[Editor’s note: This article was originally published in The Insider on Friday, 28 May.]

‘I’m in heaven. I had to kill myself to end the pain…’

That was the first text I ever received from Murray Dawes, the day after the night before.

It was October 2011. I was Port Phillip Publishing’s newest recruit. And I was sent by the publisher at the time to attend a two-day ‘Mining and Metals’ conference at the convention centre on Sydney Harbour.

It just so happened Greg Canavan was there too. It was before he’d moved to Melbourne.

Murray, Greg, and a guy called Alex, all arrived at the conference separately. And as we all worked at the same place, we decided to catch up at a local pub at the end of the first day.

And so began one of those legendary spontaneous nights out that you can never plan…but always talk about.

Ever since then we still refer to our collective selves as ‘The Four Horsemen of the Sydney Apocalypse’.

And it felt like an apocalypse the next day…

A couple of beers at the pub turned into a steak and foie gras dinner at a delightful Paddington French bistro, which turned into five bottles of Bordeaux, which turned into after dinner drinks in Kings Cross, which turned into the first nightclub, which turned into the second dinner at a souvlaki stall, which turned into the second nightclub, which turned into Alex raiding his hotel’s minibar and watching the sun rise at the front of the hotel…with day two of the conference starting in a couple of hours.

Somehow I made it. Greg scarpered back to Wollongong. Alex managed to get through his scheduled appointment with mining execs.

And Murray…well, his text message said it all!

But it was a great way to get to know your new colleagues and new country.

To this day we all say it was a night we’ll never forget.

But it was also the night I first heard about another event — a trading event — that Murray experienced a few years earlier.

In fact, if it wasn’t for this experience, Murray may never have been there that night…or doing what he does today.

It was a hard-won lesson that ultimately changed the course of Murray’s professional life…and led to the creation of the trading strategy he uses today, which hundreds of his subscribers now rely on.

Now, over the next few days we are exploring this strategy in a unique event with the man himself. And you’ll see the remarkable results he’s helping readers generate.

You can see just a snippet of the many reports we’ve received from those readers on the free sign-up page to this event. It went live this morning, and you can get your name down here.

But now I want to hand over to Murray to tell the story of the trade that changed everything…

Over to Murray…

|

Let’s go back to late 2008…

If you remember it, the levels of fear in the market were intense.

Leading up to September 2008, I was extremely bearish. And I’d been making quite a bit of money on short trades right up until the collapse of Lehman Brothers. (Short trades are when you bet on falling stock prices or indices.) And I was convinced there was more to come.

So I decided to put 15 grand into some put options on the E-mini S&P 500 futures.

An E-mini S&P 500 put option is a bet that stocks are going to go down.

The options expired on 19 September 2008.

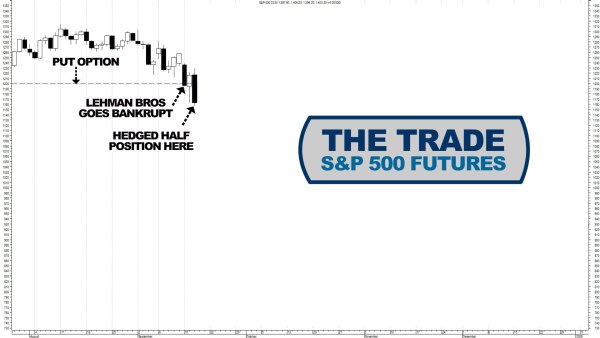

Now, take a look at this chart:

|

|

| Source: CQG Integrated Client |

19 September is two days after the edge of the chart.

You can see where Lehman collapsed — on 15 September — four days before then.

So my plan was this: I believed a crash was coming. A BIG one. I intended to roll over any profits into MORE put options.

The date of expiry of these options was 19 September.

Simply put: If the market closed lower than 1,200 on that day — 1,200 being the dotted line you can see on the chart — I would’ve made US$1,500 for every point the S&P 500 dropped.

Things started to go crazy after Lehman Brothers collapsed on 15 September.

The market started selling off hard. The value of my options skyrocketed.

And that’s when things started to unravel…

Look at that chart again:

|

|

| Source: CQG Integrated Client |

My short position was flying because the market was crashing.

I had a hedge in place in the form of futures. Basically, this meant I protected half my position if the market recovered.

So on 17 September, my short position was worth AU$75,000. By hedging the position, my worst outcome was an AU$23,000 profit.

Now…the day before the expiry of the options on 18 September, stocks really started to dive.

The market fell off the cliff on the open.

The crash that I was convinced was coming…the BIG one…was here.

I could feel it in every bone of my body.

This was 3:00am Aussie time.

But I didn’t need coffee. I was wired by the prospect of making a killing. The kind of win that only comes along a couple of times in your life — if you’re lucky.

As the rest of Melbourne slept I sat at my trading screen transfixed — watching the American market fall like a stone.

Just as I predicted, I was going to clean up.

In hindsight, looking back, at this point the trade was well and truly wrapped up in my ego.

That led to my downfall. But it happens all the time. It’s why 80% of traders lose. And ultimately, it led me to sacrifice a $500,000 payday. It was the hedge position…

Because I’d hedged the short trade I was only making US$750 for every point the market dropped instead of US$1,500 a point.

Now in my mind everything was coming into fruition.

Just as I’d predicted, the Big One was here.

So the ‘overconfidence drug’ took over.

The dollar signs started flashing.

And I can remember very clearly the exact second I screwed myself over.

‘If I just dumped the hedge I’d be exposed to the ENTIRE crash as it happened! Fifteen hundred bucks with every point below 1,200. If this was the big crash, I’d be up $200k or more by the time the sun came up!’

The crash was happening. The crowd was selling. My hedge was a bet against the crowd.

So I ditched it.

Even if the market rallied a little, the options expired the next day, what could go wrong?

So I went to bed safe in the knowledge I was a genius.

The next morning, I woke up to this…

|

|

| Source: CQG Integrated Client |

At 6:00am, while I was dreaming of sipping champagne in Montmartre, the virtually impossible happened. US President Bush announced the TARP rescue plan. The markets rallied so hard they were up 14% by the time my options expired.

It was the largest one-day move in the history of the index.

That’s what I mean by virtually impossible.

My options position — which had been worth more than AU$100 grand when I went to bed at 3:00am — was now worthless.

If I’d held onto my hedge I would have been up a hundred grand.

Of course, the up-move was only temporary.

The big crash I anticipated did happen.

But I watched on in horror without a position in it.

If I had managed to roll over the options position — as I planned to do — my profit at the bottom of the crash three weeks later would have been HALF A MILLION DOLLARS.

I lost that money.

And even more of my own money as I tried to chase the loss.

I nearly gave up trading.

In fact, in early 2009 I stopped trading almost altogether.

And it was here I started down a new road. And began laying the foundations of a radically new trading strategy…

Regards,

|

Murray Dawes,

For Money Weekend

What a story.

But it has a silver lining. Murray has been helping readers use this radical new trading strategy since 2018. And the reported results have been some of the best in our business.

See for yourself by signing up to our brand new ‘Quantum Trading Event’ today.

And for more insight and a live analysis of what Murray’s method tells you about the market today, check out a conversation we recorded on Thursday

Click on the play button below to check it out:

Have a great weekend.

Cheers,

|

James Woodburn,

Group Publisher, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here