Can you feel the heat?

All the ingredients are there for the Aussie stock market to start firing on all cylinders.

All-time highs should break in 2024.

Yep, I’m bullish. I’ll show you my favourite sector below to take advantage of it.

Here’s three reasons why I hope you’re pumped for the opportunities coming up…and happening now!

1) CHINA’S BACK (AND SO IS IRON ORE)

Ever since COVID came along the Chinese economy has been offline, out of sorts and/or anaemic.

That hasn’t helped Australia’s stock market — because so much of it is commodity dependent.

China is really revving her market now thanks to the central bank.

Beijing is also making fresh moves to sort out the property issues.

Bloomberg reports this week the Chinese developer bonds and shares are surging as confidence comes back.

We’ve seen a few of these rallies over the last 18 months.

Maybe it lasts, maybe it doesn’t.

When you see a story like this, it helps to get confirmation from somewhere else.

We don’t have to look far.

The price of iron ore is now over US$130 a tonne.

That’s surprising most (though hopefully not you as a Fat Tail reader, lately).

Look at how it’s busted out since the drop into August…

|

|

|

Source: Australian Financial Review |

Naturally this is lifting the iron players: BHP is now at a six-month high, and Fortescue Metals at a 52-week high.

If you’re worried about a recession or market crash, it seems to me the market is telling you the opposite!

This is a huge driver for the Aussie stock market. Now we need to see it keep going.

Help comes from…

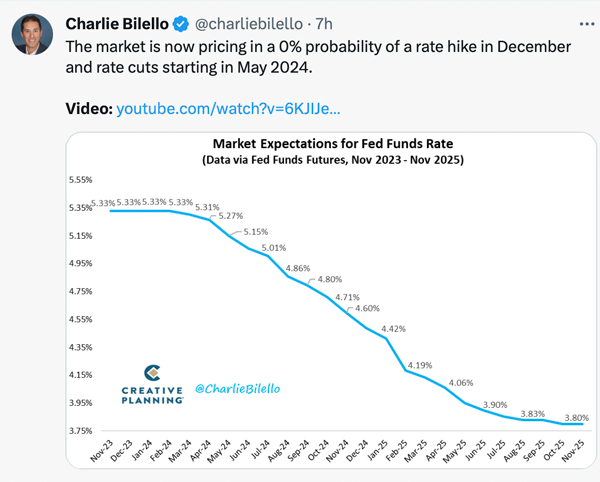

2) INTEREST RATE BETS FALLING AWAY

The threat of rising interest rates has hung over the market like a dark cloud.

Those bets are now being retracted as US inflation comes down, via oil falling and supply coming back to the market.

See that visually this way…

|

|

|

Source: Charlie Bilello, X |

Aussie business commentator Peter Martin makes the following point too.

The decline in rate bets is causing the US dollar to fall (or the Aussie dollar to rise).

International goods get cheaper for us when this happens.

Great!

I’m no currency expert.

But it’s hard to see the Aussie dollar as anything but too cheap considering Australia’s trade surplus and resilient economy.

Natural resource investment can soar if mining really gets going. That could bring in a tidal wave of capital.

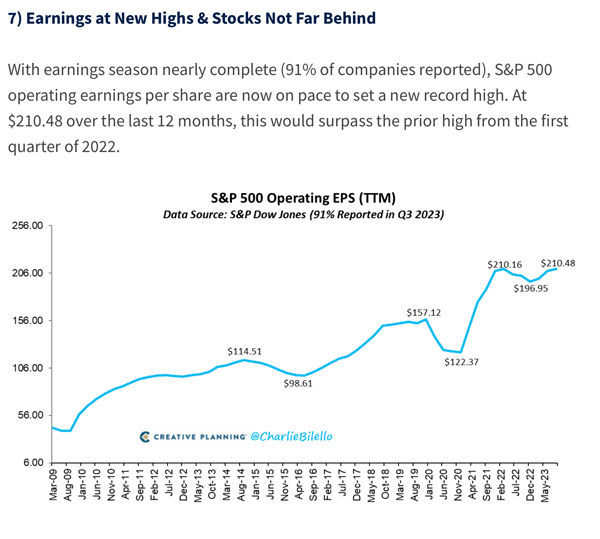

3) GROWTH IS BACK, BABY

For the last 18 months, macro concerns have dominated the entire market narrative.

It’s been inflation, rates, Ukraine and the inverted yield curve portending a US recession.

The market moves on expectations. Reality doesn’t always pan out the way everybody thinks.

There is no US recession. Odds on we get a modest slowdown in the American economy in 2024.

That’s priced in. What matters for US stocks is ongoing growth in earnings. That appears to be on track.

You can see that here…

|

|

|

Source: Charlie Bilello |

The Aussie market should pick up on this tailwind.

Now…

Where is the best way to chase growth?

Small-cap stocks!

These small firms grow revenues at a fast clip and create new products and markets.

They roll out stores or into new countries. They might be developers building a new mine.

You get the idea!

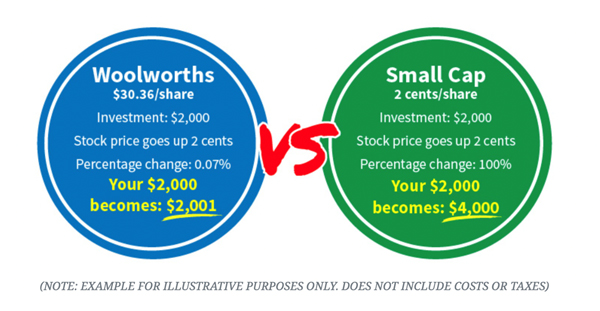

Why do you care?

Because of their tiny size, it doesn’t take much trading volume to move the value of a small-cap company by a lot — up OR down.

Here’s the logic…

If Woolworths’ shares go up by 2 cents, big whoop.

But if a small-cap stock goes up by 2 cents…it can double your investment fast.

Here’s a hypothetical example:

|

|

|

Source: Fat Tail |

Woolworths — on the left — is a large-cap share, sometimes known as a ‘blue-chip’ share. It’s one of the largest companies in Australia.

At around $34 a share, Woolworths is probably not going to double in a week.

In fact, there’s little chance of any blue-chip share going up by any more than a handful of percent in the short term.

Sure, they may pay a small dividend a couple of times a year…but if you’re looking for stunning profits, forget it.

A quick note of caution too on this point…

What gives small caps this ‘hyper-gearing’ quality is also what makes them the riskiest stocks on the market.

Put another way: Woolworths is also unlikely to HALVE in a week.

Of course, small caps can.

However, as above, so many stocks in the sector have been hammered that I believe you’re almost crazy NOT to consider dipping your toe in now.

As a sector, I recall one fund manager described small caps this way:

‘They are the first sector to fall in a downturn, and usually the last to come back in a recovery.’

He’s been bang on this cycle.

Small caps started turning down in late 2021 — long before the top end of the market came under pressure. They’ve now underperformed blue chips for two years.

In other words, they are the last to recover.

Now’s the time to start thinking about positioning for this recovery. I’m not saying it’s without risk. There’s always risk. Especially in small caps. So you should always do your own research before investing.

But if you like to play the odds, here’s what you need to know to get started. I’ve been telling readers to position for this since August.

It’s now playing out right in front of you.

Best wishes,

|

Callum Newman,

Editor, Fat Tail Daily