I’ve banged on about the folly of investing in apartments for years.

It’s often seen as a way into the property market at an entry-level price point. No one wants to take on too much debt in an environment where lending costs are going to continue rising.

An established two-bedroom apartment in Melbourne, for example, transacts for anything from around $450–550K.

It looks very affordable compared to detached housing.

And with rental yields rising across all capitals, apartments are often spruiked as a good, ‘affordable’ hedge against inflation.

But there are numerous unforeseen costs and headaches with investing in this sector.

I’m not just talking about the fact that apartment prices have barely tracked the rate of inflation over the last 10–20 years.

In recent weeks, I’ve been contacted by several owners wanting advice on selling apartments that have lost significant value since construction!

I’m talking to the tune of $50–70K per unit.

Furthermore, the apartments are situated in cities currently experiencing strong price growth: Brisbane and Perth.

After hanging on for several years hoping the market would improve, they’re now resigned to selling at a loss.

That’s not a nice situation to be in.

Property prices always rise, don’t they? At least, that’s the story pumped by the real estate sector.

Post-COVID, the situation has become worse.

Home buyers want more space.

There’s still an exodus of migration away from the major cities and, therefore, less demand for compact living.

Then we have continued bad media regarding the quality of construction.

Did you hear the recent news about Bond Square?

It’s a large apartment complex in Spencer St, West Melbourne.

Around 9–10 months ago, a six-storey car stacker collapsed.

It crushed one vehicle and trapped about 30 others.

Take a look:

|

|

| Source: A Current Affair |

Luckily, no one was hurt.

Although, rumour has it one owner had only just exited their vehicle in time.

The thing is, the situation at Bond Square is now in limbo.

No one is taking responsibility for the malfunction or repair.

Residents are forking out thousands for hire cars and rideshares while still paying registration and monthly insurance on their trapped cars.

Furthermore, the owners’ corporation has washed their hands of the situation!

‘According to the Owners’ Corporation, liability rested with Levanta Park, the Queensland company that supplied and installed the stacker.

‘The Owners’ Corporation warned it would “not be responding to any demands in respect of loss of access to your vehicle”.

‘Levanta’s lawyers fired back in a letter of their own and said: “Repairing and maintaining common property and associated fixtures and services is a function of the Owners’ Corporation.”’

What a nightmare.

These problems go to the core of the way strata management companies handle their finances.

A colleague called me just this morning to discuss this — he’s trying to reform the sector.

For example, some states have legislated sinking funds for apartment complexes.

If you’re not aware, sinking funds collate payments that owners make each year, usually in line with 10-year management plans for the maintenance, repair, and replacement of items such as windows, lifts, roofs, and car stackers!

However, oversight is lax, and the few payments collected usually end up sitting in term deposit accounts that can’t maintain pace with the rate of inflation. Especially not in today’s environment.

If the payments are not made, the building loses value, and no diligent buyer will touch it.

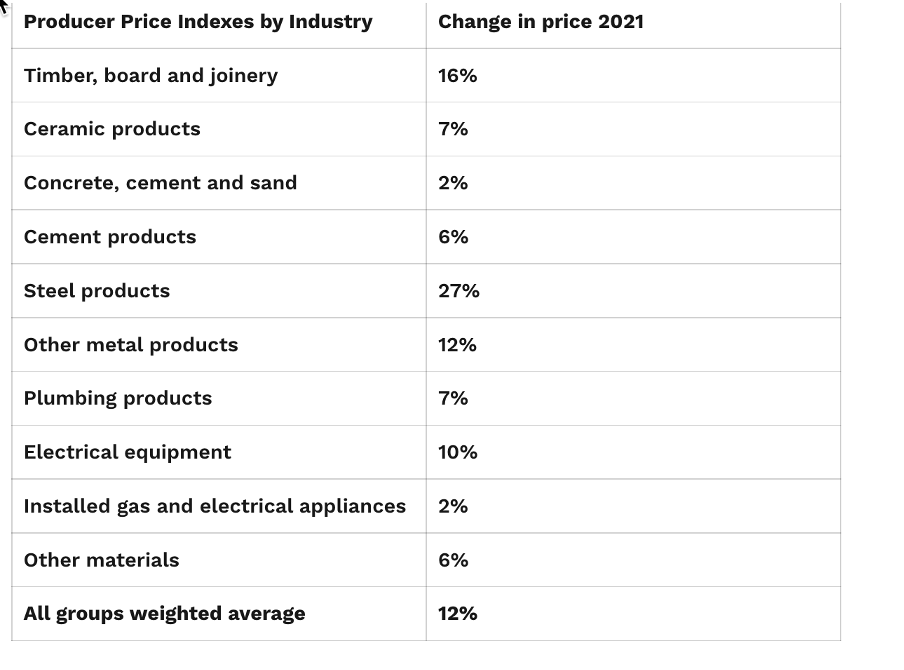

This becomes more significant when you consider the ongoing and escalating costs of construction.

For example, in the December quarter of 2021, input prices for construction rose an average of 3.8%. Going forward, that’s an annualised 12%!

Here’s a rundown:

|

| |

| Source: ABS and Strata Guardian |

If apartment owners are with a management company that doesn’t plan for rising costs or — worse still — doesn’t take the time to invest the funds wisely, the consequences are dire.

The owners are at risk of being left with a property investment they simply can’t sell.

Don’t get me wrong, real estate can be a great hedge against inflation. Many owners have benefitted greatly over the last two years from rising rents and rocketing land prices.

To put a figure on it, over the last 12 months alone, we’re talking a whopping $135.6 billion (or for investors, $40.6 billion) in land price inflation.

Small rate hikes aren’t going to be enough to stall the market, as I explained the other week.

But knowing what to invest in and where to invest is key.

Equally so, when to get into the market and when to get out!

You can find out more about that here.

Best wishes,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia