New data has just come out.

And it’s not good…

On Sunday night the Italian government confirmed cases of coronavirus had spiked from three to 152 in a mere matter of days.

Three people have already died.

A dozen small towns in North Italy are now in lockdown and the famous Venice Carnival has been cancelled.

On the same day the South Korean government put out a red alert. It’s their highest national threat level.

In that country 169 new cases came out on Sunday, with another 161 following close behind on Monday.

Yesterday Iran confirmed eight deaths, the most reported deaths outside of China. Today I read they’re now saying 12 people have died.

The point is, we’re starting to get data that shows this virus could be spreading fast. And perhaps it’s out of control already.

So, what should you do?

Let’s look a bit closer at the data so far. And what could happen next.

Pay close attention

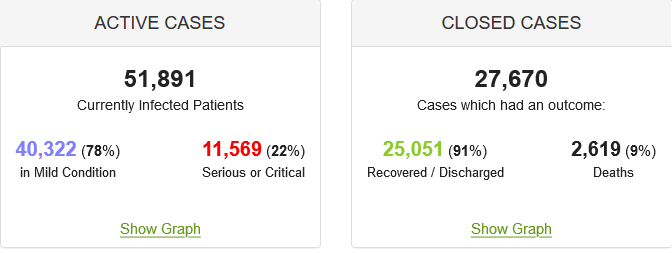

This is the situation right now:

|

|

| Source: Worldometers.info |

Now, you’ve got to take the Chinese numbers (which are included here) with a pinch of salt.

Like a lot of data in China, there’s a political influence which makes it hard to trust the veracity of the disclosed information.

That’s why it’ll be important to watch how these numbers change as cases outside of China start to increase.

Now I don’t want you to panic (despite my headline). There are a lot of unknowns here. And it might not get as bad as we fear.

We just don’t know yet.

But what I do know, is that financially speaking the market has been shaken out of its complacency by this latest Italian and South Korean news.

Yesterday, the ASX fell dramatically and closed around 2% down. US markets followed suit overnight and ended 3.5% down, the worst drop in two years and erasing all the gains from this year.

At the same time the gold price and gold stocks started to attract investor funds as people sought out safe haven assets.

It’s a clear sign investors are starting to think about fat tail risks. The risk that the contagion effects of this virus could get a lot worse.

We’re also starting to see the first direct financial effects of the virus on company profits…

A black swan in the making

You can’t hide the truth forever. And every day new facts are slowly coming to light.

If the situation in China is as bad as some unofficial reports I’m reading say it is, then we’ll start to see the effects ripple out over the next month.

Maybe we’re starting to see it already…

For example, BlueScope Steel Ltd [ASX:BSL] shares were down 5.9% yesterday, as they announced a 70% hit to profits. They directly blamed the coronavirus and conditions on the ground in China.

From the AFR:

‘Steelmaker BlueScope says its China division won’t make any profit in the June-half as the output from its four main plants in that country are severely curtailed by the coronavirus outbreak, and it grapples with logistics disruptions in the supply chain.’

With China the epicentre of global manufacturing, the knock-on effects to every business in the world could be set to grow.

As reported in the WSJ:

‘Small U.S. businesses that sell everything from bicycles to custom software are struggling with the ripple effects of the coronavirus epidemic, which has disrupted global supply chains and left Chinese factories closed or short-staffed.’

As well as supply chain problems, there was even some talk at work that the summer Tokyo Olympics could be called off if the virus persists.

[conversion type=”in_post”]

Into the unknown

The fact is, right now, there are a lot of unknowns.

And while I usually loathe to panic (and prefer to remain optimistic), I do think a sensible approach to the situation right now is to make sure you’re comfortable with how much money you have invested in the stock market.

The old trader maxim says: ‘If you’re going to panic, panic early.’

So, for what it’s worth, I personally have lowered my exposure to share markets. I’d rather do it now and be wrong, than be caught in a rush for the exits later.

If it all blows over, a vaccine is found, containment measures work, and we get the mother of all stimulus packages pushing markets to new highs, then great.

There’ll always be opportunities to jump back onboard.

But right now, the downside is my concern.

Let’s stay alert here and see what the next few weeks bring…

Good investing,

Ryan Dinse,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments