As I’ve predicted for a while, we finally saw 11 spot Bitcoin ETFs (exchange traded fund) approved last week slap bang on the 10 January deadline.

There was quite a lot of excitement about this moment in both the Bitcoin and wider investing communities.

But as often happens, the short-term price action suggests it was a ‘sell the news’ event.

The price of Bitcoin plummeted almost 10% at one stage over the weekend and the ever-eager Bitcoin sceptics were quick to gloat.

For example, long time Bitcoin basher Peter Schiff tweeted this:

| |

| Source: x.com |

It’s funny how obsessed some bitcoin haters are with Bitcoin.

I mean, if I don’t like an asset class, I usually just ignore it and focus my attention elsewhere.

Each to their own I suppose…

Anyway, I could spend all day rebutting people like Schiff but I think one chart will suffice.

Facts don’t lie

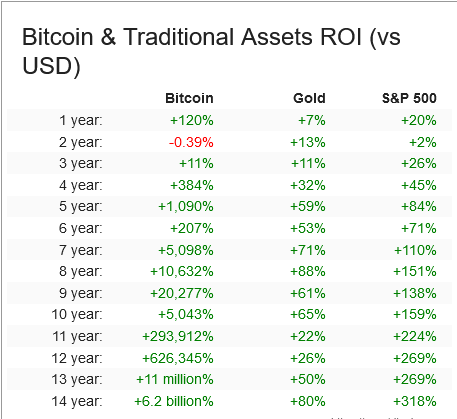

Check this table out:

| |

| Source: Casebitcoin.com |

This table shows the return on investment (ROI) of Bitcoin, gold (Schiff’s favoured asset) and the US stock market over different time frames.

As you can see, holding Bitcoin is the clear winner in most cases.

And when you consider Bitcoin’s returns have come about in the face of extreme opposition from various governments, Wall Street elites, and the mainstream media, the results are even more remarkable.

So believe me when I tell you, long time Bitcoin holders aren’t in the least bit phased by a post ETF launch price sell off.

In fact, in a lot of ways the launch was actually a roaring success.

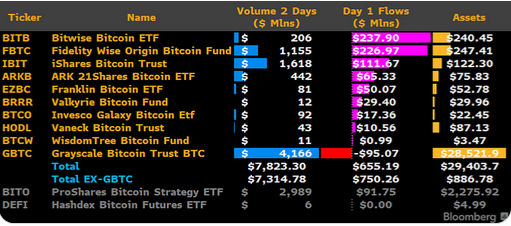

I mean, a record US$4.5 billion in volume was traded on day one.

You can see the breakdown here:

| |

| Source: Bloomberg |

A small detail to take note of here…

A lot of the day’s selling came from the Grayscale Bitcoin Trust ETF (GBTC). This was an existing trust that converted into an ETF.

Now, for a long time, holders of units in this trust could only sell at a steep discount to the actual value, but when it became an ETF, this discount evaporated.

So one current theory is that these long-suffering holders were most ripe to sell on the ETF launch as they had essentially been ‘locked out’ of selling at a fair valuation for years.

It’s probably partially true, though I expect a lot of speculative money and leverage accentuated any price moves too.

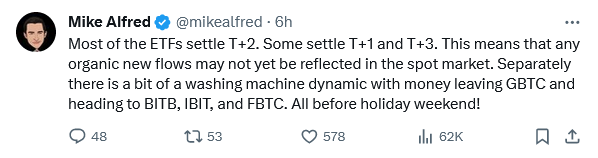

One Bitcoin analyst also made the point that the traditional finance system is really slow and inefficient so we may not even know the true flows yet!

| |

| Source: x.com |

Compare that to the fact that the Bitcoin network settles every 10 minutes!

Anyway, the point is, we’re bound to get some twists and turns in the short term as people work out how these ETFs will work.

Opposition remains

Then there was the amazing fact that some big Wall Street platforms are still refusing to list these Bitcoin ETFs!

The biggest firm doing this was Vanguard saying that Bitcoin ETFs ‘do not align with the building block of a long-term investment portfolio.’

Again, I’d point you to the table of returns I showed at the start to illustrate how nonsensical that statement is.

And as Swan analyst Steven Lubka sarcastically tweeted:

| |

| Source: x.com |

It seems some like Vanguard are making a political calculation that it’s better to keep opposing these products even though they’re now regulated and legal.

I think this decision will age very badly, especially in the next Bitcoin bull run.

And already I’ve seen anecdotal evidence that many Bitcoiners in the US with Vanguard accounts are switching to friendlier firms.

Even non-Bitcoiners like free market advocate George Selgin are critical of this decision, tweeting:

| |

| Source: x.com |

Of course, other big firms like Fidelity and Blackrock are taking the other side of this bet.

I’ve heard reports that Fidelity advisors were on the phones actively telling clients how the Bitcoin ETFs work on Friday.

And Blackrock head honcho Larry Fink was on TV laying out the case saying:

| |

| Source: x.com |

Anyway, I expect once the dust settles the ETFs will start to do very well.

But look…

Ignore the sideshow, focus on the real end game

For long-term Bitcoiner’s like me, these ETFs are almost a sideshow.

Don’t get me wrong, it’s a milestone in term of Bitcoin’s maturing process into a legitimate asset class.

And it’s a vindication for many of the arguments I’ve been making for a decade now. Most said this moment would never come.

But it’s not the end game…

Bitcoin is a public good, controlled by no one and accessible to everyone.

It gives everyone access to self-sovereign money that can’t be debased or confiscated.

That is the ultimate idea we continue to work towards.

These ETFs merely allow different types of investors to share in some of the rewards as this network grows in value.

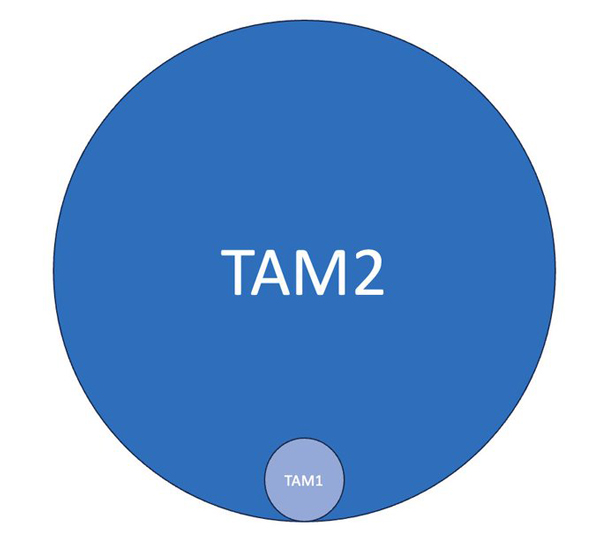

And now that the pension funds, super funds, and institutional investors can invest in a format they’re comfortable with, the total addressable market for Bitcoin has widened considerably.

This chart illustrates it:

| |

| Source: Alesandro Ottaviani |

So what now?

If we see more price weakness in the weeks and months ahead, it’ll give you one more chance — perhaps your last one — to start learning how to buy and store Bitcoin the ‘proper’ way before Bitcoin starts to get gobbled up by these new participants.

Because the fact is…

When the next big Bitcoin bull run comes — and I’m very confident it will — it’s now easier than ever for a heck of a lot of capital to get into Bitcoin very fast indeed.

Prepare accordingly…

Good investing,

|

Ryan Dinse,

Editor, Crypto Capital

Comments