Elon Musk tweeted in January last year that:

‘The most entertaining outcome is the most likely.’

That certainly seems to be true when it comes to his own life!

The new owner of Twitter is obviously having a lot of fun — despite the fact many think he’s vastly overpaid for the company — in his new role.

Check out his revamped Twitter profile, for example:

|

|

|

Source: Twitter |

He’s amended his description to ‘Twitter Complaint Hotline Operator’ in response to constant critiques on some of his planned changes.

And his new location?

‘Hell’!

I think the mischievous Musk enjoys playing the devil in all this.

And his quote at the start is probably more of a self-fulfilling prophecy than anything else.

But it made me think…

Is this true of market outcomes too?

Well, sort of yes and sort of no.

In my experience, the most likely outcomes are the ones least expected.

I mean, who saw interest rates rising at a record pace 12 months ago? Certainly not bond investors, nor even central bankers themselves.

And it’s a point our Editorial Director, Greg Canavan, drummed home last week. He sent out a company-wide email that read:

‘Thanks to the Fin Review, you now know what’s in the news and in the price.

‘This is just a reminder for us to push ourselves beyond this narrative and look for the next thing that the mainstream media hasn’t seen yet.’

With that in mind, today, let’s explore a possible outcome not many are predicting or even thinking about…

Calling BS on inflation

We’re firmly in doom and gloom mode right now.

Everyone is expecting the worst…

The latest doom merchant was the Bank of England. Last week, they raised rates for the eighth time in a row from 2.25% to 3%.

At the same time, they added the warning that they could go as far as 5%, triggering a painful two-year recession.

The aim is to try to bring down inflation.

But what if interest rates have little effect on inflation?

Not a popular viewpoint right now, but I think it’s one worth exploring.

Jeff Snider, a strategist at Atlas Financial, is one lone voice advocating this line of thinking.

He says (my emphasis):

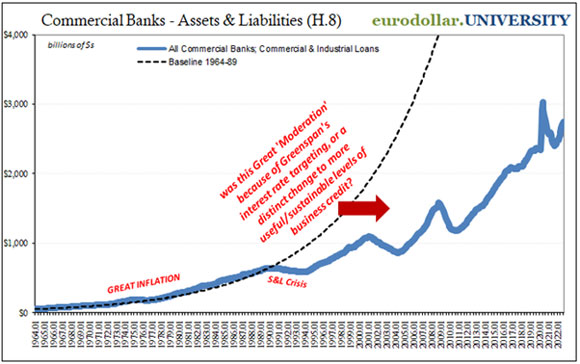

‘This idea that rate hikes somehow restrain the economy via credit just doesn’t stand up to scrutiny.

‘Everyone agrees with the idea simply because everyone agrees with the idea. Credit growth was sustained when rates were higher and rising.’

|

|

|

Source: Twitter |

Jeff does a great job of explaining his opinion in this 20-minute video.

His main point is that the relationship between interest rates and inflation is mostly an illusion perpetuated by the Fed since the 1980s in order to pump up their own importance.

And today, all this jawboning is actually an attempt at psychology more than anything else…

To make people behave in a certain way to try and drive an economic outcome rather than the other way around.

Agree with that or not — it’s worth considering.

Because if Snider is right, we’re raising rates into a recession. While that’ll help bring down demand, it might not have much effect on inflation.

And that’s because a lot of measured inflation is actually supply-side inflation, not demand driven.

In other words, it’s the underinvestment in certain key areas causing inflation, not the level of demand.

Such structural issues take years to resolve.

After all, you can’t just magic up new materials, energy, or food the way you can money!

This also means that inflation — while it’s already coming down as economic growth slows — will probably be elevated for a while to come.

Funnily enough, that spells opportunity for Australia…

Who benefits?

So who benefits from sustained levels of elevated inflation?

Producers of commodities, that’s who!

Miners, farmers, equipment suppliers to these industries, state government coffers, and even house prices through the flow-on effects.

Hard assets are hedges against high inflation because they’re the very things rising in price.

This was actually an outcome I’ve been thinking about for a while.

I wrote to subscribers of my Exponential Stock Investor service back in December 2020:

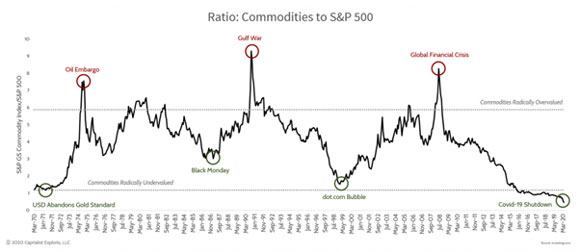

‘This chart below maybe shows why this is such a pivotal moment for commodities:

|

|

|

Source: Capitalist Exploits |

‘So, what are you looking at here?

‘This chart shows you just how cheap commodities are right now compared to other top stocks (the S&P 500).

‘Yes, there’s been an uptick in prices very recently. But — despite that — as you can see, resource prices are still literally through the floor.

‘Take a closer look.

‘You can also clearly see what happens when commodities are as cheap as this in the past. The trend suddenly reverses, and we roar into a new commodities boom.

‘The last time we had a big reversal point, it led to the original mining boom of the early 2000s that produced the gains we talked about above.

‘It was a time of immense wealth creation for Australia…and for Australian investors who backed the right stocks.’

With hindsight, I was a bit early in this call.

But the facts haven’t changed.

If anything, the likelihood is even greater now of a surprise commodity boom, no matter what central bankers do with interest rates.

And it’s a view our new mining specialist James Cooper agrees with.

He’s a geologist by trade and knows the mining industry inside out.

He told me he’s seeing things on the ground already…

Murmurings in the streets of Perth of something ‘big’ coming up.

Old hats from the original mining boom appearing on company boards.

Luckily for us, he’s just put together an investment ‘attack plan’ for 2023 based on everything he’s seeing.

You’ll see why he thinks a SCARCITY-driven resource stock surge could be one of the only speculative trends worth playing next year.

And where the opportunities are lurking on the ASX right now…at substantial discounts.

It could be one of the best bits of investment insight you get from us in what’s been a pretty depressing year overall for investors.

And I personally like it because I don’t know anyone else with James’s viewpoint right now. Which, as I said at the start, is usually a good sign.

Anyway, Money Morning is going to go full force with James’s research starting this Thursday.

Stay tuned…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.