In today’s Money Morning…making memes, making money…the butt of the joke…and no one wants to suffer at the expense of that…and more…

By now you’ve probably noticed a bit of a theme in this week’s Money Morning articles.

Both my colleagues — Ryan and Lachlann — have focused in on the state of cryptocurrencies.

Talking about developments like why bitcoin is the only asset that is outperforming when adjusted for money supply. Or, how China plans to use its centralised cryptocurrency (a CBDC) to exert more control over its people. And more importantly, why buying crypto may be your best bet of escaping a monetary confluence of extreme regulation and eroding freedoms…

Quite heavy topics indeed.

But they’re also extremely important topics. Because collectively, most of us here at Money Morning see change on the horizon — both good and bad.

We see the shifts that have happened and are happening in our pre- and post-COVID society. With the reign of central bankers who appear to have lost control of the monetary policy monster they have created.

A modern spin on a classic narrative…we could even call it ‘Fiat Frankenstein’.

Just remember though, the real monster wasn’t Frankenstein’s creation, it was Frankenstein himself…

Which is why today I want to talk to you about Dogecoin. Because despite what you may have heard, this joke of a crypto has more nuance to it than you might realise.

Making memes, making money

For the uninitiated, Dogecoin is a cryptocurrency that was first created way back in 2013. A side project of IBM and Adobe software engineers Billy Markus and Jackson Palmer.

However, this was no ordinary side project. It wasn’t meant to be some entrepreneurial venture. It was a joke from the very beginning. A satirical creation designed to mock the flood of new bitcoin copycats or ‘altcoins’ at the time.

Even the name and logo — both of which refer to a popular internet meme of a Shiba Inu dog — are a complete joke. A cryptocurrency whose only redeeming quality was that it was a gag.

As can often be the case though, the joke quickly took on a life of its own.

Fuelled by a cult internet following though, Dogecoin became quite popular. And as one of the older cryptocurrencies to still exist — Dogecoin even predates Ethereum — it has somehow not fallen by the wayside.

Quite the opposite in fact, as we’ve seen this week…

At the start of the month, Dogecoin was trading for roughly US$0.053, with an already staggering market cap of US$6 billion. More than six times the net worth of the world’s richest comedian, Jerry Seinfeld, who has a paltry US$950 million to his name.

So, by dollar value, Dogecoin was already one of the biggest jokes in the world.

But then, as April has dragged on, things took a new turn. Because as the GameStop Corp [NYSE:GME] saga showed us earlier this year, the internet has taken a liking to financial markets. Particularly when it gives users a chance to mock the elites and ‘sophisticated’ investors who often dictate market action.

Bitcoin vs Gold: Which Should You Buy in 2021?

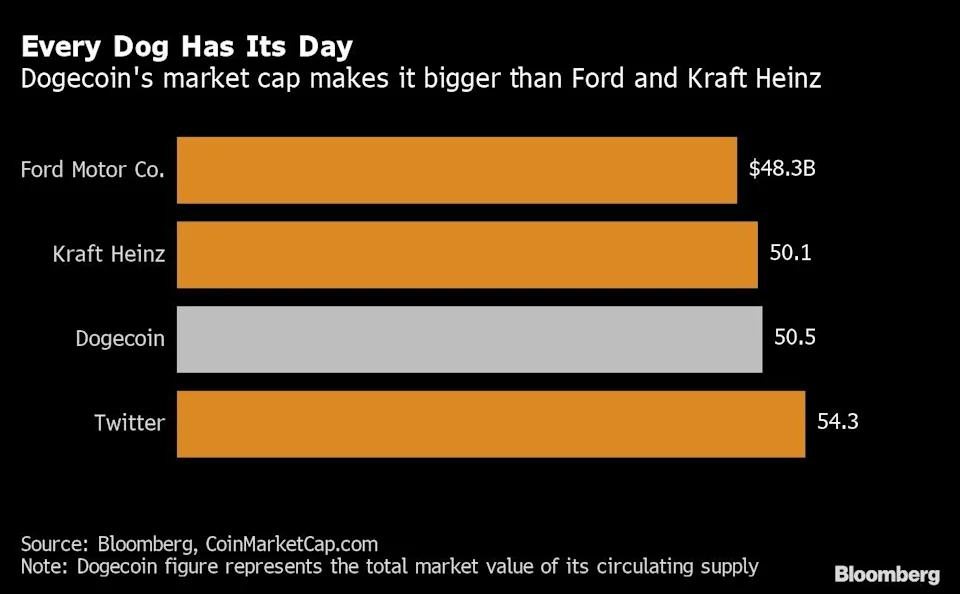

All of which culminated in a sharp rise of Dogecoin trading. Pushing the market cap to a staggering US$53.99 billion on Tuesday. Which, as Bloomberg pointed out, made it worth more than Ford and Kraft for a brief point in time:

|

|

|

Source: Bloomberg |

This result was because of an effort to try and push the dollar value of Dogecoin (which topped out at US$0.417) to US$0.69 on 20 April. A date that is known as 4/20 and is celebrated by pot smokers for its own humorous reasons.

As for the 69-cent target, well that was chosen due to the number’s association with a specific sex position known as the ‘congress of the crow’ by the Kama Sutra. Which, as is often the case, appeals to the internet’s childish and crass sense of humour.

And while Dogecoin may have fallen short of that goal, it has certainly made its mark in other ways.

Not to mention, with its 686% gain over the past three weeks, it has made a lot of people a lot of money.

The butt of the joke

At this point you might be wondering why the hell anyone would put their money into Dogecoin.

Which is exactly the point of it all. Because there is no real point. It is a joke, and always has been. The only question is, who is the butt of the joke really?

After all, I’m not going to shy away from the fact that everyday people are going to lose money on Dogecoin. In fact, I’m sure plenty already have. Especially those who are piling in simply out of greed.

The only reason anyone should ‘invest’ in Dogecoin is so they can laugh as the price goes higher.

A cryptocurrency that is anti-intellectual by design.

There is no logical reason why people should invest in Dogecoin. Indeed, there is no reason why anyone should even care about it at all.

But the fact that we’re not only seeing individuals, but also major brands engage with it, is as stupid as it is surprising. With both Slim Jims (a popular snack brand owned by Conagra Brands [NYSE:CAG]) and Snickers (which is part of Mars Confectionary Company) using Dogecoin to market their products.

An effort that results in a parody of a parody.

Which is probably fitting, considering I’m sure these brands and corporations feel like they’re in on the joke. In reality, I don’t think they realise that they are now just another part of the joke, rather than being privy to it.

Perhaps they are though, willingly choosing to be the butt of the joke with the rest of the Dogecoin pundits.

Because at the end of the day, that’s kind of the point. Dogecoin is a laughingstock because people want it to be a laughingstock. Which is why most, but certainly not all, people investing in it are in on the joke.

And it is this very slight, but very specific nuance that is crucial in my view.

Dogecoin is about being able to laugh at oneself the way anyone with a sense of self-awareness can. Giving you the kind of control that only someone knowledgeable of their own circumstances can.

Which is what Dogecoin is really about, being able to control the joke…

It gives everyday people the collective power to move markets just as effectively as those who oversaw its collapse in 2008. Putting the power back into the hands of the individual, rather than any centralised authority.

And that, dear reader, is the funniest part of all.

Because if a nonsensical digital coin with the picture of a dog on it provides more financial freedom (for better or worse) than any fiat currency, then perhaps the real butt of the joke is the modern monetary system as we know it.

And no one wants to suffer at the expense of that.

After all, right now the ludicrous policies of central bankers and flood money is a far bigger joke than Dogecoin will ever be. Because when it all comes crashing down, the only ones laughing then will be those who get taxpayer-funded bailouts once again…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Promising Small-Cap Stocks: Market expert Ryan Clarkson-Ledward reveals why these four undervalued stocks could potentially soar in 2021. Click here to learn more.