Do not for a minute believe that we are seeing an economic recovery in the world.

I can’t refute this using official unemployment and GDP statistics. These statistics are based on definitions that have changed over time. They moved the goalposts.

This ‘recovery’ is off the back of a numbers game…that’s fiddling with them!

Don’t believe me?

You might bring up how private corporations are faring by referring to how the stock market indices are trading at record highs.

This is exactly where I want you to go.

Because I am going to tell you about the swindle that government officials, economists, and their media lapdogs have been playing for a long time.

I just analysed the performance of the leading 200 listed companies on the Australian Stock Exchange (ASX).

I found that the largest companies flourished. Furthermore, I found a clear trend between the stock price performance and company size.

We have a lopsided stock market…and economy.

This could spell danger to our future prosperity and social stability.

Playing the numbers game with stock market indices

A stock market index is often considered as an indicator of the prosperity of a particular country or sector.

Indices can come in two forms.

The first is to weight each constituent equally (equal-weighted index).

The second is to weight each company based on their market value (market-weighted index).

Most indices are market-weighted. This appears to make intuitive sense as larger companies move the economy more than the smaller ones.

However, a market-weighted index suffers from distorting the picture of the whole economy as the performance of larger companies overshadow that of smaller businesses.

The health of the economy as a whole is more than how the larger companies perform.

Smaller companies may have less share of an economy’s revenues and profits.

However, they serve a large proportion of the economy. And many people make a living as owners or employees of small businesses that are not publicly listed.

How the subprime crisis caused capital misallocation

Since the subprime crisis in 2007–09, the economy decoupled from the broad market indices. A country may be in a recession while at the same time their broad market indices break record highs.

Financialising the global economy made this possible. This is where the banking sector has become a substantial component of the economy. The banking sector deploys funds to invest into the market or offer credit to institutions and households to speculate in the market.

The consequences of this can be drastic.

Firstly, investors seeing a rising stock market could cause capital misallocation as they chase trends (also called FOMO). This could destabilise the economy as the rally transforms into a market bubble.

Effective resource allocation creates value in the future. Buying into bubbles is an example of poor resource allocation. This is because an investor is overpaying for future profits and growth. Some companies may even fail to make profits in the future, let alone grow.

Secondly, rising stock market levels without smaller businesses prospering can lead to a greater concentration of larger players in sectors and industries. This could stifle market competition. Also, a shrinking small business sector could see a massive fall in employment.

The ASX 200 Index hides the bleak picture of our failing economy

The ASX 200 Index is Australia’s leading broad market index covering the top 200 companies by market value. It accounts for almost 90% of the market value of all the listed stocks on the ASX.

The ASX 200 Index returned 27% over the 2020–21 financial year. That is exceptional given the long-term annual average is just 10%.

The returns ranged from an eye-watering 657% gain for Chalice Mining Ltd [ASX:CHN] to a 72.41% loss for Nuix Ltd [ASX:NXL].

However, the performance of the index constituents is not evenly distributed.

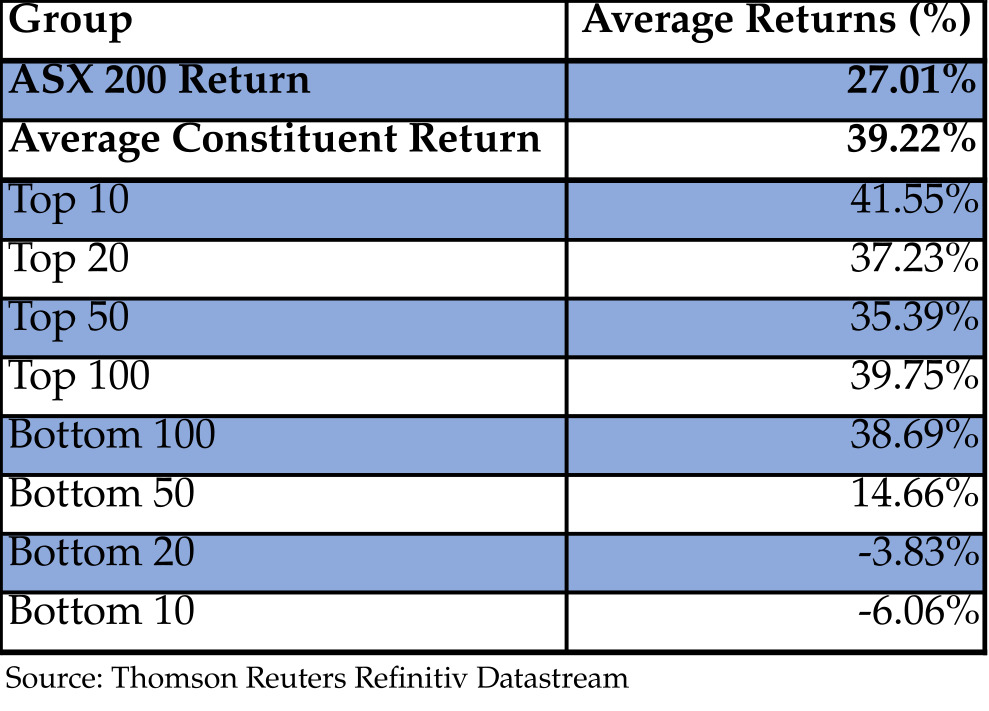

The table below shows you how the constituents performed after classifying them by their size:

|

|

|

Source: Reuters |

The data shows that the average return of the 10 largest companies on the ASX 200 Index is 41.55%, followed by 37.23% for the 20 largest companies, and so on.

The smallest 20 companies delivered an average loss of 3.83% and the smallest 10 companies delivered an average loss of 6.06%.

What struck me most about this table is the clear trend between the size of the company and the average return.

You would also expect larger companies to return less than smaller companies. The reason for this is smaller businesses can grow faster than a larger business.

The trend I am seeing is either the Australian economy transforming into one where larger businesses are crowding out smaller businesses, or investors have been buying the stocks of larger companies due to chasing the momentum.

Neither of the two reasons spell good news for our economy.

I do not expect the trend to change anytime soon. Not when the fiat currency system is still in force.

I believe the stock market can continue its insane rally for a while longer. Anything is possible now. However, I am not going to follow the crowd off the cliff.

My safe refuge is in gold and silver bullion.

Hope you have your safe refuge too.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.