Crypto is in a bear market right now, but history suggests this is a great time to accumulate quality crypto projects.

One such project — let’s call it Crypto X — can be the ‘saviour of the bear market’, according to veteran crypto expert Ryan Dinse.

In a wide-ranging presentation, Ryan offered his thoughts on why now can be an amazing time to lock up leading projects…just like the smart money is doing.

Crypto bear market and crypto opportunities

Crypto prices cratered this year.

And prices may fall further, with more worthless projects imploding…

Some may think that’s a bad thing, but the crypto ecosystem certainly needed some pruning.

Now, we’ve seen crypto winters before.

But this one has been amplified by a host of factors.

Pandemic, war, inflation, and central banks raising interest rates.

And factors intrinsic to crypto itself…

The de-pegging of the TerraUSD stablecoin in mid-May…

The Celsius scandal and ensuing trouble with various crypto exchanges…

And the various platforms suspending trades and withdrawals and filing for bankruptcy.

It’s not been pretty.

But investors face a choice: declare crypto dead (again) or take advantage.

I know what the smart money is doing: locking up the best crypto projects at massive red-zone discounts.

It happens every cycle. The weak hands fold, and the strong hands start strategically accumulating.

The current sell-off is hitting the good along with the bad.

But ask yourself: is every crypto project doomed to fail?

No.

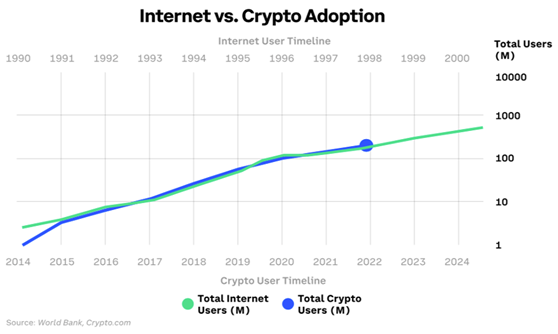

Long term, crypto will be the biggest disruptor since the internet.

We will see a recovery.

The key is sifting among the duds and frauds to find the crypto assets that will lead it…

That’s exactly what the smart money is doing…while the rest are selling in panic.

Source: World Bank

The great crypto opportunity

Ryan Dinse, Fat Tail’s crypto expert, believes we are nearing a period of immense opportunity.

But he’s not the only one.

The smart money is already moving…fast.

In the current crypto bear market, a lot of the good stuff is being dragged down into the mud.

But the smart money is buying that good stuff…

…at MUD prices…basement-level prices.

Not everything, though.

They’re targeting only very specific projects…for specific reasons.

Shiny and new…mania fads like NFTs…high-trading volume…all that’s out the window now.

Big-wallet bargain hunters are instead making moves on the true disruptors of the next phase.

They’re focusing on who’s building what…and how that product is going to feature in the world in a few years’ time.

Ryan covers these projects in The Great Crypto Lock-Up Seminar, embedded above.

One such project Ryan covers has the potential to be crypto’s Amazon.

Crypto Amazon

This project — Ryan’s key recommendation outlined in the seminar — looks like it’s ticking all the smart money boxes and then some.

Key tech figures have been distancing themselves from cryptos all year…with Bill Gates saying last month, ‘I’m not involved in that…’

…while, mysteriously, this project has recently gained backing from one of the Godfathers of Silicon Valley. That is extremely rare in crypto…full stop. In a crypto bear market, it’s even rarer.

Ryan thinks something big is on the cards with this project.

The Bank of England Deputy Governor Jon Cunliffe just came out and said the survivors of this crypto crash could rise to become the Amazons and eBays of the 2030s.

Ryan 100% agrees with that.

The crypto project he explores in the seminar is his best bet on this thesis.

As Alex Tapscott, managing director at Ninepoint Digital Asset Group, recently pointed out:

‘The most successful people in crypto are those who can keep calm and carry on.

‘I don’t know when this bear market will end, but I am highly confident that like all others, it will end.’

Consolidation and capitulation cycles are actually what push crypto TOWARDS mainstream adoption…not away from it.

The smart money knows this.

And…behind the scenes…it’s BUYING…not selling.

But who is the smart money, exactly?

And WHAT are they buying, specifically?

Watch Ryan’s Great Crypto Lock-Up Seminar to find out.

Now, to find out more about Ryan and his Crypto Capital advisory service, click here.

Regards,

Kiryll Prakapenka,

For Money Morning