In today’s Money Morning…the economy, stupid!…the Chinese economy, stupid!…we’ve gone from fighting over money, to fighting over what money is…and more…

|

Murray Dawes pointed out something which I’d completely forgotten the other week.

Namely, that one of China’s two main stock markets was well off its all-time highs.

Check out the Hang Seng Index [HSI]:

|

|

| Source: Tradingview.com |

This Hong Kong exchange is about 25% below its all-time high at the start of 2018.

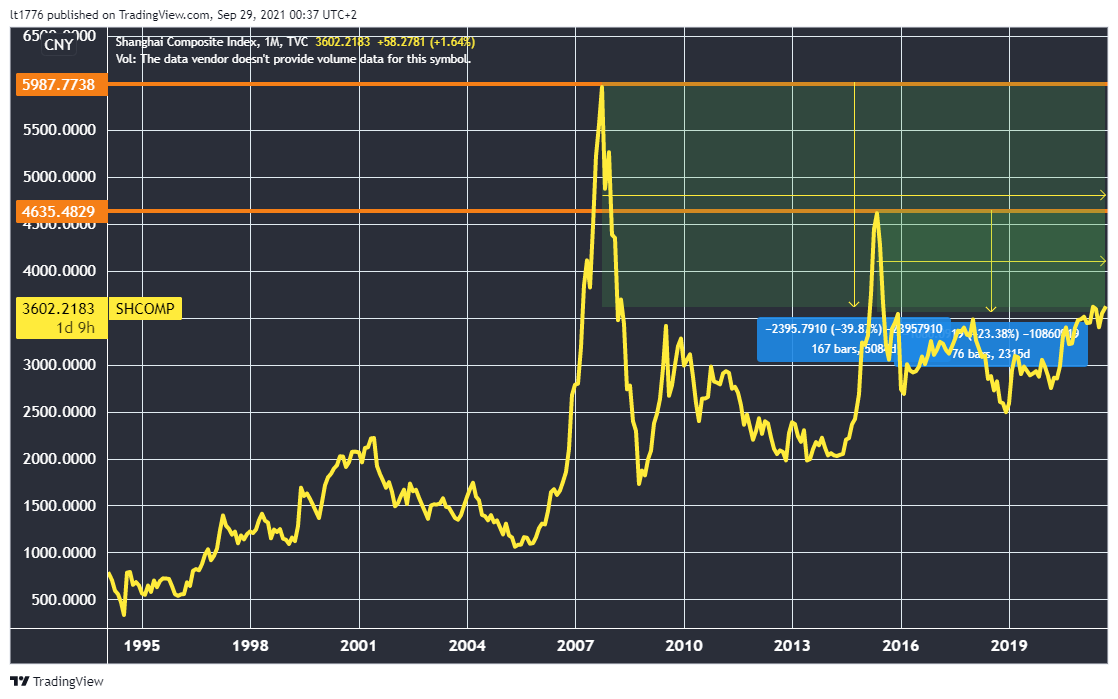

The other, the Shanghai Composite Index [SHCOMP], is nowhere near its all-time highs as well:

|

|

| Source: Tradingview.com |

The most recent high for this Chinese index was back in 2015, and it’s a whopping 40% or so off its all-time high just before the GFC changed everything.

So when Murray pointed out this little factoid, a little light bulb went off in my head.

Namely, that when you think about the showdown between the West and China, you have to realise that ideology is shaping priorities.

Intriguingly, this has massive implications for Aussie investors, and I’ll show you what I mean at the end.

First, though, consider this.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

The economy, stupid!

Bill Clinton’s chief strategist once made a key point to the would-be president about the primacy of the economy for American voters.

Fast-forward some 30 years later and the mantra may’ve changed to this — the market, stupid.

What I’m trying to say is this:

- The GFC started the break-up between markets and the economy in the West

- The pandemic and the deluge of monetary and fiscal stimulus that came with it effectively severed the link

I’m not sure the two can ever be fully patched up — which may explain why value investing is so firmly out of vogue amongst many investors.

Call it crazy town, call it an abdication of reason, or whatever you like.

But in the West, we’ve become obsessed with the market instead of the economy.

Aussies know this too well, as much of their retirement is tied up in markets via their superannuation.

The Chinese economy, stupid!

China, on the other hand, clearly doesn’t give a damn about how their markets fare.

There’s a lot of talk about ‘common prosperity’ in China these days as the country clamps down on less-than-masculine protagonists in the media, reduces the amount of time children can spend on video games, and basically crumples the empires of tech oligarchs like Jack Ma.

China, due to its ideology, has completely different priorities to the West — and it’s all about the economy.

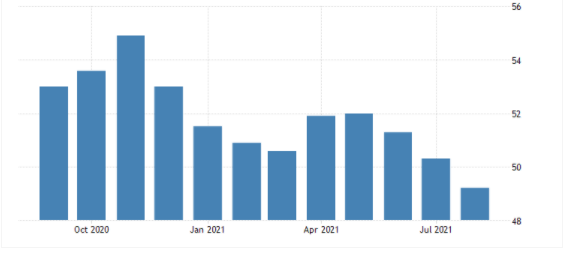

Here’s the Caixin China General Manufacturing PMI:

|

|

| Source: Tradingeconomics.com |

That’s a pretty consistent downtrend for this key barometer of the Chinese economy and a reading below 50 indicates the output of their factories is contracting.

As Trading Economics explains:

‘[It] fell to 49.2 in August 2021 from 50.3 in July, missing market estimates of 50.2. This was the first contraction in factory activity since April 2020, dragged down by containment measures to curb rising cases of the Delta strain, supply bottlenecks, and high raw materials. Output shrank for the first time in 17 months; new orders dropped for the second month which was the steepest rate in 16 months, and exports sales contracted for the first time since February.’

Because this fall in output is in part due to high raw materials prices, this also explains the move to release metals from their strategic reserves.

Which just goes to show…

Without growth and thus jobs for the lower rungs of China’s social strata, the authorities’ power would likely wane.

Everything China is doing now is an attempt to shore up support in their society from the bedrock of their rule — the working class.

It makes sense.

The West favours markets, and China favours the economy — that’s the punchline.

It’s not necessarily a massive insight at first glance, but if you look deeper into it, this insight explains a lot of what is happening now.

And more importantly, what could happen down the track.

Here’s what’s bubbling below the surface…

We’ve gone from fighting over money, to fighting over what money is

This is the crux of the matter.

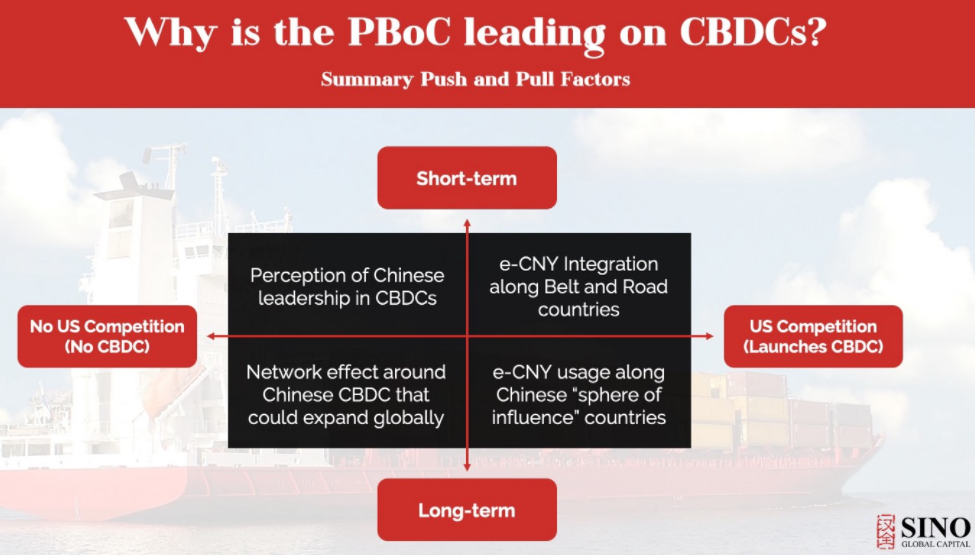

China’s e-CNY, the new CBDC, is looking to insert itself into the techno-monetary competitive landscape.

I read through some great slides from Sino Global Capital recently which explains why China wants this.

Here’s one that really stood out:

|

|

| Source: GitHub |

No doubt, this is a carefully planned strike on US dollar hegemony.

Win the money war and you win the new Cold War.

If you don’t like the sound of e-CNY, I don’t blame you.

The alternative is clear — crypto.

So definitely look into New Money Investor if you haven’t already.

This service will guide you through how to position yourself ahead of some massive structural changes in the world of money.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here