Governments are ‘problem creators’, not ‘solution providers’.

Overpromise, under-delivery, and massive cost blowouts are par for the course with almost every headline grabbing political thought bubble.

Personally, when it comes to elections, my vote goes to the person who promises the least. They’ll have told less lies and will break less promises.

But I accept this is the minority view.

Society, in the main, wants, wants, wants.

Appalling track records on the delivery of promises and an inability to exercise budget restraint appear to be irrelevant considerations.

Experience overwhelmingly shows us government ‘reforms’ are invariably the ‘thin edge of an ever-expanding wedge’.

Once introduced, these schemes — no matter how well intended — only increase in size and expense…becoming costly problems for future taxpayers.

Social spending…a classic ‘edge to wedge’ example

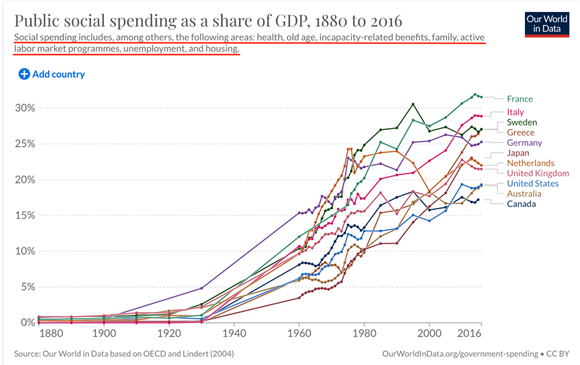

When originally introduced a century ago, to help the aged and most disadvantaged in society, social spending in Western economies represented a few percent of GDP:

|

|

| Source: Our World in Data |

Since then, governments of all stripes have widened the ‘thin edge’ to include all manner of welfare programs.

What was once considered a ‘handout to help the neediest’ is now seen as an entitlement.

Any change to what we firmly believe we’re entitled to is met with backlash. Right now, the French are protesting over an increase in the pension age from 62 to 64.

By the way, look which country sits on top of the list of social spending expenditure…France.

Australia’s recent history is littered with ‘thin edge of the wedge’ schemes.

NBN

Remember when the self-proclaimed ‘economic conservative’, PM Kevin Rudd, dreamed up the National Broadband Network? We needed to ‘future proof’ our nation with a high-speed fibre network. Sounded good. But at what cost?

The original $10 billion budget has blown out to around $60 billion.

And as reported in the Financial Review in December 2022:

|

|

| Source: Financial Review |

And Kevin ’07, the architect of this monumental financial failure, gets to live ‘high on the hog’ in a taxpayer funded mansion in Washington. That’s how it works folks. We get shafted with the bill, not once, but twice.

NDIS

What about Julia Gillard’s National Disability Insurance Scheme (NDIS)?

The concept of the scheme was noble and worthy…offering financial assistance to the disadvantaged in society.

No one could fault the ideal.

Personally, we have friends who have benefitted greatly from the support provided.

However, the ‘thin edge of the wedge’ principle has once more been applied.

The original budgeted cost has been blown out of the water.

As reported by the Financial Review in October 2022:

‘From a limited rollout in July 2013, the National Disability Insurance Scheme has experienced rapid growth and now counts more than 530,000 participants.

‘Disability Minister Bill Shorten revealed last week the budget for the program had blown out by another $8.8 billion over the next four years, taking the scheme’s annual running cost in 2026 to $50 billion.’

Here’s Bill’s great insight into why costs are going parabolic:

‘With more people joining the scheme, fewer people than expected leaving, and service levels increasing the longer people stay on, costs are forecast to grow steadily.’

With a century of experience on how social spending programs work, no one saw that coming? Give me a break.

Climate change

Then we have the cost of fighting ‘climate change’.

If you listen to the political and greenie celebrity rhetoric, no amount of money is too great to allocate to this ‘threat’.

The Climate Council proudly declared:

‘The Federal Government’s 2023 budget is the first in a decade to take climate seriously as both an opportunity and a threat for the Australian community. The new government has lifted investment in climate action from virtually nothing in the May 2022 Budget to $24.9 billion in this update.’

Two questions.

We are already in debt to the tune of $1 trillion, where do we get this $24 billion from and what do we, as a nation, gain from spending one red cent on this ‘fight’ against something that has occurred naturally for millions of years…an ever-changing climate?

If our island nation was swallowed up by the rising oceans tomorrow and all our nasty CO2 emitting equipment went underwater, what difference would this make to global emissions?

Succinct answer…three-fifths of five-eighths of sweet nothing.

China would replace our nation’s carbon output within a matter of days/weeks/months.

So why are we spending billions we don’t have on something we cannot change?

The word ‘dumb’ comes to mind.

However, such logic fails to resonate with the broader public. We must do something, anything to ward of this (Al Gore enriching) threat. Bureaucracies are created. Green think-tanks funded. Lobbyist employed. The list of hangers-on just goes on and on.

All for what? Little, if anything, of material gain is achieved.

But that’s what happens with ‘thin edges of the wedges’ — they get bloated and more expensive.

And we haven’t even touched on the burgeoning costs of healthcare and defence or the waste and incompetence at the state government level.

Which brings us to…

The latest ‘thin of the wedge’ proposal…the Voice

On 29 August 2016, Chair of the Prime Minister’s Indigenous Advisory Council Warren Mundine said on the ABC’s Q&A:

‘We sat down with the Productivity Commission. We looked at the Indigenous space. $30 billion is spent in this space annually. $30 billion on 500,000 people and you still see the problems you get to see. What that tells me straightaway as a businessman, because I run my own business, is there’s a lot of fun and games going in there and we need to sort that out and we need to find out where the wastage of our funding is.’

Seven years ago, $30 billion PER ANNUM was being spent on a host of Indigenous programs and agencies.

What’s that figure today?

From what we know of ‘thin edges of the wedge’, we can be sure the number will not be less.

THIRTY BILLION DOLLARS ANNUALLY for SEVEN YEARS…that’s $210 billion, and we still have an indigenous problem?

How is that possible?

Why hasn’t PM Albanese addressed this ‘rather large elephant in the room’ before embarking on his grandstanding crusade for Constitutional change?

Was the wastage Warren Mundine mentioned, ever identified?

I know…that’s a rhetorical question.

Here’s a suggestion for our PM.

Before proceeding with the referendum to establish another Indigenous agency — and you can bet ‘London to a Brick’ a whole bureaucracy will spring up behind the proposed Voice — why not do a root and branch audit on why $210 billion has not been enough to fix the Indigenous problems? Is there a duplication of services? How many hangers-on are there?

How much of the $30 billion per annum actually makes it to where it is meant to go?

What Australians — those of all race, colour, and creed — should be concerned about is the Voice becoming another ‘thin edge of the wedge’.

Taxpayers are already contributing at least $30 billion per annum to Indigenous affairs. How about we sort out why this hasn’t delivered value for money before embarking on a process of throwing more money at the problem?

We have enough ‘thin edge of the wedges’ already to fund.

What the government doesn’t have enough of are the tax revenues needed to meet the already increasing costs of existing programs.

Inflationary pressures are building

Interest payments on our national debt are going…UP.

Funding the war on climates is going…UP…which in turn, pushes UP energy costs.

NDIS cost is going…UP.

Defence spending is going…UP.

Healthcare and Aged care spending is going…UP.

Budgets, forever and a day, are going to be dripping in red ink.

Globally, we have an inflation problem caused by excessive government handouts during the pandemic. Governments spending serious amounts of money they don’t have is only going to stoke the inflationary embers. Who is going to buy all the government bonds? Central banks printing more money? Are the political class that stupid they cannot learn from our most recent history? It appears to be so.

Costs need to be reined in…the last thing we and future generations can afford is another open-ended ‘edge to wedge’ program that sees a massive blowout in the already $30 billion per annum taxpayers are funding. And, in 10 years’ time, will the problem be fixed, or will the call go up for even greater funding?

If government’s woeful track record on delivery of stated outcomes is anything to go by, my (and my children’s and grandchildren’s) taxpayer money is on the latter.

Two more wedges

You don’t need to be Einstein to figure out why Treasurer Chalmers is looking for a bigger slice of your retirement capital. He needs money to finance the exponential cost wedges.

In typical style, they pick a big number to target…those with more than $3 million in super.

The crowd loves it. Screw the rich guy and gal.

Be careful what you wish for…these ‘reforms’ are all thin edge of the wedge.

Eventually, the majority get caught in the tax trap they once thought would not apply to them.

The other, even more potentially damaging wedge from the Voice is the racial divide it might create within society.

As vocal critic of the Voice, Senator Jacinta Nampijinpa Price, said:

‘This government has yet to demonstrate how this proposed Voice will deliver practical outcomes and unite rather than drive a wedge further between Indigenous and non-Indigenous Australia.’

For the sake of our nation’s long-term well-being — financially, economically, and culturally — I will be voting NO to the Voice.

The last thing Australia needs is another wedge.

Don’t miss James Cooper’s Phase One presentation

Inflationary pressures within the global economy might abate, but if the 1970s is any guide, falls in CPI readings tend to be more temporary than permanent.

In every corner of the developed and developing world, there are a multitude of ‘wedges’ with insatiable appetites for taxpayer money.

War machines. Climate change. Health care. Welfare.

Funding these open-ended commitments with greater and greater deficits is going to keep the CPI needle well above the targeted range.

How do you protect the buying power of your capital in inflationary periods?

Hard assets.

Precious metals and commodities.

Here, at Fat Tail Investment Research, we’re fortunate to have James Cooper, an experienced field geologist, on the editorial team.

James is launching a new service to identify outstanding prospects (no pun intended) in the junior resource sector.

If you’d like to hear more from James about the exciting potential in this sector, please go here to register for his free presentation this Thursday.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia