There’s a company listed on the stock market that has gone from a US$1 billion valuation in 2020 to US$9 billion by the end of 2023.

A 9x rise in just three short years.

OK, what’s the big deal about that, you might be thinking.

After all, there’s always some high-flying stock out there. Finding them before they surge is the trickier bit!

But this is the remarkable part…

This company made this leap in value without creating any new groundbreaking products.

It’s not riding some wave of hype in AI, electric cars, or the metaverse.

And although it turns a profit, these are nothing to write home about.

Check it out:

|

|

|

Source: Market Screener |

If you look at the net sales (revenue) and EBIT figures (earnings before interest and tax), you can see the company’s results are pretty stable.

Boring even!

There are no insane levels of forecasted growth on the horizon either.

So how has the market cap of this company gone up so much?

Well, the CEO of this company discovered a little-known value hack a few years ago.

A move that has allowed him to arbitrage the value of one slow growing asset for a much faster growing one.

Most thought he was mad when he started doing this, but as I’ll show you shortly, the results speak for themselves.

And I’ll wager it’s a strategy now on the radar of many in corporate America.

For investors, being aware of how this strategy plays out could create several compelling opportunities for you.

Including one staring you in the face right now.

Let me explain…

Genius or madness?

You’ve probably heard of MicroStrategy Inc [NASDAQ:MSTR] and their CEO Michael Saylor.

He’s made headlines over the past few years for being the corporate voice of Bitcoin [BTC] evangelism.

To many, this was seen as madness.

To risk a company’s cash in an asset as volatile as Bitcoin seemed like an insane punt at best.

But to Saylor — a computing engineer by trade — this was simply a matter of logic.

The best move he could make in the face of a world consumed by endless money printing, super low interest rates, and unsustainable debt loads.

As he noted in 2020 when MicroStrategy first bought Bitcoin:

‘We just had the awful realization that we were sitting on top of a $500 million ice cube that’s melting,’ Saylor said. MicroStrategy has settled on bitcoin as the treasury alternative.

‘This is not a speculation, nor is it a hedge,’ said Saylor. ‘This was a deliberate corporate strategy to adopt a bitcoin standard.’

As Saylor explains, companies with excess cashflow have only three choices:

- Invest in research and development hoping for growth. Tough to do in the tech world when you’re competing with the big giants, as in MicroStrategy’s case.

- Buy back your own stock (in Australia, paying franked dividends is the preferred option because of tax rules). This was the favoured strategy of many a listed company over the past decade. In 2022 stock buy backs hit a record US$1.5 trillion, up 9% from the year previously; and more than US$700 billion over 2018. It is a way to reduce the number of shares on issue and hence pump up the value of the stock price on a per share basis.

- Put money in the bank. As Saylor said, this is like putting it in a ‘melting ice cube’. Fiat debasement is the one guarantee over the next 100 years.

None of these seemed compelling to Saylor.

So he opted for a fourth option and started buying Bitcoin in 2020 to a sceptical reception.

At first, things went well.

He rode the 2020 bull market higher. But when the crypto crash of 2022 hit, the naysayers were quick to pounce.

Here’s The Wall Street Journal’s headline from 3 August 2022:

|

|

|

Source: WSJ |

But what happened next?

As is typical in these things, the mainstream media is the perfect inverse indicator.

They bandwagon jump at the top of a bull market, and put the boot in at the bottom of a crash.

In 2023, Bitcoin roared back to life…becoming the best performing asset of the year by far, closing out the year up 155%.

And with it, Michael Saylor’s fortunes turned drastically around.

As I write, MicroStrategy’s Bitcoin stack is worth a staggering US$8.2 billion. They’re in profit to the tune of US$2.26 billion (+38%).

Think about it…

A company that started out with US$500 million in cash, generating only US$80 million a year in earnings, managed to accumulate an US$8.2 billion treasury in just three years.

The maths don’t make sense.

Until you see the really clever part…

An insane arbitrage hiding in plain sight

Here’s how Saylor did it.

Think back to the four choices MicroStrategy had with their US$500 cash balance back in 2020.

Invest for growth.

Buy back stock

Put money in the bank.

Invest surplus cash into Bitcoin.

Now, after much research, Saylor concluded that Bitcoin was ‘digital gold,’ the ultimate digital property asset.

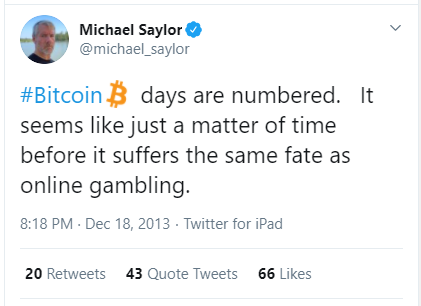

This was a big turnaround from his 2013 position on the nascent asset:

|

|

|

Source: x.com |

So in 2020, he started buying Bitcoin as a balance sheet asset for MicroStrategy, announcing to the world:

|

|

|

Source: x.com |

But he didn’t stop there.

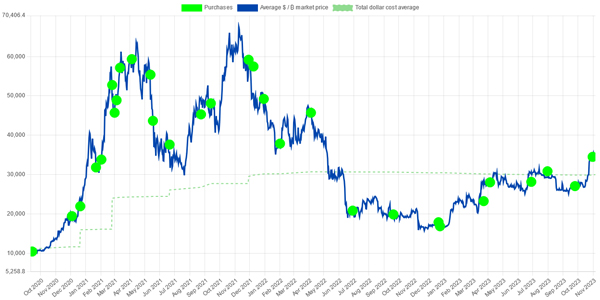

Saylor’s company continued buying Bitcoin all through the bull and bear cycles, a so-called dollar cost averaging approach.

Every green dot here represents a Bitcoin purchase:

|

|

|

Source: Saylortracker.com |

As you can see, he bought high and he bought low…but he never stopped buying.

This is where it gets interesting…

The initial purchases used the company’s savings and any company cashflow to buy more.

But that’s nowhere near enough to account for the US$6 billion worth of Bitcoin MSTR has bought over the past three years.

How did Saylor come up with that cash?

Well, instead of buying back stock like everyone else, he did the exact opposite.

He issued more stock to raise funds, and used the proceeds of these funds to buy more Bitcoin!

In fact, in 2023 he increased shares on issue in MSTR by 25%.

The basic fact Saylor was taking advantage of was that he could easily raise money off the back of his slow growing software business and invest that in faster growing Bitcoin.

It was a basic arbitrage strategy.

Mainstream investors in the fiat world were happy to keep giving him money for more stock.

To them, MSTR was undervalued on a fiat basis due to its immense treasury holdings (of BTC). Some even used it as a way to get exposure to BTC before the launch of the newly approved spot ETFs (more on this soon).

Saylor was happy to dilute the shares because he was confident that on a Bitcoin standard — not on a fiat standard — every shareholder would be better off.

He prices the company in Bitcoin per share, not earnings.

And that’s exactly what has happened so far. Allowing this company to turn around US$800 million of cashflow into U$8.2 billion Bitcoin.

Do you see how amazing this was?

And I’d point out, this wasn’t just a consequence of a raging Bitcoin bull market. It took place in both bull and bear market conditions.

My point is…

If this strategy takes hold on a more widespread basis, it could lead to a wave of corporate adoption in the years ahead.

Especially in low growth companies looking for ways to preserve their value.

The real great reset

When will Wall Street cotton onto this strategy?

Who knows if they ever will.

In the past, most mainstream companies have been put off by the poor reputation of crypto in the mainstream world.

(Though there are some interesting companies already with Bitcoin on their balance sheet, including Norwegian mining giant Aker, as you can see here.)

But that could be set to change with the recent introduction of regulated spot Bitcoin ETFs.

This moment validated the asset class in the eyes of many in traditional business. At the very least, it’s no longer taboo to speak about Bitcoin in corporate boardrooms.

And perhaps it’s no coincidence that in just three weeks, these new ETFs are seeing an insane amount of demand.

As I wrote to subscribers of my Crypto Capital service last week:

‘…when you add it all up, day 12 saw a net INFLOW of funds into all Bitcoin ETFs to the tune of US$256 million.

That’s a total net inflow so far since inception of over US$1 BILLION!

To put this in context, the ETFs have bought over 145 days’ worth of Bitcoin (based on 900 BTC per day mining rewards) in just 12 days!!’

As the price of Bitcoin rises, we could see more and more low growth but profitable companies, start to see the genius of Saylor’s strategy and adopt some version of it.

Or they will, in Saylor’s words, ‘die a long, slow death.’

As it stands, Bitcoin is severely undervalued compared to its potential.

So why wouldn’t a business swap one low growth asset (their equity) for a much faster growing one (Bitcoin) while the opportunity is still there?

The same applies to anyone really, from individuals to nation states.

Indeed, it wouldn’t surprise me if some countries are already starting to silently convert their worthless fiat currencies — money that can be printed at will — for the hard asset of Bitcoin.

And if we get to the stage where businesses, individuals, and nation states all start to measure their wealth in Bitcoin terms (not fiat), then that’s the kind of great reset I could get behind.

Of course, none of this is going to happen overnight.

But my point today is to show you that it’s a lot closer than you might think too…

(PS: One interesting demographic rarely talked about in Bitcoin circles is the millions of small and medium sized businesses that are steady, low growth, cashflow positive businesses. Where do these businesses park their cash to secure their wealth? Property? Savings? Well, one small Canadian restaurant chain has been ploughing all their profits into Bitcoin since 2020. And like Saylor, it’s paying huge dividends for them. Read more about that amazing tale here.)

Good investing,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

![MicroStrategy Inc [NASDAQ:MSTR]](https://daily.fattail.com.au/wp-content/uploads/2024/02/FTD20240205_1.png)