Editor’s note: In today’s video update I discuss the tech-led sell-off in the US and how this impacts two ASX tech ETFs. Click the thumbnail below to view.

With the US election just two months away, the S&P 500 [SPX] took a tumble falling 3.51%, along with big name tech stocks like Tesla Inc [NASDAQ:TSLA].

After puncturing the $500 mark, the growth darling posted its third losing session.

Is this the end of the run for the market?

Well it depends which market you are talking about.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

We know the ASX is experiencing a long bout of sideways trading, while US indices are pushing higher.

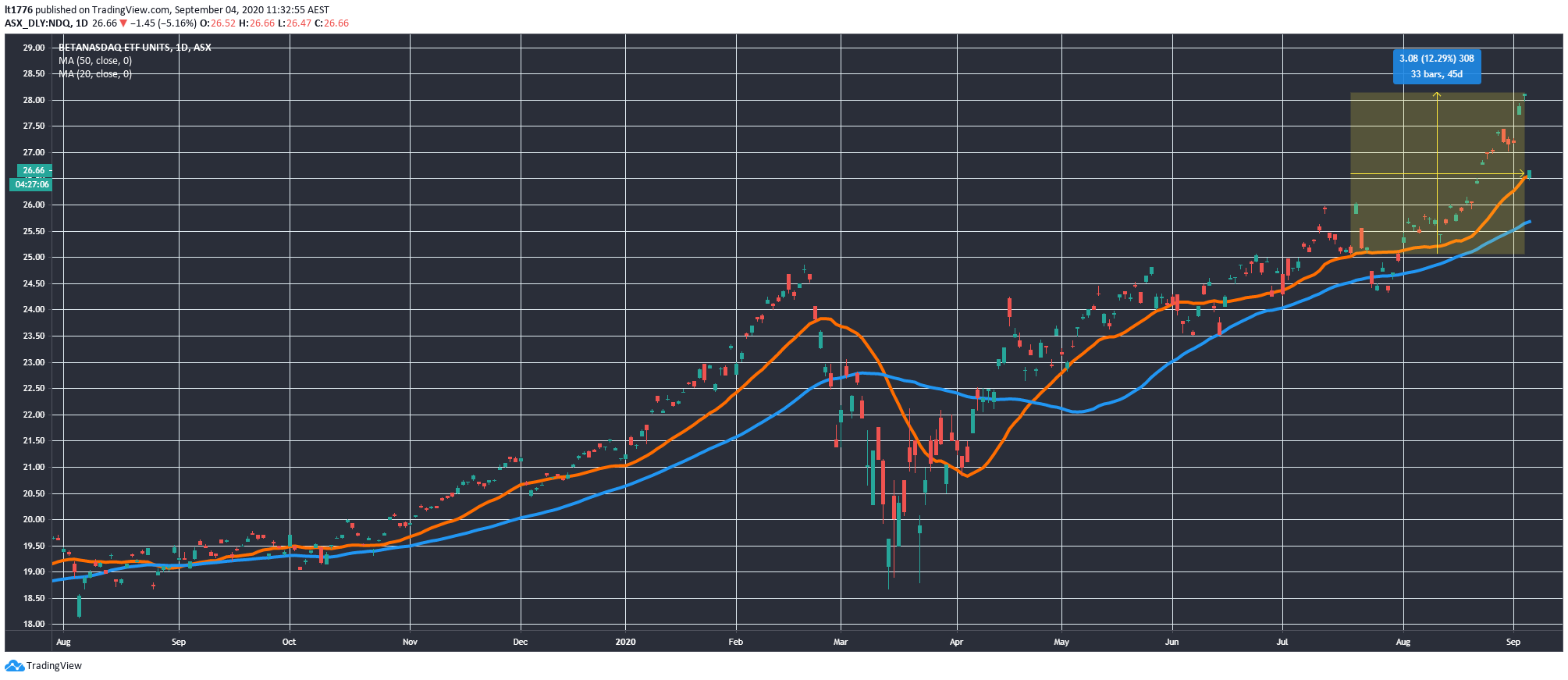

And on 20 July I discussed the US tech stock-led rally in the context of the Aussie tech ETF BetaShares NASDAQ 100 ETF [ASX:NDQ].

I said in the medium term NDQ had another 10–15% in its run.

The run came to a halt today, in the middle of that range (12%), which you can see below:

|

|

| Source: tradingview.com |

With the ASX 200 [XJO] posting a 2.65% drop at midday on Friday, does this mean the pivot to BetaShares Australian Equities Strong Bear Hedge Fund [ASX:BBOZ] is on?

Here are two reasons why the bears may have to wait a little while longer.

Reason #1: Never underestimate the power of the money printer

More US stimulus is still on the horizon.

The Democrats and the Republicans are haggling over the scope of the deal, but I expect it to get over the line before the election.

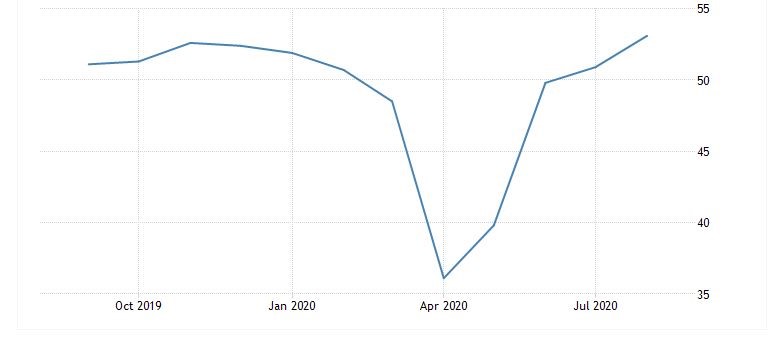

US economic data was stronger than expected and you can see the US manufacturing PMI below, with a reading of 53.1 for August:

|

|

| Source: tradingeconomics.com |

This means the manufacturing sector in the US is expanding as more people get back to work in the factories.

I don’t think the two parties will want to endanger the recovery, and both will be looking to get their future president (whoever it is) off to a good start come November.

The Federal Reserve recently indicated it might let US inflation ‘run hot’ for a couple years.

And they continue to buy up mortgage bonds, as per this snippet from Bloomberg:

‘The Federal Reserve has snapped up $1 trillion of mortgage bonds since March, a record pace of purchasing, as the U.S. central bank tries to blunt the impact of the Covid-19 recession on American homeowners.

‘The Fed bought around $300 billion of the bonds in each of March and April, and since then has been buying about $100 billion a month. It now owns almost a third of bonds backed by home loans in the U.S. Buying the securities has pushed mortgage rates lower, with the average 30-year rate falling to 2.91% as of last week from 3.3% in early February.’

In short, never underestimate the power of the money printer.

The bears sound a bit like Holden Caulfield in Catcher in the Rye, saying all these asset valuations are ‘phony’.

And they are right, but it doesn’t mean you can’t take advantage of the loose monetary policy.

Like my colleague Ryan Dinse says, ‘If you are going to panic, panic early.’

You take half profits, move up your stop-loss, and bank the gains.

Then you can re-enter if a massive correction plays out.

Reason #2: Economies are slowly recovering and vaccines are progressing

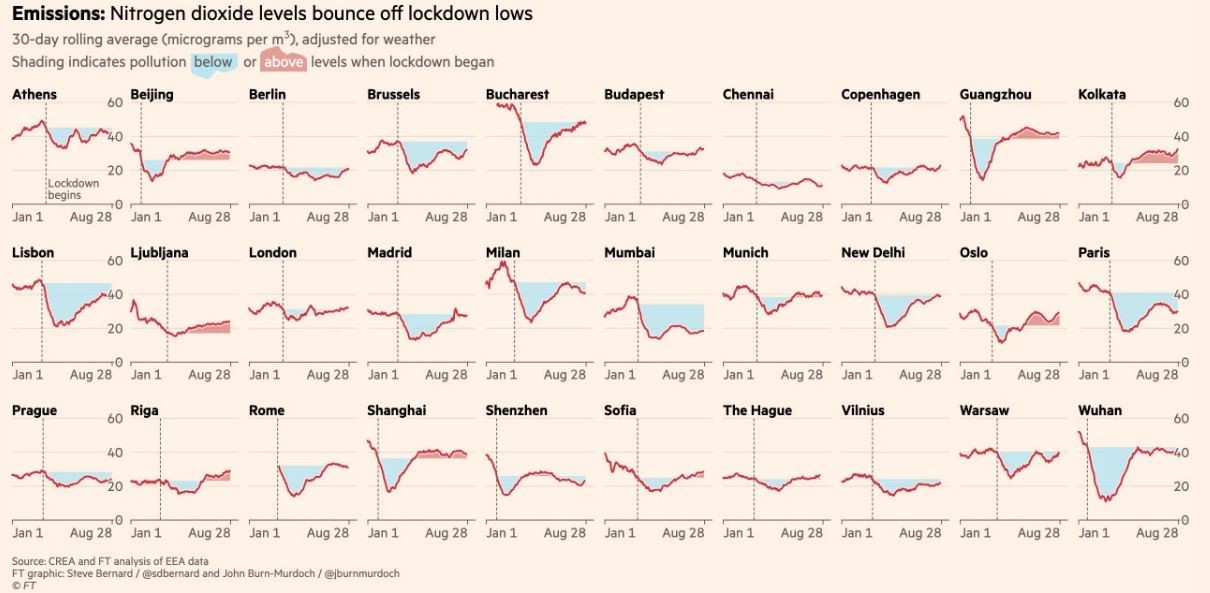

There’s a great article from the Financial Times that tracks the global economic recovery using ‘alternative indicators’.

You can find that here.

Job postings, retail footfall, and consumer spending are all up…and this odd indicator:

|

|

| Source: Financial Times |

As you can see, nitrogen dioxide levels in these major cities are recovering along with increasing manufacturing output.

As for a vaccine, China and Russia have pumped out vaccines without waiting for Phase 3 results, and you can find a timeline for vaccine candidates here.

Imagine the enthusiasm to snap up equities should a vaccine be released before the end of the year?

Depending on which way the election goes, you may see a sell-off in lead up to the political decision, followed by a bounce. Or you may see the opposite, a run-up followed by fall — a lot depends on polling here.

But I wouldn’t be surprised if by the end of the year US markets are still higher than the February peak.

As for the ASX, it’s a different story.

Earnings season was mixed and the Melbourne lockdown continues.

Passive strategies such as ASX 200 ETFs may underperform as small-caps shine.

Either way, I think especially with regards to the ASX — it remains a ‘stock picker’s market’.

And the great unwinding of the global financial system that the bears are crowing about, may be some way off.

Assuming of course, the two reasons for optimism outlined here aren’t proven to be way off the mark.

Regards,

|

Lachlann Tierney,

For Money Weekend

PS: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments