In today’s Money Morning…money rarely lies…decarbonisation…FMG isn’t the only iron ore giant branching out…and more…

Our crack researcher, Kiryll Prakapenka, recently wrote an in-depth report on nine big trends to watch for in 2022.

In today’s Money Morning, we give you a sneak peek at the first two. Enjoy…

Trend #1 The great lithium disconnect

Lithium wars: whatever it takes

In the last month of 2021, giant automaker Volkswagen announced it would invest a further €17 billion to develop its electric vehicle fleet.

Volkswagen’s total EV spend has now risen to a substantial €52 billion, the largest such investment by any traditional manufacturer.

Money rarely lies. And following the traditional automakers’ money trail leads to EVs.

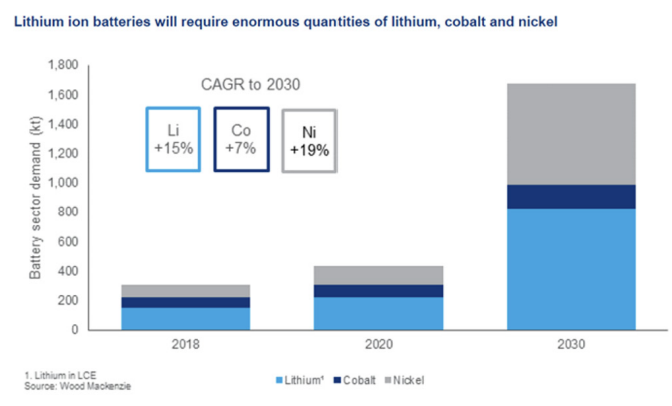

And an EV world is one hungry for lithium.

In 2020, 10 million EVs were sold globally.

But the International Energy Agency recently set a target for at least 200 million EVs by 2030.

The next decade will be a busy one, then.

Long term, the world where most of its cars are electric will be a world using significantly more lithium than the world we are leaving behind — the waning age of the internal combustion engine.

|

|

|

Source: Wood McKenzie |

And demand for EVs — and the corresponding rush to stock up on lithium and other needed elements like cobalt, copper, and nickel — could ramp up as soon as next year.

Why?

BloombergNEF projects the cost of a lithium-ion EV battery pack will fall below the magic threshold of US$100 per kilowatt-hour by 2023, if not earlier.

Why is this the magic number?

Should EV battery packs fall below that, electric vehicles would reach price parity with traditional cars by the mid-2020s.

You can imagine the demand impact.

Faced with two equally priced cars, more people will likely be swayed to go with the one that’s electric.

|

|

|

EV brands set to compete with Tesla (Source: Financial Times) |

But affordability isn’t the only factor.

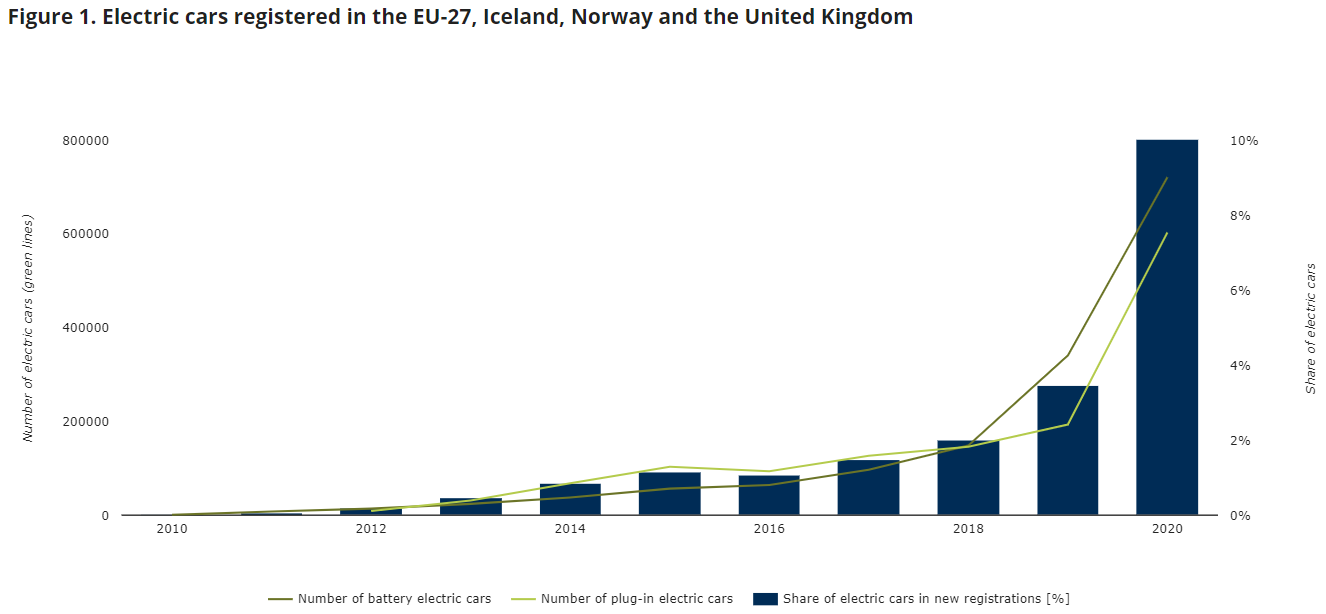

The adoption of EVs is also driven by regulation and governments proactively positioning for a greener future.

In November 2021, Biden signed a US$1.2 trillion infrastructure bill that allocated US$7.5 billion to populate the US with 500,000 EV charging stations.

At the same time, the European Union proposed legislation to cut CO2 emissions from cars by 55% by 2030.

What’s a great way to reduce car emissions?

Encourage citizens to go electric.

|

|

|

Source: European Environment Agency |

As the Financial Times noted:

‘There was a direct correlation of when new European emissions rules came into force and when electric car sales really took off across the continent. What you expect going over the next few years is every time the rules tighten, those are the years in which you are likely to see a very big spike in electric vehicle sales.’

The EV switch isn’t prospective but firmly in the present, albeit patchy.

In 2020, the share of electric vehicles was 75% in Norway, 46% in Iceland, 33% in Sweden, and 28% in the Netherlands.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

But the rush to electrify our car fleet left supply behind in 2021.

Lithium carbonate prices, for instance, soared more than 300% in the 12 months to December 2021, according to oft-cited Benchmark Minerals.

The market intelligence firm’s CEO — Simon Moores — dubbed the market situation as the great lithium disconnect:

‘Right now lithium demand is growing a three times the speed of lithium supply. That’s a big problem that needs to be solved.’

Now, if you’re interested in lithium stocks and the wider clean energy theme but not keen on sifting through feasibility studies and ore readings, we have a dedicated publication here at Fat Tail Investment Research that may be of service.

New Energy Investor shows how you can grab your stake in the great energy switchover as the world transitions out of fossil fuels and into cleaner, greener, renewable energy.

Helmed by James Allen in London and Selva Freigedo in Melbourne, New Energy Investor hunts for the best and brightest clean energy prospects on the market — long before many Australian investors get to hear about them.

As Selva recently wrote:

‘This isn’t the first time that lithium prices have rallied, they did the same during 2015–18. But that rally fizzled out as more producers entered the market and prices collapsed.

‘This time things are looking a bit different, though.

‘While there are more lithium mines coming our way, it takes a while for that supply to get onto the market.

‘Higher prices are also driving battery and EV makers to take on longer-term contracts to secure supplies.

‘And, of course, back in 2015 you didn’t have as many carmakers investing in EVs as governments set up targets to phase out petrol cars. Demand is only going to ramp up…

‘The Australian Government Department of Industry, Science, Energy and Resources (DISER) expects global demand for lithium to go from 305,000 in 2020 to 486,000 tonnes of lithium carbonate equivalent (LCE) this year…and that to increase to 724,000 tonnes by 2023.’

Trend #2 Decarbonisation — green switch activated

Lithium is a sub-theme of something wider — decarbonisation.

Decarbonisation refers to the reduction of CO2 emissions stemming from human activity, with the eventual aim of eliminating CO2 emissions altogether.

Getting to a net-zero target requires shifting from fossil fuels to alternative energy sources — including lithium but many more besides.

BlackRock, the behemoth asset manager, named decarbonisation as one of the key trends in its 2022 global outlook.

BlackRock said that:

‘Navigating net zero is not just a long-term story — it’s a now story. The global transition to a more sustainable world will require a massive retooling of economies, in our view.’

Now, sometimes, a great way to analyse a topic is by paying attention to incentives and rational self-interest.

Businesses aren’t charities. We can glean important market signals from what businesses are doing in the pursuit of self-interest.

Let’s consider old hands Woodside Petroleum Ltd [ASX:WPL], the historied oil and gas producer, and Fortescue Metals Group Ltd [ASX:FMG], the iron ore giant.

In December 2021, Woodside CEO Meg O’Neill pledged to invest US$5 billion in emerging new energy markets by 2030 as Woodside prepares for the energy transition.

O’Neill told an investor briefing:

‘We expect LNG to remain an important part of the energy mix in our region for decades to come, both as a lower-carbon source of fuel for coal-dependent countries and as convenient firming capacity for renewables.

‘But our significant investment target in new energy is aimed at positioning Woodside as an early mover in this evolving market and supporting the decarbonisation goals of our customers.

‘We expect that in the mid-2020s the transition to new energy will be underway, including the start-up of the first of our own projects.’

Woodside’s planned investments will include hydrogen and solar thermal power.

Woodside isn’t the only big player seeing where the future’s headed — and adjusting accordingly.

Fortescue is also positioning for the switch to green energy.

Fortescue now sees itself as more than just a resources business.

In a December 2021 market update, Fortescue said it was transitioning from a ‘pure resources company to a vertically integrated green energy and resources group.’

And FMG isn’t the only iron ore giant branching out.

In December 2021, Rio Tinto Ltd [ASX:RIO] paid $825 million to acquire the Rincon Mining lithium project in Argentina.

RIO said the acquisition showed its ‘commitment to build its battery materials business and strengthen its portfolio for the global energy transition.’

Decarbonisation is already becoming a major focus — both for governments and private enterprise.

And as the world shifts from fossil fuels to renewables, the decarbonisation theme is only set to grow in prominence and importance.

Regards,

Kiryll Prakapenka,

Contributing Editor, Money Morning

PS: How to Find Promising Energy Stocks — Discover why the energy market is ripe for massive disruption and how to identify innovative energy stocks. Click here to learn more.