Around 2011–13, I made several trips to explore Portugal, visiting Lisbon, Porto, and the Algarve for the first time. At the time I was living in Spain, so Portugal was just next door.

To be honest, I was underwhelmed.

Don’t get me wrong, Portugal is beautiful. The food, the culture, the people, the natural scenery…Portugal is well worth going to.

But at the time, Portugal was considered one of the ‘PIGS’ (Portugal, Italy, Greece, and Spain), an acronym for the weakest economies in Europe.

In particular, Lisbon looked like it had been through the wringer during the 2008 crisis.

It’s a small city and the streets were quiet during the day, with little or no other tourists. There were ‘for sale’ signs everywhere, empty shops, and unemployment was very visible.

It had been a very different story in other busy European capital cities that I had been to during that time: Paris, Madrid, Rome…

In hindsight, though, all that should have been a clue. Because while at the time it didn’t look like it, there was a silent boom brewing in Portugal.

Since then, you may have heard that Portugal has become a very popular spot, attracting tourists and residents alike.

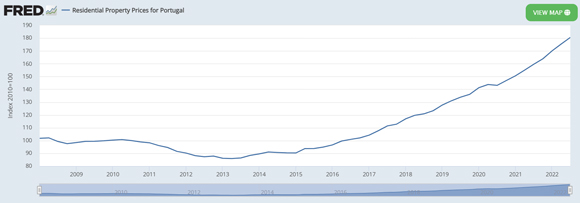

And as the number of people have grown, so have residential property prices:

|

|

| Source: St Louis Fed |

As you can see, in 2013 prices hit a bottom, so anyone who bought property in Portugal during that time has likely made a bundle.

It’s a missed opportunity. But also, a good reminder that when things aren’t looking that great out there, opportunities are still lurking in the background.

The banking crisis continues…

After the collapse of SVB last week, yesterday saw another couple of banks lose confidence.

The first one came from Credit Suisse, the second-largest bank in Switzerland.

Credit Suisse shares cratered after one of its major shareholders, the Saudi National Bank, said it wouldn’t buy more shares.

Shares then recovered after the Swiss National Bank stepped in with a 50 billion Swiss franc credit line to stop the fallout.

The second came from California-based First Republic Bank. Depositors started withdrawing their money after a downgrade in its credit rating by S&P Global Ratings.

Things calmed down after some of the biggest banks in the US, including JP Morgan, agreed to deposit US$30 billion into the bank.

On top of all that, the European Central Bank went ahead with its plan to increase interest rates another 50 basis points.

In spite of all the turmoil, markets finished up overnight.

But this is all very concerning.

The big worry, of course, is contagion. While governments and banks are stepping in to try and stop the fallout, at the end of the day, that money has to come out from somewhere…

One main question is if the US Federal Reserve will continue to hike interest rates?

And then, of course, geopolitically things aren’t looking that great. There’s a real chance that the war in Ukraine could keep escalating.

All of this, as I mentioned on Wednesday, has been lifting gold prices and continues to do so. Gold prices in Australian dollars hit north of $2,900 an ounce, as you can see below:

|

|

| Source: Goldprice.org |

So, with so much uncertainty and open fronts out there, gold could continue to do well this year.

2023 could be a big year for the mining sector

While there was a lot of hype last year on how the China reopening story could bring a commodities boom, things haven’t really panned out…yet.

I think some of the recession fears for China may be overblown, and China’s demand could resurface later this year.

As we all know, it takes a while to reopen an economy after a three-year halt. So, we could very well see an uptick in commodities later this year.

And the energy transition continues to tick on.

Overnight, the EU released its Net-Zero Industry Act — a proposal looking to boost its clean energy manufacturing and compete with US’s Inflation Reduction Act to retain industries.

While the EU is looking to source more critical minerals locally, the Act also looks at diversifying its supply chain through strategic partnerships and trade agreements, which could be good news for Aussie miners.

All in all, the story for critical minerals hasn’t changed long term.

Of course, stock picking will be key. On that note, keep an eye out for James Cooper’s new premium trading service launching soon.

Regards,

|

Selva Freigedo,

Editor, Money Morning