‘We expect capital city prices to fall 18 per cent over the balance of 2022 and 2023, before a 5 per cent gain in 2024 as mortgage rates fall’, said ANZ senior economists Felicity Emmett and Adelaide Timbrell this week.

To give some context, an 18% *crash* in median values (because that’s what it would be if the forecast played out) hasn’t occurred in the Aussie property market for decades…

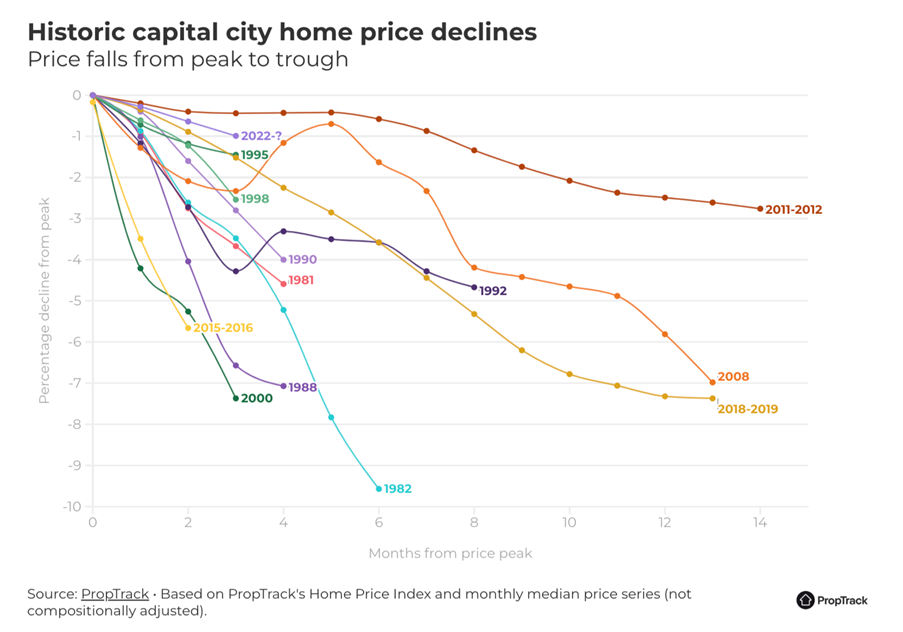

You can see this on the chart below — it shows capital city price falls from peak to trough since the early 1980s:

|

|

| Source: PropTrack |

Sure, the median can cover a lot.

If an owner needs to sell — and there are no buyers — likely they’ll have to slash the price 10–20% to get a sale.

I’ve seen a few examples of that over the first half of this year, particularly at the top end of the market.

But to get a broad-based drop of 18% in the median capital city house price would require a large proportion of property owners desperate to sell, hitting the market over the period, and nothing to support prices on the other side.

I just can’t see it happening.

A large proportion of households with variable rate mortgages are well ahead in repayments.

We’re not in a period where it’s hard to find employment.

It’s not the GFC.

And let’s face it, those that are subject to increases in rates will do everything they must to avoid default.

Cuts to spending on the one hand — seeking an increase in income on the other.

If you need a job, you can get one.

I would also argue that it’s never been easier for mortgage holders, in an age of technological innovation, to access multiple streams of income.

If some owners require an extra $200 per week to meet rising rates and prevent going into foreclosure, it’s possible to generate it.

I stumbled across this story the other day:

‘Sophie Thomas, 33, rents out her clothes on The Volte and says it has been “such a positive experience” and a good return on investment, earning her $3000-$5000 a month.

‘“I bought a dress for my son’s christening while I was on maternity leave one year ago and I really couldn’t afford it at the time,” she says.

‘I had heard about renting out dresses on The Volte so I uploaded after the christening — the next day I woke up to my very first booking request.

‘Thomas says the money made through renting out clothes is paying for her upcoming wedding. “It’s amazing that the wedding costs are covered from a side hustle and not coming out of our income,” she says.’

The Volte says some users make more than $100,000 a year and the average user earns $1,500 monthly.

And there are a plethora of platforms offering something similar:

- Spare bedrooms can be rented out on platforms such as The Room Xchange — potentially bringing in up to $1,000 a month.

- Caravan and motorhome owners can rent out their vans on Camplify. The platform saying users can earn up to $10,000 annually.

- Online marketplaces such as eBay, Gumtree, and Facebook Marketplace have reportedly delivered some users the equivalent income of a full-time job.

- You can share your car for cash on platforms like Car Next Door for an average of $280 a month.

The platform claims:

‘Some members have turned car sharing into a side business, with a fleet of 10 cars making an average of $103,604 a year…

‘We have several members who rent out multiple items or spaces simultaneously, so the earning potential is huge.’

Then we have the rise of fintech.

New entrants into the space are offering lower fees and more competitive rates than you can access through the majors.

Just this past week or so, news of fintech lender Futurerent hit the headlines.

This time it’s offering landlords up to $100,000 of their rent in advance to either carry out property improvements or buy another property.

With rents rising of more than 10% per annum on the back of record low vacancy rates in some regions. The market is continuing to attract yield seeing investors.

Subscribers to Cycles, Trends & Forecasts know where (and when) this is all going to end.

But right now, it’s fuel that offsets outlandish calls of 18% drops to the median over the next 12 months.

It’s not all ‘doom and gloom’ in the real estate market either.

This week, 27-year-old cryptocurrency casino owner Ed Craven smashed the Melbourne house price record, purchasing a mansion in Toorak for $80 million.

To be clear, though, he didn’t buy a house. He purchased 7,200sqm of prime land.

The property is known as Toorak’s ‘ghost mansion’.

A previous owner — HOYTS boss Leon Fink — had half-built a French Renaissance-style mansion on the block. It has been untouched since.

It’s not Craven’s only purchase this year either.

He paid $38 million for another Toorak mansion in March.

The property, a two-level Orrong Rd home, set on almost 2,000 square metres of land.

Never forget — ultimately, all gains from innovation and technology find their way into land’s price through the cycle.

The house (or rather land) always wins in the end.

Best wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor

Comments