The writing’s on the wall for the petrodollar fiat system.

Months of aggressive rate rises by the US Fed and central banks have nailed the coffin that is the global economy and financial markets.

Now we’re living in a system comprising decades of accumulated debt and waste that piles up like the Augean stables. To make it worse, governments around the world slapped on even more debt and implemented excessive control measures during the pandemic. As a result, businesses and households faced an insurmountable challenge ahead trying to revive trading activities and rebuild wealth in a crippled economy.

On one hand, we’ve so much debt that would only reduce if there’s production and wealth creation. On the other, the supply chain is crippled, stifling business activity.

There’s nothing worse than having a seething mess and realising your means of cleaning up is damaged!

Who’s to blame for getting us into this?

The ‘Great Reset’ and a new financial dystopia

The leading culprits are those who engineered this quagmire in the first place. They need no introduction nowadays as they’ve been proudly broadcasting their agenda, which they call the ‘Great Reset’. All these crises we’re facing are meant to usher in the ‘Fourth Industrial Revolution’ with a new societal order governed by unelected technocrats using a new central bank digital currency.

The other culprit is us. We allowed this to happen. Through ignorance or greed, we handed our finances to those who never had our interest in mind.

Can’t afford a home? Want to build an investment property portfolio to get rich without lifting a finger? Easy, take-out mortgage loans that enrich the banks via decades of interest payments.

Want to live a lifestyle to emulate the (non-)reality TV stars? Max out your credit card, take out more loans, and impress people who really don’t give a hoot about you.

Wow, this political party offers to subsidise your healthcare, childcare, etc., if you vote for them in the next election! Why not? Vote them in and enjoy ‘free’ benefits, generously paid for through your taxes and public borrowing!

Now that governments, institutions, and households are stretched to the limit on debt, there has to be a way out of this situation.

And what better way than to destroy this financial system and start all over again?

A system backed by sound money to help us spend responsibly with cheques and balances?

Sounds good, but in your dreams!

It’s about to get worse…they want to track your spending and silently tax you by linking you to a centralised digital system.

And if you don’t comply or express dissent, they could easily shut you down and cut you out of their system. Ask the Canadian truckers, the Dutch farmers, and the Brazilian citizens who are protesting over their contested election.

Hope on the horizon

While there’s much fear over this dystopic system, I believe there’s enough resistance in the global population leading to this agenda to change form or risk rejection.

Several countries are now seeing citizens mobilise to demand governments and businesses change their allegiance or face their wrath. They’re hitting the ballot boxes and corporate bottom lines with varying levels of success.

There’s also a migration out of the fiat currency system into precious metals and cryptocurrencies. While the prolonged gold bear market and the crypto winter, exacerbated by the collapse of FTX, have slowed the growth of this resistance movement, the momentum is powerful and unrelenting.

I’ll cover how the momentum is growing in future. What I’d rather focus on now are signs that gold is building up for its imminent boom.

Gold waits at the wings for its dramatic recovery

There’s mixed opinions, even among those at Fat Tail Investment Research, as to whether the recent gold price recovery and the ASX Gold Index [ASX:XGD] point to gold having bottomed two months ago.

My colleagues, Greg Canavan and Callum Newman, are leaning on the recent rally in gold stocks being a recovery in this space.

As for me, I’m leaning on this being a temporary bounce.

This may come as a shock to many of you, as I’ve been quick to cheer any signs of a recovery in gold over the last year and a half.

I’m by no means bearish on gold, however, I don’t think that the stars haven’t fully lined up for gold to take off, and that the fireworks will more likely come after one more pullback.

So I think gold’s waiting in the wings.

Allow me to briefly lay out what I’m seeing from the various market indicators so you can judge for yourself.

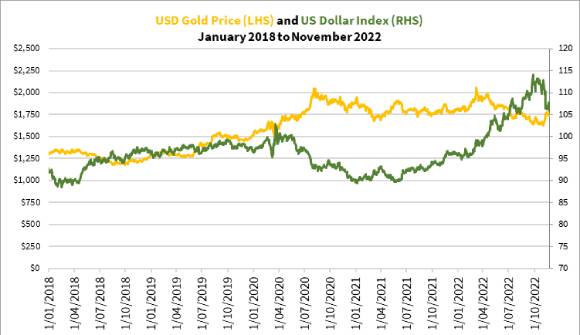

Firstly, the price of gold in US dollar terms has been rising only because of recent weakness in the US Dollar Index [DXY], which you can see below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

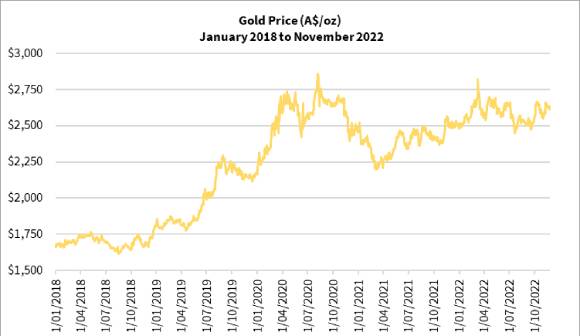

Gold hasn’t become more valuable in intrinsic terms over the past six months, and you can see it in the Australian dollar price of gold too:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

How about gold stocks?

|

|

| Source: Thomson Reuters Refinitiv Datastream |

The ASX Gold Index has recovered more than 30% from its most recent lows in September. Some of the leading gold producers have gained more than 40% over this period. These are bullish signs.

Normally this should be enough for me to say it’s time. Honestly, I was calling a gold stock recovery in the past two years on weaker signals than what’s happening now.

But what’s making me hesitant now, besides being several times bitten?

The looming oil crisis — climbing over the hill

My view is that the macroeconomic outlook, especially regarding the US economy, the supply and price of oil, and diesel casts a shadow on current markets.

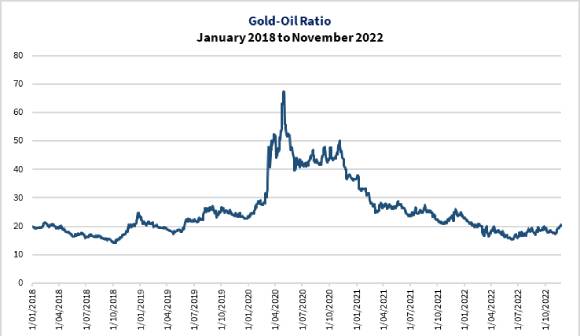

Many of you are aware that I use the gold-oil ratio as my key metric to gauge whether gold producers are operating profitably. It helps me measure if gold producers are fairly valued in the market.

This is what gives me an edge against other gold investors out there.

Right now, it’s moving in the right direction as the price of oil is falling, leading to a rising trend in the gold-oil ratio:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

However, the world is gripped by a global shortage of oil and diesel due to the green agenda and sanctions against Russia.

With the Northern Hemisphere winter coming up, things could change quickly such as the price of crude oil rising, possibly exceeding the price back in June.

Should that happen, inflation could rear its ugly head once more. And as long as the Federal Reserve holds its ground on raising rates, gold will likely retreat, pushing down the gold-oil ratio.

Positioning yourself for the gold rally sooner or later?

So that’s my take on why I’m cautious about this recent rally in gold stocks. I believe there’s still one more hill to overcome before things turn rosy for gold and gold stocks.

At what point will I change my mind?

If oil fails to rally in the coming months and inflation continues to head down, causing the Federal Reserve to pare back on raising rates, then it’s time to come out guns blazing.

And how do I know if I made the right call?

Should the Federal Reserve raise rates and cause the asset markets to buckle and crash 10% or more, that should be enough to freak out central bankers and cause them to change course.

So, the case of the gold boom is sooner or later…

Be patient for just a little longer, it’ll be worth it!

If you want some trading action with gold (as well as other sectors), consider signing up with Callum on his Small-Cap Systems.

For steady hands investing, I’d recommend giving Greg’s Fat Tail Investment Advisory a go.

And finally, you can sign up with me on Gold Stock Pro, where I’ve got many speculative gold explorers and developers that could deliver sizable returns in the next gold rally!

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

Comments