In today’s Money Morning…would you have risked it all?…a new gold rush…winners and losers…and more…

I spent last week on a short family holiday in the historical gold mining town of Ballarat.

It’s a great place to visit and the kids had a lot of fun, especially at Sovereign Hill.

For those unfamiliar with it, Sovereign Hill is a recreation of Ballarat’s gold rush days from the mid to late 1800s.

It’s an open-air museum, complete with characters walking around in period dress, redcoats marching up and down the street, and even an underground gold mine you can take a tour of.

I found the place fascinating. Especially the stories of people drawn from all around the world to try their luck down under in the ‘new world’ of Australia.

They were a real mix of oddballs, risk takers, adventurers, and desperados…

Would you have risked it all?

As I explored Ballarat’s rich history, I wondered what I would’ve done if I was alive at the time.

Would I have risked it all for a chance of glory?

Would I have been as brave and adventurous as Ellen Clancy, for example?

She set off as a paying boat passenger from England in 1852 to join her brother in the Victorian diggings.

Ellen kept a vivid diary filled with descriptions of goldfield life, ‘adventures’ with bushrangers, stories of orphaned children, falling in love and getting married.

She published this extraordinary account of miner life on her return to England in 1853 called A Lady’s Visit to the Gold Diggings of Australia.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Then there was the Austrian, Eugene von Guaerard.

After failing to find any gold in Ballarat, he decided to travel around the country sketching what he saw.

And it seems he was a much better artist than gold miner.

You see, Eugene went on to become a founder of the Victorian Society of Fine Arts in 1856 and curator of the National Gallery of Victoria.

But he died penniless in London after Australia’s banks crashed in 1893 and he lost all of his investments.

This was the aftermath of the gold boom that saw a huge fall in land values in Melbourne.

John Humffray was an educated Welshman who quickly abandoned his legal studies to try his luck in Ballarat’s goldfields.

He played a role in the Eureka miners’ uprising of 1854, advocating for voting rights and eventually went on to become an elected official in the Victorian parliament.

At his own request he was buried near the diggers who fell at the Eureka Stockade.

There are many more interesting stories I could go into…

The point is this gold rush era was full of people who made their mark in some way.

Fortunes were made and lost, tragedy struck, rebellions rose up, democratic ideals were formed, and cities sprung up from scratch.

All of this on the back of gold first found near Ballarat by John Dunlop and James Regan in 1851.

And the legacy of this era lives on today.

As you walk down modern-day Sturt Street in the city centre, you can see the wealth of the time in the lavish buildings that still line the wide, six-lane boulevard.

It’s no exaggeration to say that Ballarat as we know it wouldn’t exist without gold. And that could be said for Bendigo, California, and any other gold rush town.

At that time, gold was money and it was there for the taking for anyone who wanted to try.

And while gold mining still exists, it’s mostly the preserve of big mining companies these days.

Anyway, gold is no longer money.

The modern-day ‘gold miners’ are the central banks who create money at will and dole it out through their chosen cronies.

It’s why places like Wall Street and the City of London became the new boom towns of the 20th century.

The gold boom towns mostly turned back into pastoral communities, or even ghost towns.

But there’s a change in the wind.

This change could soon make financial hubs like Wall Street obsolete. And it’s all due to a new kind of gold rush.

Like the gold rushes of old, this one is open to all who are game enough to give it a go.

I’m talking about bitcoin…

A new gold rush

Now as you probably know, bitcoin and cryptocurrencies aren’t physical objects. They’re computing code.

This code decentralises many functions of the fiat system of money we live under.

In my opinion, they will completely change the financial fabric of our lives. And yet despite bitcoin rising over 10 times in value over the past year, it’s still very early days.

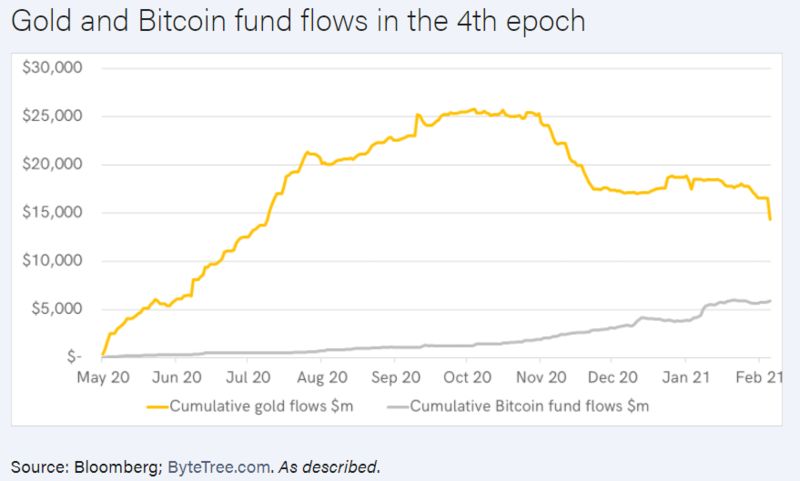

But bitcoin has its eyes on taking over gold very soon:

|

|

|

Source: Bloomberg |

Fund flows are moving into bitcoin while at the same time they’re falling in gold. This is a very interesting development to keep an eye on.

But I don’t want to delve into the ‘bitcoin versus gold’ argument today. That’s actually only a very small part of the value proposition brought by bitcoin and cryptocurrencies in general.

Instead, I want to talk about how bitcoin could end up creating new cities and towns very much like gold mining created the Ballarats and Bendigos of the 1800s.

You see the process of securing the bitcoin network involves something called bitcoin mining.

This is a highly intensive computing process that requires access to cheap energy to be competitive.

Bitcoin miners are rewarded with newly minted bitcoin and the more miners there are, the more secure the network is.

So, if you think like me that bitcoin is going to be a new form of money for the 21st century, then the follow-on consequences of the bitcoin mining industry are very interesting.

In a nutshell, it means access and proximity to cheap energy becomes a huge asset for anyone who wants to help secure the bitcoin network (and in turn generate bitcoin).

This new profit opportunity changes the game for many energy projects, even ones previously considered stranded or uneconomic.

Winners and losers

Marty Bent explains it well in a very interesting blog post called ‘The Last Tax’. It’s well worth reading.

He writes:

‘The vision of distributed sovereign small (and large) nation states and city states being erected around stranded energy sources that are leveraged to mine bitcoin.

‘If a determined state gets its act together and moves with intention, it could potentially eliminate the need to tax its citizens into perpetuity, establish energy independence, and quietly + peacefully secede from the Federal Government.

‘Energy rich states like Wyoming are sitting on an obscene amounts of stranded resources that can be turned into bitcoin, the scarcest asset man has ever come into contact with.

‘If a Wyoming plays its cards right, it can issue the last tax it ever issues, or simply raise money in debt markets, to fund bitcoin mining infrastructure that takes the state’s energy resources and turns them into bitcoin which gets rolled into a permanent fund that finances education, infrastructure, healthcare, farming, and other services.

‘Maybe it even pays out a dividend to citizens if the endeavor is profitable enough. If the mining operation is run correctly and profitably, some of the revenues are used to reinvest in the mining infrastructure to ensure a steady flow of funds into the future.

‘Something like this was never possible before Bitcoin. There was no way to take stranded energy with no delivery mechanism and make it profitable.’

Wyoming, by the way, recently elected a bitcoin friendly Republican senator called Cynthia Lummis. And she’s on the House Banking committee in the US Senate…don’t think politicians won’t be making moves into bitcoin right now!

But the main point Bent makes is extraordinary.

And he’s saying that like the gold booms of old, there will be geographical implications too.

Specifically, there will be new ‘Ballarats’ that spring up close to new sources of energy as bitcoin develops. There will be winners that take advantage of their natural advantages.

And losers that don’t.

Knowing where this hidden ‘gold’ is in advance will give savvy investors — and savvy countries — a huge edge.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

P.S: Bitcoin vs Gold — Expert reveals how these assets stack up against each other as investments in 2021. Click here to learn more.