The government has just approved its latest ‘offshore wind zone’.

The 1,800-square kilometer patch of ocean, offshore from the NSW coast, is the second such area of its kind. It’s a new zone that will soon be tendered to be filled with wind turbines to power local homes.

And while the space is smaller than initially proposed, it is still sizeable.

By 2030, it is hoped that it will be able to generate up to five gigawatts of power — a hopeful replacement for the recent shutdown of the Liddell coal plant in the region.

Energy minister Chris Bowen was certainly trying to sell the idea on its job-creating potential.

As he put it:

‘The Hunter is undergoing significant economic change, and the prospect of creating new job opportunities for decades to come through a new offshore wind industry is a game changer,

‘Today’s declaration opens the door for a new industry in the Hunter, which could create over 3,000 construction jobs and another 1,560 ongoing jobs.’

We’ll have to wait and see if these benefits do indeed end up flowing through to the local community. But I certainly wouldn’t be surprised if — like the turbines themselves — this all just involved a bunch of hot air…

The cost of net zero

See, what’s frustrating about politicians’ ongoing push toward renewables is the short-sightedness of it all.

They can zone and declare sites like this offshore wind farm all they want, but it doesn’t change the fact that the materials needed to build them are rapidly rising in price.

The International Energy Agency (IEA) put this in clear view with the release of a recent review. The detailed report analysed the ever topical ‘critical mineral’ market.

And it’s damn clear from their findings that demand is leading to much higher prices.

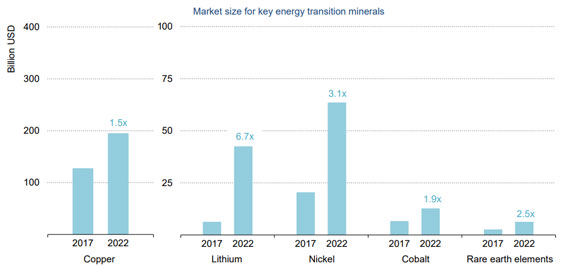

Just look at the acceleration in these five minerals over the past five years:

|

|

| Source: IEA |

As you can see, copper has been the biggest market to revel in the renewables boom. Growing faster, though, is the need for key battery metals like lithium and nickel.

And then there are the smaller, but still important, cobalt and REE markets.

This is all great news for mining companies and mining investors. We’re seeing a new boom unfold in Australia and around the world as these minerals continue to dominate demand.

But, as the IEA report also notes, supply is perhaps the far bigger concern:

‘Limited progress has been made in terms of diversifying supply sources in recent years; the situation has even worsened in some cases.

‘Compared with the situation three years ago, the share of the top three producers in 2022 either remains unchanged or has increased further, especially for nickel and cobalt.’

The fact of the matter is we’re relying too heavily on existing projects, a plan that is good for profits in the short term but concerning for overall production in the long term.

After all, prices can’t keep going up all they want.

Eventually, it will become unsustainable.

A point that will make renewable efforts, like this new offshore wind farm, far costlier than expected.

A cost that could make this net-zero push all for nought…

Mining investor dilemma

What this means for investors is that you have a few options at your disposal.

Short term, you should be looking at mining stocks for potentially handsome gains. Our commodities experts, James Cooper and Brian Chu, are both extremely keen on select market opportunities.

Long term though, one has to wonder if this net-zero push will all be for nought.

Like other trends we’ve seen, it carries a worrying lack of foresight and planning…fundamental necessities that could end up exposing the market and projects like this offshore wind farm to cost and feasibility issues.

If that happens, we’ll all have to ask ourselves how we plan to keep the lights on…

Gas seems like the obvious answer right now, but that could change. I certainly wouldn’t bet against fossil fuels though, because as unloved as they are by politicians, they’re consistent.

As Greg Canavan and his subscribers will tell you, fossil fuels are far from dead.

Take Whitehaven Coal [ASX:WHC], for example. Back in 2021, amidst the pandemic, Greg tipped this languishing coal miner.

Sitting at around $1.50 at the time of his recommendation, the stock surged all the way up to around $11 by late last year! And while it has come down since that peak, Whitehaven is still sitting around the $6.70 mark right now.

It’s been one of the best mining trades any investor can make.

And while it isn’t as topical or exciting as the ‘critical mineral’ trend, it has delivered results. For Greg and his more risk-averse approach to investing, this is exactly what he has to offer his readers.

Which is why, if you don’t have the stomach for the volatile critical mineral boom right now, I’d suggest following Greg’s latest advice…

Dividend stocks are where he believes you can get the most bang for your buck right now.

You can check out this report for the full details on Greg’s top six income stocks.

Because just like the government, you won’t want to mistake blind optimism for rationality.

The push toward net zero is filled with feasibility concerns and rising costs. So too are many investment opportunities on the stock market…

When all else fails, there are reliable avenues to turn to.

For energy, it has long been fossil fuels.

And for investors, it has long been dividends.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

|