Well, it didn’t happen.

At time of writing, there is no crash in sight.

For now.

The S&P 500 [SPX] closed up .45% to 3,130.01, on Friday Aussie time.

The ASX 200 [XJO] also headed higher, just above the 6,000 mark to 6,047.2, at time of writing.

What does it mean?

It means, the concerted monetary gymnastics of central banks around the world are (kind of) doing the trick.

On Wednesday, we had a look at the disconnect between economies and markets.

And the US certainly defied expectations with the latest job numbers, adding a record 4.8 million jobs.

Sparring between Joe Biden and Donald Trump ensued.

Dividend disaster! Find out why bank dividends could be under serious threat

Introducing the trust quotient

In the long arc of history though, this is all fluff.

The real story is what’s happening at the heart of the monetary system.

The spend on stimulus dwarfs what was deployed during the GFC.

The Federal Reserve is pledging to keep rates low for an extended period of time.

Negative rates are off the table for now, apparently.

Read: Definitely on the table if things head further south — and the implications of a negative Fed rate are massive.

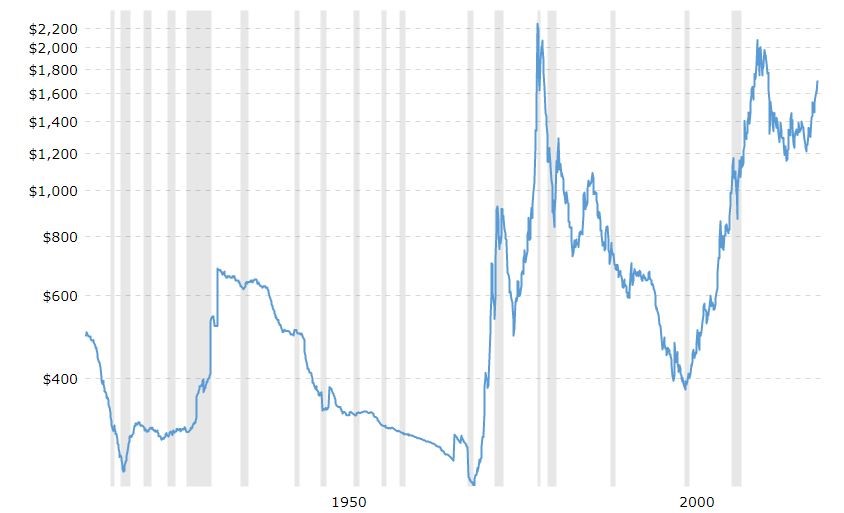

Without delving too deep into the history of money, since the US dollar was removed from the Gold Standard the inflation-adjusted gold price went on a big run:

|

|

| Source: Macro Trends |

What to make of this…

Is this a representation of how many people don’t trust the new iteration of the global financial system (as of 1971)?

I believe so.

Call it the trust quotient.

Trust is an ethereal term, but one thing you can be sure of is that endless rate tinkering and debt-funded growth leads to the decay of it.

And I think there is another asset which thrives in a low-trust environment.

This is cryptocurrency, and Bitcoin [BTC] remains the favoured vehicle for bets on a bank-less future.

Maybe even a central bank-less future.

Indeed, Satoshi’s timestamp on the first block referenced a headline about the bailout of banks in The Times.

Two technologies, two exit strategies

Let’s take a look at how both gold and bitcoin have performed since the March market low.

I’ve matched up the price of gold in USD terms and the price of BTC against the S&P 500 [SPX] below:

|

|

| Source: tradingview.com |

As you can see, BTC took a harder plunge from the February peak to the March trough. It also bounced back stronger against [SPX] while gold kept chugging along.

Now remember, this is gold in USD terms and BTC in USD terms — the US Dollar Index [DXY] spiked in March as well, as everyone scrambled for greenbacks.

DXY is an index which tracks the strength of the US dollar against a basket of major currencies.

The main point is that BTC and gold are outstripping stocks.

It’s not a revelation, but it strikes to the core of market psychology.

And the trust quotient should ebb further if low rates are locked in for potentially years.

Which brings us to when the Fed money machine could snap…

It could be six months, a year or if a digital USD is launched, maybe never should monetary tech evolve that way.

While many people think of BTC as a technology, many also forget that gold is a technology as well, just older.

Its unique properties and finite nature often draw comparisons.

Both are an exit strategy too.

I suspect there is a generational divide on which exit strategy is preferred.

Younger people may favour BTC and older people may favour gold.

But whichever way you look at it, something needs to change in a competitive way to restore order to a financial system that has favoured the wrong people for too long.

Whether that’s a ‘blast from the past’ third bull run for gold, or a leap into the future via crypto.

I suspect it may be a bit of both should the fiscal and monetary stimulus unwind in a nasty way.

Simmel said it best

The trigger could be any number of things.

Japan’s huge debt-to-GDP ratio, global corporate debt, a Eurozone default, you name it.

Just as we are due for a reckoning between economies and markets, we are due for a reckoning between institutions and the money they create.

Simply put, if you create more of it, suddenly it means less.

Speaking on the economy of early 20th century Germany Georg Simmel said, in The Philosophy of Money, the following:

‘If the profit from debasement of the coinage had not been contingent upon the size of the area, the chaos of coins in Germany would have been much worse, because of the terrible frivolity with which the privilege of coinage was granted to every monastery and every small town…If we suppose that the usefulness of money is the reason for its acceptance, its material value may be regarded as a pledge for that usefulness.’

I think the same is true today.

When the trust quotient hits zero and a form of money’s usefulness expires, it gets replaced.

Regards,

Lachlann Tierney,

For Money Weekend

Lachlann is also the Junior Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.

Comments