It’s time we tackle the most important, and possibly most dangerous, factor in the world of finance — China.

Most of what the world believes about China is not true. Growth is not strong. The yuan will not be a world reserve currency. Their future is not bright, and China will not dominate the 21st century.

This doesn’t mean that China isn’t powerful. It is.

China has the third-largest landmass in the world, after Russia and Canada, as well as the largest population in the world (about 1.4 billion). It has the second-largest economy in the world, after the US. It is the third-largest nuclear-armed power in the world, after Russia and the US. By every conventional measure, China is a superpower and will remain so.

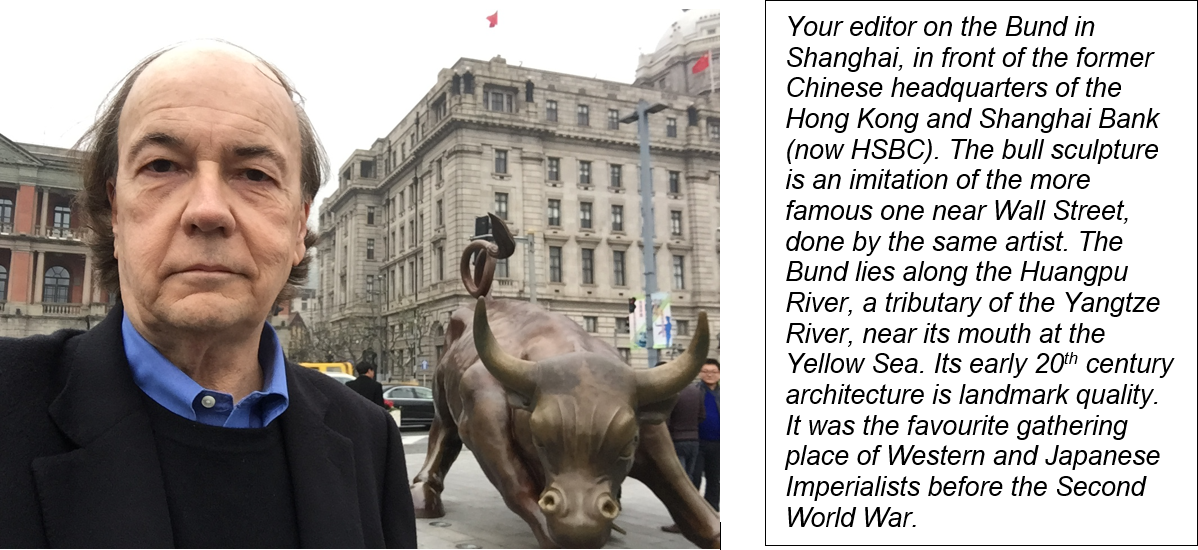

|

|

Still, superpower status does not automatically translate into economic success or political stability. The Soviet Union became a superpower in August 1949 when it detonated its first atomic bomb, nicknamed Joe-1. Yet it collapsed uneventfully on Christmas Day in 1991. The Soviet Union’s landmass, nuclear power, and military did not produce economic success beyond a certain middle-income status. China is facing the same conundrum today.

The delusion of Western perception

The last 30 years have seen one of the greatest political self-deceptions in history. We have witnessed the massive gap between the West’s perception of China, and the reality of China as it is. This gap is now evaporating, as the perception is discredited, and reality takes hold.

The perception was fed by elites, including Jeffrey Sachs of Columbia University, Richard N Haass of the Council on Foreign Relations, Bill Clinton, George W Bush, and many others. These elitists understood that China was governed by communists and had a horrible record of human rights abuses that collectively led to the deaths of tens of millions, through starvation and execution.

The elite view was that engagement with China would lead to gradual internal reform. If trade was expanded, cultural exchanges encouraged, and the Western education system thrown open to Chinese students, then the Chinese would see the benefits of capitalism and open discourse.

No one expected the Communist Party of China to just fade away. Instead, the expectation was that they would drop their hard line, adopt market systems, and gradually become ‘just like us’. At that point, China could join the community of nations as an equal partner, despite its authoritarian leanings. This would ensure peace and productive collaboration.

The reality was nearly the opposite. China did join the World Trade Organisation in 2001. The Chinese yuan was included in the IMF’s world money basket (the special drawing right, SDR) in 2016. Tens of thousands of Chinese students flocked to Western universities.

A visit to any Chinese government agency today will bring you face-to-face with graduates of MIT, Harvard, Stanford, Johns Hopkins, and other pillars of the US higher education edifice.

The engagement took place exactly as the elitists hoped. But the effect was the opposite of what they expected.

Communism with efficient characteristics

Instead of becoming Westernised, the Chinese became more efficient communists. Chinese students took the best of what the West had to offer in terms of technology and education and turned it to their own purposes.

The reality is that China is communist, atheistic, totalitarian, and genocidal. China’s one-child policy resulted in the deaths of 60 million baby girls — many drowned in buckets next to birthing beds — because of a cultural preference for boys.

China allows human slavery under the guise of remedial punishment and has concentration camps for political dissidents. They are systematically destroying Uyghur culture in Xinjiang province.

China permits a multibillion-dollar organ harvesting industry in which vital organs are removed from political dissidents and other prisoners without anaesthetic, to supply a waitlist of rich patients in need of the organs. The bodies of the ‘donor’ victims are then disposed of in crematoria, in a manner reminiscent of the Holocaust.

China has also grown rich by stealing Western technology, adopting Western manufacturing methods, developing some of its own technology, and piling up multitrillion-dollar reserves of hard currency and gold.

Still, the historic economic growth of the Chinese economy from 1989–2019 has not fulfilled the elitist delusion that they would become ‘just like us’. Instead, China is more communist, more ideological, and more threatening to the West than at any time since Genghis Khan. The elite vision has been discredited — although some still cling to it.

A harsh reality has prevailed.

But what does this mean for the Chinese economy?

All the best,

|

Jim Rickards,

Strategist, The Daily Reckoning Australia

This content was originally published by Jim Rickards’ Strategic Intelligence Australia, a financial advisory newsletter designed to help you protect your wealth and potentially profit from unseen world events. Learn more here.