Dear Reader,

A good mate of mine has just made it back to Queensland after a prolonged trip to Europe.

Apart from moaning about the increase in prices generally — including $1,000 for a three-day car rental and $250 for a night in a motel — his first comment to me after finally setting foot in Surfer’s Paradise:

‘The rental market is really bloody tight up here.

‘I think a lot of people bought second homes and holiday homes, and now loads of people aren’t sure what they are doing next.

‘There’s nothing much decent available to rent in SEQ…

‘Pretty greedy landlords at the top end of the market as there’s so little decent stock available…

‘Assume a lot of people have skipped out of Danistan as well.’

No kidding…every day, I come across someone in Melbourne who tells me they have plans to move to SE Queensland. Including my dentist!

Vacancy rates in the region are at record lows.

Stories circulate of prospective tenants offering 6–12 months rental in advance to attempt to beat the competition.

Some offering more than $50 a week above the asking price.

Others are staying in caravan parks because their applications are repeatedly turned down.

In Maryborough and Gympie, the vacancy rate (VR) is just 0.1%.

The Gold and Sunshine Coasts are not much better, with a VR of 0.8% and 0.5%, respectively.

It seems it’s just as hard to get on the rental ladder these days as it is the property ladder.

Still, better to be a buyer than a renter.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

If you study your cycle history, you will know what happens next.

Remember, one of the first to identify the real estate cycle was Dr Homer Hoyt.

Hoyt was a US economist and real estate speculator.

In his classic One Hundred Years of Land Values in Chicago (1833–1933), published in December 1933, he uncovered five major real estate cycles.

These peaked and crashed in 1837, 1857, 1873, 1893, and 1926–29.

Hoyt showed the cycle functioned like clockwork.

It followed the same pattern, in the same sequence…over and over…

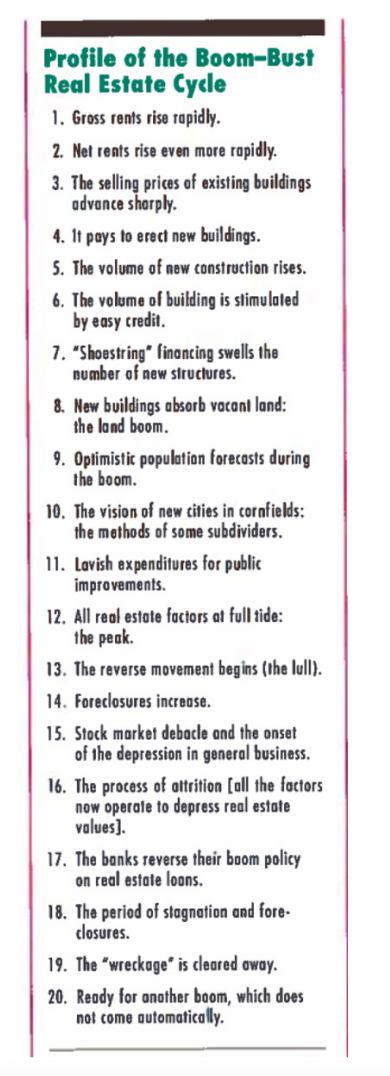

The pattern Hoyt identified still stands today, with only minor adjustments:

Take a look:

|

|

| Source: Homer Hoyt — stages of the property cycle — Lincoln Institute of Land Policy |

The first two steps are the trigger:

‘Gross rents rise rapidly’ (followed by net rents).

This lights a few fires.

Firstly, it encourages renters to become buyers.

And secondly, the increased earnings (rent) of the land allows a higher lending capacity from the banks.

The third step is the consequence:

‘Selling prices of existing dwellings advance rapidly.’

Based on this alone, you would expect the boom in South East Queensland’s property values to continue to trend upwards for the foreseeable future.

This is certainly in line with the forecasts we made for the state back in 2019 over at Cycles, Trends & Forecasts!

We showed readers how rocketing gains would push up land prices between 2020 and 2026.

And that’s exactly what is happening.

Domain’s latest House Price Report shows house prices in the state’s capital shot up 10.7% in just the three months to December 2021.

It’s the steepest rise in property values across the city for almost 18 years.

18 years is a significant period.

It’s the timing of the property cycle that Homer Hoyt identified back in the 1930s.

There’s a lot of knowledge buried in Hoyt’s writings that can benefit investors considerably.

I can unlock those secrets for you and help you apply them to the property market in Australia.

Regards,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.