Every now and again you come across something that opens your eyes to a world you didn’t know existed.

You suddenly see what’s really going on beneath the surface.

I came across such a thing over the weekend…

As often happens, it was an unusual chart pattern that first drew my attention.

But it was the rabbit hole I fell down after, that really blew my mind.

Let me explain…

The oil-gold ratio is off the charts

Gold and oil are the two most watched commodities in the world.

In their own way, both are indicators of the health of the economy. Usually they move in tandem with each other.

The thinking goes like this…

A high oil price feeds into the cost of transporting goods and feeds fears of price inflation. Which usually means investors turn to gold as an inflation hedge.

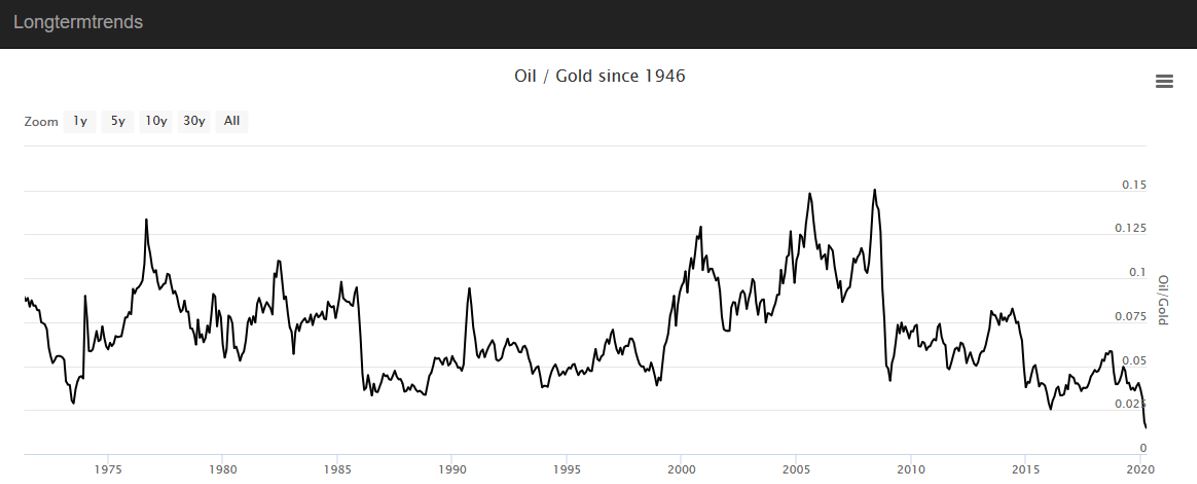

It’s not a perfect relationship, but for much of the past 40 years the oil-gold ratio has stayed within a band of roughly 0.05–0.1.

Meaning one barrel of oil was worth roughly 0.05–0.1 troy ounces of gold. You can flip that ratio on its head and it’ll give you an average of 15.8 barrels of oil for one ounce of gold over the past 25 years.

The key point is, the higher the oil-gold ratio the more expensive oil is in terms of gold. The lower the ratio, the cheaper.

Now look at this chart:

|

|

| Source: longtermtrends.net |

Now you don’t need to be a charting wizard to see that this ratio has just plunged below a 45-year low.

In other words, oil has never been so cheap in terms of gold. One ounce of gold buys you nearly 80 barrels of oil!

So, what does that mean and why is it important?

This is when I had my Alice in Wonderland moment…

They’re coming after the ‘almighty’

So, looking at this chart led me to a bunch of obscure research I’d never come across before.

And what it pointed to is a concerted effort to end the US-dominated petrodollar system that’s dominated the world for the past 45 years.

It’s a complicated and multi-layered tale that involves Russian oligarchs, European bankers, Middle Eastern sheikhs, and Chinese communists. And it’s a continuation of the never-ending story of money.

I’ll try to summarise the gist of it today…

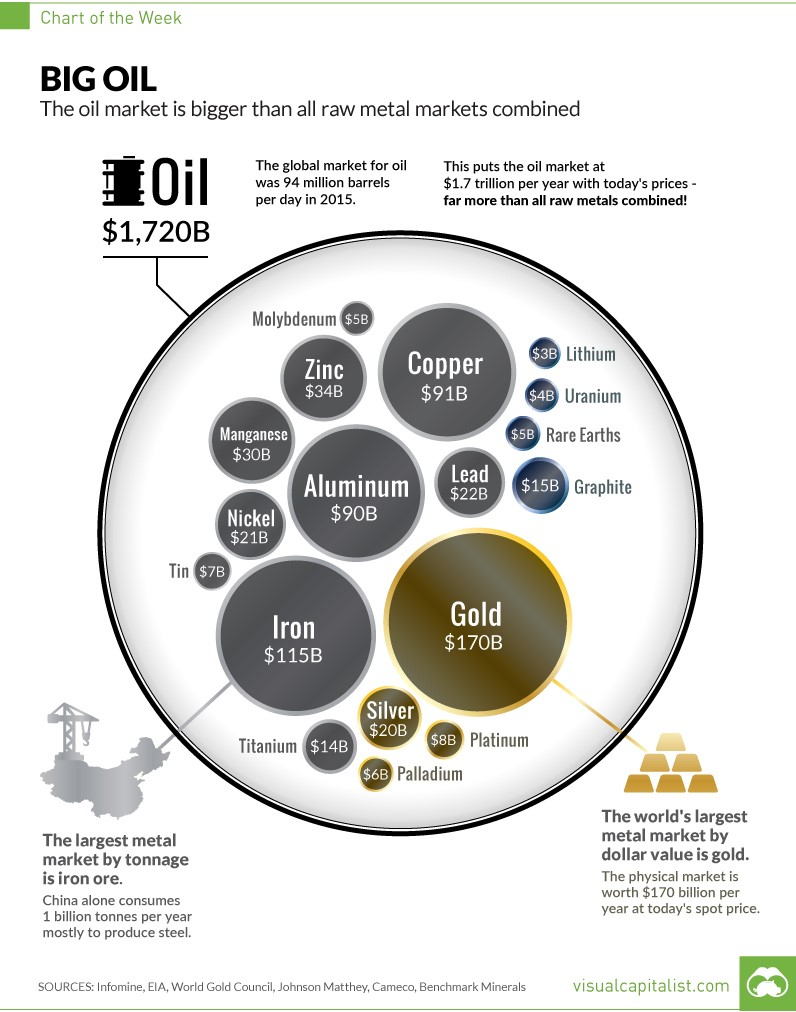

Before the US dollar, it was gold that underpinned the global financial system. It was the ‘oil’ of money, the fuel that made the financial system work.

Conversely, oil was in turn the ‘black gold’ of the 20th century.

It literally made the world go ‘round, even today…

This chart will help you contextualise just how important these two commodities are in the grand scheme of things. They dwarf all others in size and scope.

|

|

| Source: Visual Capitalist |

As you know, oil is getting cheap while the price of gold is rising.

It’s led us to this situation where the oil-gold ratio has never been so low and the old economic relationship between oil and gold so disconnected.

Now, think about why oil is getting cheap today?

According to the mainstream press, the Saudis and the Russians can’t agree to OPEC output cuts and the flood of oil is driving down oil prices. They’re at ‘war’, we’re led to believe.

Rubbish I say…

The Saudis and Russia are known close allies.

The image below of President Putin and the Saudi Crown Prince high-fiving each other a few weeks after the murder of the Saudi journalist Jamal Khashoggi in the Saudi Embassy in Turkey, is one I’ll never forget.

|

|

| Source: USA Today |

A picture tells a thousand words, as they say. No, my take is these two are very much in cahoots with each other.

This attack on the oil price is very much so a deliberate move.

Which leads to the next question…

Why would they make oil — the very product they sell and finances their economy — cheaper?

Well, in part, it’s to combat the rise of the US shale oil industry. They’re going for the jugular here, and trying to put many US energy producers out of business.

But that’s only the top-level target.

In reality they have a bigger target. The ‘almighty’ US dollar itself.

You see, enemies of the US know that as long as the US dollar dominates the world, they have a huge advantage over everyone else.

They can print out money at will and use it to buy goods, finance wars, make weapons, and generally do what they want. A fact the US has long rubbed in everyone’s face.

But history has shown that most empires get too addicted to this power. And eventually they fall through the debasement of their currency first.

It’s how the Roman Empire declined, for example.

They started clipping the corners from their coins to mint new coins, then they started mixing in cheaper metals. It was a slippery slope, and by the time Rome fell, their currency was worthless.

Now think about this…

If you can make a country debase their currency, you’re attacking one of their fundamental strengths. It’s a silent and bloodless act of war.

So, how do you make the US debase their currency?

Well, it’s not like they weren’t doing that already. US debt levels have been growing for decades. But now, the money printers are in full effect.

This is where the attack on the oil price comes in…

Last week the US announced $2.3 trillion in bailout money, some of which would be used to bail out the ‘junk’ bond market. This is the market for people who have loaned money to less credit worthy borrowers.

And surprise, surprise, a huge part of that market is US oil companies who have borrowed huge amounts in the quest to turn the US into an oil superpower.

According to MarketWatch, energy companies make up the biggest part of the $1.5 trillion junk bond market.

As the US prints out more and more dollars to prop up failing parts of their economy, it can’t not have an effect on how the world views the US dollar.

And as that story plays out, gold potentially becomes part of an alternative system for pricing commodities like oil.

Luke Gromen of macroeconomic research from FFTT put it bluntly:

‘We have been saying for years that as multi-currency oil market matures, incentives of oil producers changes from “cut oil supplies to maximize USDs” to “produce full out.”

‘OPEC isn’t needed if the USD monopoly on the oil market is broken. This is the chess game Putin’s playing.’

4D chess

Not just chess, but 4D chess more like.

There are many moving parts and I won’t pretend to be able to tell you how this all plays out.

But as you can see, there is a deeper story at work here. Something beyond the superficial mainstream headlines.

Here’s what we know:

It involves gold, oil, and the US dollar.

It involves control of the global financial system and the very concept of money.

And it involves the biggest players in global politics.

As an investor it’s a story you need to know. I’ll be keeping an eye on it in the months ahead. There’ll be many twists and turns for sure.

If you believe the US is on the back foot, then the immediate opportunity is in gold. Conversely, if you believe in US strength, then there could be huge opportunities in oil in the coming months.

My friend over at The Daily Reckoning, Shae Russell, has a very interesting way to play the gold theme. You can read about it here if you’re interested.

Good investing,

Ryan Dinse,

Editor, Money Morning

PS: ‘The Coronavirus Portfolio’ The two-pronged plan to help you deal with the financial implications of COVID-19. Download your free report.

Comments