-mountain-of-lies-threatens-to-topple-over-anytime/2021/12/03/e coming home to roost.

The last month, we saw the increasing number of civilian-led protests over the government mandates and the increasing realisation by the public that the economy is falling apart and the government is doing little to help relieve the people’s plight.

Then, there is the massive bombshell that the Clinton campaign is now officially the target of criminal investigations for fabricating evidence against President Trump in the 2016 election.

The media spent more than four years telling us it was a sure deal. President Trump was a Russian spy. It’s a really bad look to find out that they peddled a fake story, and people are facing criminal charges.

This could turn into something huge, implicating several governments (including Australia as we are part of the ‘Five Eyes’ alliance that share intelligence), intelligence agencies, media, and business circles.

All this is happening as poll numbers for most Western incumbent governments are in the toilet. Best to start posturing by poking the bear — Russia’s President Putin. That should divert the attention away and save face.

You can say that this is nothing short of disastrous for the powers that be.

Protect your wealth, how gold is the answer

There’s going to be much red in the world the coming few months.

Red in the markets.

Red numbers in financial statements.

Red faces in high society.

Blood in the streets, though I pray that won’t be the case.

But I hope that you spare yourself from being a casualty during such times.

Gold was a laggard in the pantheon of investment assets for much of the last 18 months. It was literally the butt of jokes. Think of all those swipes people levelled at gold.

Have a look at how it performed in the hours after the news broke of the escalating conflict in Ukraine (and the subsequent bounce):

|

|

| Source: Market Watch |

Those who taunted at this 6,000-year-old safe haven, I wonder how they are faring now. When war occurs, people will go to gold.

Let’s have a look at how the ‘star assets’ performed during the same period.

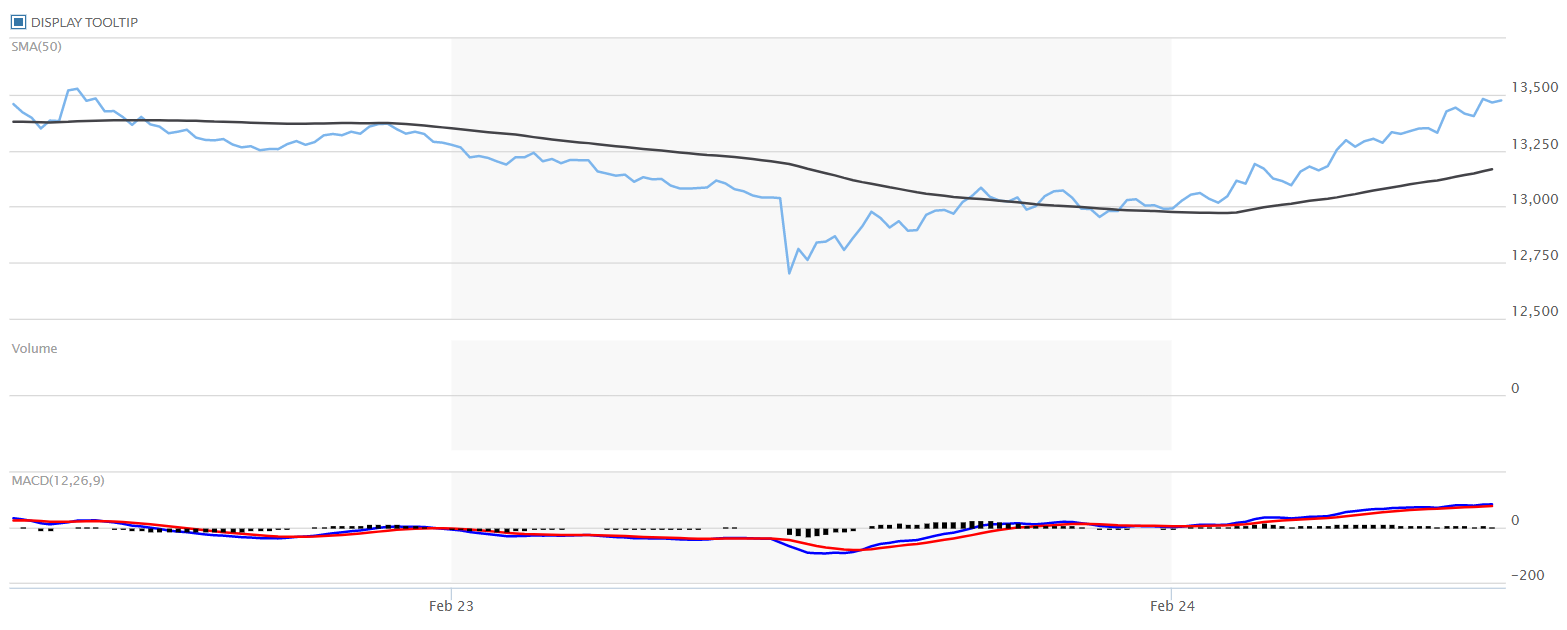

Here’s the NASDAQ Index:

|

|

| Source: Market Watch |

Here’s Bitcoin [BTC]:

|

|

| Source: Kucoin |

And Ethereum [ETH]:

|

|

| Source: Kucoin |

This should put to bed any doubts on which are safe haven assets. Gold is. Period.

It takes a serious crisis to let gold show its true colours, even if this crisis seemed to subside so quickly.

At least for now…who knows if tensions will rise further.

Gold is not going away anytime soon as a way to preserve and even grow your wealth.

With economic woes likely to linger for much longer than the conflict in Ukraine, I expect that gold and gold investments will outperform against the other assets.

You should take a look at how I have built my wealth with gold investments in the past eight years. It doesn’t take a war to do so. There are other events that can cause it.

Right now, it seems like it is all lining up in gold’s favour.

Check out what my ‘niche gold’ investments are all about here.

In the meanwhile, continue to pray that conflicts in the Black Sea region will subside and that other parts of the world don’t see any escalation in tension.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

Comments