I spent much of 2019 writing about the huge changes coming to Australia’s banking landscape.

My contention was a bunch of tech savvy upstarts were going to start eating into the big banks’ profits.

The threat looms large from both ends of the spectrum. It’s not just idealistic start-ups coming at them.

I read today that Apple Inc [NASDAQ:AAPL] is on track to handle 10% of the entire global card transactions by 2025. It already has 5%.

Yes, big changes are coming. And they — the big banks — can’t do anything about it.

They’re too big, too entrenched in outdated technology, and too reliant on ‘old’ profits, which usually rely on customer habit rather than anything ‘better’.

The very concept of change is anathema to their whole business model.

But they’re not stupid. They know change is coming.

So they’re using their go-to strategy to try and bludgeon the competition down. And they’re getting some help from an unlikely ally.

Let me explain what’s going on in the hidden battle for banking…

Banks using regulation as a weapon

Tom Blomfield is the CEO of British fintech success story, Monzo.

The digital-only bank founded in 2015 was recently valued at US$2.5 billion after raising US$136 million last year. It has over three million customers in the UK.

Recently Blomfield had this to say about his UK big bank competitors:

‘Banks are set up to prevent change basically. A lot of the systems inside the bank — particularly risk and compliance functions — are there to stop things changing.

‘Because if things change it creates risk. And so they’re like these antibodies that go around hunting out change and trying to kill it.’

Now here’s the thing…

When you can’t do change, what do you do?

Well, if you already dominate 81% of the market like Australia’s Big Four do, you try and make it hard for anyone else to implement change.

The status quo is your goal for as long as you can keep it.

It’s a uniquely Australian irony, that those using regulatory oversight to their advantage — after the Hayne Royal commission into banking exposed the big banks as the main offenders — will probably be the big banks themselves.

Despite what you might think, big banks love regulation…to a point.

Download now: Three ASX fintech stocks taking on the banks (and winning).

They’ve the resources, the lawyers, and the middle managers to compete on regulation. Especially compared to start-ups with scarce capital.

And they’ve always used regulation as a weapon to try and beat their competition when it suited them.

Take this submission from Afterpay’s managing director to a government inquiry into Financial and Regulatory Technology (my emphasis):

‘In Afterpay’s case, banks have sought to undermine Afterpay’s popularity with Millennial and Generation Z consumers by suggesting (including through mortgage brokers) that obtaining a home loan will be more difficult for Afterpay’s customers due to the operation of the responsible lending obligations.’

That’s very sneaky…and not true at all.

Or how about this story from last year?

‘Banks push for tougher regulations in industry super funds.’ — 23 April 2019

The truth is industry funds have outperformed bank super funds for the best part of two decades.

They’ve really got some nerve…

The fact is, a war of regulatory attrition is a game the banks think they can win.

Competing on technology, customer experience, and price…not so much.

An unholy alliance?

Recently I’ve been wondering if the banks are also in cahoots with big media in this fight against fintech disruption.

You see, I’ve noticed a trend from the mainstream media, particularly the AFR, to start bashing some of the upstart competitors.

To cast aspersions on their bona fides, to make them seem in some way ‘dodgy’.

Coincidence?

Perhaps…

But take the recent reporting on one of our great Aussie fintech success stories — Afterpay Ltd [ASX:APT].

Surely this is a story to be lauded as one of extreme entrepreneurial success. An Aussie battler taking on the world!

Well, readers of the AFR in the past few months haven’t heard so much of that. More these types of headlines:

‘Regulation risks hit Afterpay business model’ — Oct 2019

‘Afterpay’s PR guy gifted 800,000 reasons to defend it’ — Nov 2019

‘Consumers join retailers in war on Afterpay’ — Feb 2020

‘Afterpay faces mounting valuation risks’ — Feb 2020

You get the gist…

Now I’m not saying the media should be a mindless cheerleader for any stock. But at the same time, there’s a pattern here.

I was defending Afterpay back in June 2019 from the same attacks when their KYC processes were also under attack by the same media.

The stock price has risen 44% since…

I fear some ordinary investors are being swayed by the constant Afterpay negativity.

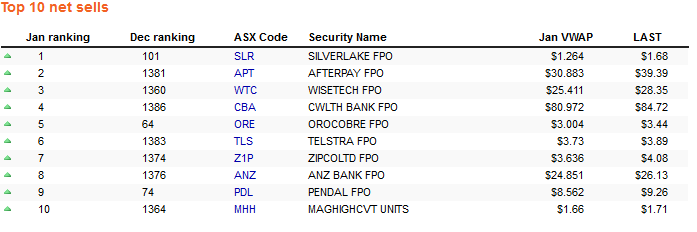

Check out the top 10 net sells on the Bell Direct share broking platform for January:

|

|

| Source: Bell Direct |

You can see that Afterpay was the second most popular stock to sell in January by retail investors.

But the share price has easily absorbed this selling and just hit all-time highs over $40 this week. A sign that this stellar run for Afterpay might not be over yet?

Of course, you need to do your own research make your own mind up on any stock pick.

But my point is, I think the mainstream finance media, instead of constantly bashing a fintech success story, should be dealing with the real issue in Australian banking…

[conversion type=”in_post”]

Living in the past won’t help

It’s been two years since the UK put in place open data laws. These new laws levelled the playing field for fintech innovators with existing banks by making customer data available to third party apps with consent.

And it’s been a roaring success.

Open data made the banks’ hold on customer data redundant. After all it’s not their data, it’s yours.

And these new laws that allowed you to share your banking data with third party providers created a frenzy of innovation in the UK banking scene.

Companies like Monzo are an example of that. And start-ups all around Europe have seen huge entrepreneurial capital coming into their banking system.

You know the stuff that creates jobs, profits, and globally competitive companies…

Meanwhile, Australia is still wrangling over how its open data laws will work, and as a consequence we’re falling into the financial dark ages.

That’s bad for customers and bad for our future banking industry.

We, as a finance media, need to stop bashing our success stories and start turning up the heat on our government and their slow response to a fast-evolving banking landscape.

It’s time to get banking into the 21st century and stop the protection racket.

If we don’t, you can bet foreign companies will come knocking on our shores soon (actually, they already are).

Either way, I think the big banks will be finished.

We might as well stop trying to protect them to the detriment of our innovators, entrepreneurs, and ourselves…

Good investing,

Ryan Dinse,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments