Towards the end of last year, I explained what I think are the two biggest trends for 2020: More mining merger activity and more exploration.

Now, this isn’t just some idea I whipped up out of thin air.

It’s a conclusion I came to after speaking with many experts in the industry throughout the year.

Whether it was a mining boss, geologist, investment analyst, or some overworked PR rep, everyone was telling the same story.

Money for exploration has been almost non-existent and as a result confirmed resources are falling…

Exploration has halved

In several of the interviews I’ve conducted recently — from Rick Rule, Adrian Day, and other geologists and top brass mining CEOs — they’ve all said similar things.

That is, the lack of money spent on exploration means future consumption of minerals is on the edge.

Big mining companies have seen their ore reserves fall because they haven’t been actively looking for more.

Falling reserves have been a contributing driver of all this merger activity as well.

This isn’t just Australian miners either. The amount of money spent on exploration globally has halved since 2012.

Check this out…

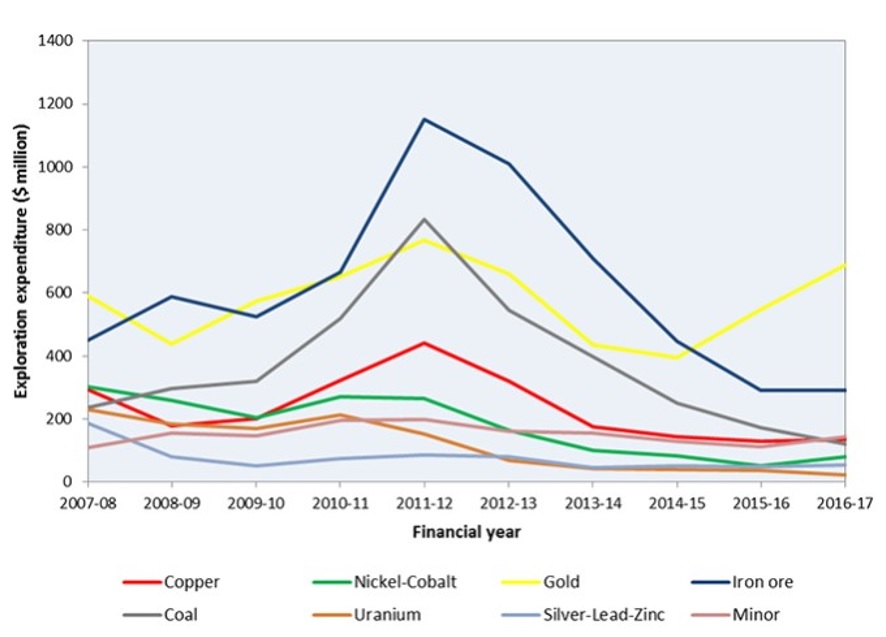

Aussie miners halve spending on exploration

|

|

|

Source: Geoscience Australia |

So let’s put this in perspective.

In 2012, it was estimated that Aussie miners spent $3.6 billion on exploration…

Yet two years later exploration spending sank…and spending has struggled to recover since.

Except for gold.

[conversion type=”in_post”]

The yellow metal is one of the few commodities that saw a resurgence in exploration spending a few years ago.

And in 2018, some $2.2 billion was spent on exploration.

Gold took up a whopping 41% ($891 million) of Aussie exploration budgets.

The problem with this, is that the money is being spent on brownfield sites.

That is, digging deeper or wider with existing old, historic mines that have been out of production for some time.

However, the annual Geoscience Australia minerals report recently noted that miners need to start spending more on greenfield sites (a site that has never been explored), as that’s really what will drive long-term value for the industry.

If that’s the key to remaining a serious global miner, why don’t more companies do it?

Simply because it means more risk…and higher costs.

All of which impacts the price of a stock.

See, every late-stage explorer has a one in 300 chance that it will become a mining development.

Yet those odds get smaller for the early-stage explorers.

An early-stage explorer (one that might have done some airborne studies, but no drilling for example) has a one in 660 chance of becoming a top-tier discovery.

In other words, finding a high-quality, low-cost, long-life potential mine.

But when it comes to a greenfield site, the odds of finding a top-tier mine are even more unlikely…

One in 1,000 chance

This means the odds of an undiscovered patch of dirt turning into a mine are even more remote.

In fact, a genuine greenfield plot that has had no exploration has a one in 1,000 chance of resulting in a mine.

Not only that, more often than not, on average it takes about 12 years from the first shovel going into the ground to an operational mine.

So if it’s obvious that more money needs to be spent on greenfield sites…

And it’s obvious that more money needs to be spent on exploration period…why aren’t more companies just doing it?

Two words: risk and shareholders.

See, shareholders are a fickle bunch.

They want to make money…but they don’t like losing money.

No one does.

But some sectors of the market carry more risks than others.

Most shareholders love the promise of a hunt, or the suspense that comes before drill results. There are some investors that really enjoy the high-risk reward trade of speculative stocks.

The thing is, you don’t buy into blue chip mining stocks for high risk…

Chances are if you’re buying into blue chip mining stocks, you’re after a less risky way to benefit from the underlying commodity price.

And big miners know that shareholders don’t come to them for a high-risk, high reward punt.

Plus, big miners know the odds.

Finding a high-quality, low-cost, long-life potential mine is a long shot.

Big mining companies are aware of these odds and have no intention of adding that risk to their share price shareholders.

Simply put, exploration means more risk and higher costs. All of which impacts the price of a stock.

This mentality has filtered through mining firms globally.

Leaving the little guys to do all the grunt work.

What does this mean for investors?

Given the high risk of finding quality deposits, just taking a punt on tiny exploration stocks isn’t enough. You need to be talking to people in the know.

The sort of people that are already working on the big gold find…or finding the people in the room who are funding it.

That means, it’s one thing to interview the biggest gold analysts in the world. But you’ve got to have the geos, engineers, and money men on speed dial too.

And that’s exactly what I’ve been working on over here.

|

Until next time, |

|

Shae Russell, |