No doubt you have been watching coverage of the war between Israel and Hamas on the news.

However, as with all mainstream news coverage, the gruesome reality of what is occurring on the ground is not being seen or adequately represented.

As some of you may be aware, I am Jewish.

I have spent a considerable amount of time in Israel over the years — and last year, I very nearly moved there. As such, I have many friends who live in Israel and have some direct insight into what is occurring.

This war is unlikely to be resolved quickly. We’re not talking days, or even weeks. Terrorists are inside the boarders of Israel and atrocities that are unimaginable are taking place on the ground.

The other night I received this text message from a friend in Tel Aviv — along with a photo (that I cannot not share here.)

‘Our soldiers just found 40 kids and babies in a room, they killed them all and took some of their heads off.. They are worse than the nazies and satan together…’

Grandmothers and young girls have been raped and slaughtered.

Immigrants that are not even Jewish — have been beaten at their places of work and decapitated.

The videos that have been sent by friends in the bomb shelters or on the front line, showing some of what is happening, have made me physically sick.

In one day, more Israelis were killed than in any day, of any cause (natural, COVID, or war) since the State of Israel was founded.

I tell you this not to inflame a political debate. But to stress it’s no ordinary war — and for once, I’ll say that it’s about more than just land.

Pure hatred lay at its heart.

It could escalate very fast.

There is mounting concern that it could develop into a multi-front conflict involving Lebanon and potentially extending beyond its borders.

Hezbollah, situated in Lebanon, has been engaging in minor provocations along the northern border.

It’s believed that they have amassed around 200,000 missiles over the past two decades, some of which possess precision technology.

While Israel boasts remarkable anti-missile defence systems, they have never faced such a severe test.

The United States is dispatching the USS Gerald R. Ford aircraft carrier, accompanied by a fleet of cruisers and destroyers en route from Italy.

This move comes in response to the evolving situation in what the military command is currently referring to as the ‘Iron Swords Operation,’ also known as the Simchat Torah War (the Jewish festival celebrating completion of the annual Torah reading.)

What does it mean? How can we put it in context of the boom/bust real estate cycle?

I have written a lot about war over recent months for my subscribers over at Cycles, Trends & Forecasts. Specifically, to prepare readers for events that are likely to take place at the end of this cycle.

You may remember I interviewed Global Forecaster David Murrin for a special edition that went into detail on the Kondratieff wave.

At that point, we were just focusing on the war between Russia and Ukraine, and potential escalation between China and the West — including mention of the change to digital currency and the threat against the US Dollar’s exorbitant advantage.

However, now there is every reason to believe that events in the Middle East may escalate further. And I honestly wonder whether Fred Harrison’s forecast of World War Three at the end of this cycle, could indeed play out.

The timing fits in with everything we would expect to see as we approach the peak of the Kondratieff long wave.

As an investor, you need to be aware of what’s ahead.

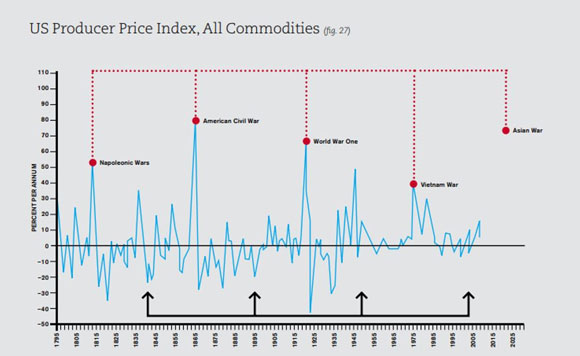

Kondratieff long waves (K-waves) are long economic cycles related to the demand for commodities and the technology they fuel.

Steam and railways, steel and heavy engineering, oil, electricity, the automobile, information and telecommunications, robotics and so forth.

They can be traced back to the 16th/17th century.

They last, on average, around 50–60 years.

Roughly 25 years of rising commodity prices, followed by 25 years down.

But the peak of the K-wave is also strongly correlated with war.

Great powers fighting to gain access to land and its raw materials. Just as we’re seeing now with the global trade wars.

Kondratieff himself noted:

‘[I]t is during the period of the rise of the long waves, i.e., during the period of high tension in the expansion of economic forces, that, as a rule the most disastrous and extensive wars and resolutions occur.’

Major struggles happen on the upswing and peak of each Kondratieff wave.

- 1803–15: The Napoleonic Wars — featuring trade embargoes, blockades, and formation of international alliances.

- 1858: The Battle of Plassey to establish British control over India — its commodities and control of its trading routes.

- 1861–65: The American Civil War — slavery being driven by demand for cotton and other agricultural commodities.

- 1914–18: First World War — territorial claims over territories in Africa and parts of Asia, for raw materials.

- 1961–75: Vietnam War — a power struggle between the US, the Soviet Union, and China.

The peak of the current K-wave will fall from around 2025 — 2027.

A graph from UK analyst David Murrin charts it nicely — with an apt addition forecast for the peak — Asian War? We’ll see…

|

|

|

Source: Analyst — David Murrin |

I draw also, your attention also to the following article in The Age a couple of days ago– There is an uneasy calm in the Oil Market.

‘Russia’s trade data revealed this week, its current account surplus has been rebounding, largely due to higher revenues from energy sales.

‘Its current account surplus in the September quarter of $US16.6 billion ($25.8 billion) compares with an $US8.6 billion surplus in the June quarter and was roughly double the level expected.

‘The higher oil price and a collapse in the value of the rouble since May is boosting Russia’s finances, even if the surplus for the nine months to the end of September of $US40.9 billion is nearly 80 per cent lower than the $US196 billion surplus for the same period last year.

‘With Russia now budgeting to spend about $US106 billion directly to support its invasion of Ukraine, about a third of its total expenditures and an increase from 3.9 per cent of its GDP to 6 per cent, the US and its allies will have little choice but to try to toughen the sanctions if they want to undermine its ability to finance the war — even though that might lift oil prices.

‘That’s why the eruption of violence in the Middle East has come at an inopportune time for the US and its allies, but not for Russia, an ally of Iran.’

And in response, note a recent tweet from David Murrin.

|

|

|

Source: Twitter |

Oil prices are likely to rise as war escalates from here on in until Israel restores the Middle East power balance and Saudi comes to the table to supply more oil to world market.

Iran will do everything to thwart Saudi as arch enemies for a long time and to stop them normalising relationships with Israel and US and rebalancing oil prices.

It could be that Russia will be dragged down to Israel and Egypt to disrupt this new war and the Saudi US and Israel relationship to restore the oil price and their economies.

Whatever may occur, it means the last two years (the ‘winner’s curse’) into the peak of this cycle are going to be intense both locally — and globally.

Knowing how to navigate them is not going to be easy.

Then of course, there is the most asked question I get from readers — where to put their money when we get there?!

Stay tuned to Land Cycle Investor if you want to have all essential content that will assist to navigate the years ahead.

Best Wishes,,

|

Catherine Cashmore,

Editor, Land Cycle Investor