Here’s the thing about the stock market. Sometimes different strategies work at different times.

That might sound obvious, but it throws up a practical problem.

For example, if you normally trade momentum, like I do, and there’s not much momentum exhibiting…what do you do?

You have two choices. One is to do nothing…and wait for momentum to come back (which it will at some point).

That’s what my service Small Cap Systems is designed to do.

Another is to use a different approach. In other words, change your strategy to meet the market as it is now.

Here’s one example from me lately…

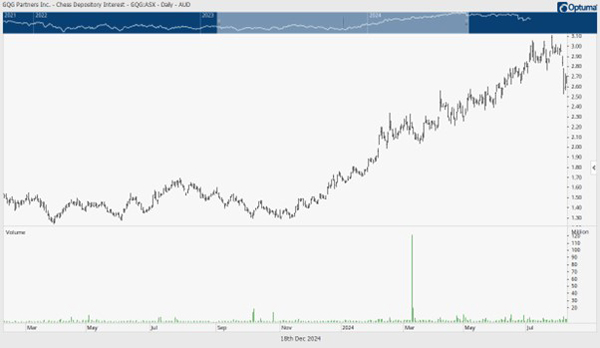

Let me tell you about a stock called GQG Partners [ASX:GQG].

It’s a US based fund manager.

It’s one of the opportunities I discussed in my Fat Tail speech to our Alliance members in November 2023.

For the first six months of the year, the stock had a cracking run up — a classic momentum trade that subscribers to my service Small-Cap Systems got on.

Check out the big run up into a July top…

| |

| Source: Optuma |

At one point, we were up over 100%.

Around August, however, the stock sold down and trigged our 15% trailing stop.

We banked a 91% gain in the end, and Small-Cap Systems closed it out and moved on to other ideas.

From August to November, GQG began to move in a volatile sideways range — without clear direction either way.

There was no trade there.

But I kept following it.

A lot of stock market trading is about previous preparation.

You get to know a stock. You follow it. Maybe chart it. But a buy or sell signal may not appear immediately.

Then one day, something happens.

On November 21 news broke that executives for the Indian company Adani were under investigation for alleged fraud and bribery.

GQG has substantial client money in the Adani group. The stock collapsed 26% on the day as the market worried about the implication to its fund performance and client flows.

Now…

This is where you can use a different strategy. You can day trade the sell off.

What so often happens with breaking news like this, is this: The stock can fall more than 30% in the first minute or two as the bids disappear.

However, the immediate reaction is often excessive, and suddenly bids start coming to buy up the stock in distress.

Day traders will look for a volatile move like this because they can perhaps nab 5% or more — either way — in minutes.

It’s dangerous, of course, because you can buy the dip only to see the stock keep falling. Day trading is hard…and not something I am particularly good at.

You can also look at these sharp selloffs with the longer term in mind. This is when deep knowledge of a stock can be worth thousands of dollars.

I saw GQG drop on that day. It went as low as $1.96.

I thought about buying it.

Generally, I don’t like messy situations in the stock market. But go back to the point above.

There’s little momentum appearing in the market now. Opportunities have to come in different guises. Maybe this was one?

I decided not to act.

GQG bounced back to around 2.30 in the days that followed.

That gave me three things.

One was that $1.96 ‘low’ in the market — an important reference point. If the shares fall below that from here, GQG shares are likely to stay under pressure.

A second point was addressing just how bad this Adani news was for the stock.

A third was that the bounce in the price implied there was at least some buying support for the stock.

The Adani situation wasn’t great news, but GQG still has a lot of appeal. It’s not particularly expensive, with excellent management and good potential over the medium term. It also has a big yield.

The shares were hit again about a week later. One of the investment banks announced it was downgrading the stock. The stock fell 13% on the news in a flash.

I’ve marked the two big down days with the arrows on the chart…

| |

| Source: Optuma |

With the above points in mind, that 13% fall seemed an overreaction to me. This time I stepped in and bought at $2.04.

GQG trades for about 10x earnings, and a 10% yield in Aussie dollars.

It was worth the risk — at least in my mind.

A week later I was up nearly 18%. Now it’s about 10%.

A bit of alpha in a flat market. I’ll take it.

What will GQG do from here? I’m not sure. I suspect not much. This Adani issue will hang over the stock until it’s resolved.

Plus, GQG’s client flows were already slowing down before this. The market will want to see these rising again before they resume buying this company.

But I have a bit of a profit buffer there, for the moment, a nice dividend and a solid place to put a stop loss — under that $1.96 low back on Nov 21.

I’ll take that too.

Clearly more bad news from Adani could rattle the stock again.

What I can tell you is that right now, there is very little ‘heat’ in the market. If you’re looking for alpha, my read is that you’re probably more likely to make a buck buying dips than buying breakouts.

I think of it as a ‘counterpunch’ strategy.

What does that mean for you?

Make a list of stocks you want to own or own more of. Follow them…then see if you get an indiscriminate market sell-off that could offer an entry point.

Who knows, that might deliver some generous opportunities to benefit in this directionless market!

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Comments