Unloved, forgotten, lonely.

The last two days I’ve been talking about the ASX 200’s sluggish performance, but there is something very interesting is brewing beneath the surface.

Turns out that there are entire pockets of the small-cap market that haven’t even started their engines yet.

These are the sectors that have been left behind while gold and Big Tech rip higher.

And that creates opportunity for those willing to look beyond the crowd…

Natural gas is forgotten, but a crisis is brewing

Natural gas might be the most overlooked opportunity in Australian small caps right now.

But here’s what many are missing.

The Australian Competition and Consumer Commission (ACCC) is warning of potential shortfalls starting this year.

Eastern Australia could face supply gaps from 2026, with controlled electricity reductions possible by 2028.

Yet natural gas stocks remain deeply unloved.

Strike Energy (ASX: STX) exemplifies this disconnect perfectly.

The company is developing critical gas projects in Western Australia but trades at what analysts consider significant discounts to fair value.

There are some high potential Queensland sleeper hits out there as well.

Natural gas isn’t going anywhere.

It’s the bridge fuel for the energy transition and increasingly essential for AI data centres’ power needs.

But the market’s treating these companies like yesterday’s news.

Iron ore: could a surprise be on the cards?

Iron ore stocks aren’t exactly setting the world alight right now.

The previous narrative was all about Chinese demand weakness and oversupply.

But here’s the contrarian view.

Iron ore prices have shown surprising resilience around US$102-103 per tonne.

And smaller iron ore producers are getting completely overlooked.

These companies are trading as if iron ore is heading back below US$80/tonne.

That’s creating genuine value opportunities for patient investors.

Here’s another one to watch…

Copper went from hero to zero on a Trump reverse card, but it’s a no brainer long-term play

Copper was grinding higher from the start of 2025.

Then Trump’s proposed 50% tariff announcement sent shockwaves through the market.

The copper price started to charge higher and higher.

Then suddenly, the most important part of the tariffs was rolled back and this is what happened to the copper price:

I think the market overreacted to the complexity.

And there are a handful of copper companies I’m looking at that remain great exposures to what I think is the bedrock of any efforts by the world to decarbonise.

They’re insulated from trade disruptions and should eventually benefit from higher global copper prices.

Yet they’re still trading like the world ended.

Check this sector out too…

Biotech’s capital starvation problem

The biotech space tells perhaps the most compelling undervaluation story.

I’ve seen many small-cap biotechs really struggle in the last 12 months.

Imugene [ASX: IMU] is the poster child for this sector-wide punishment.

Down ~80% in a year, the one time market darling was once trading at ~$20 and today sits at ~30c.

It’s definitely made some missteps over the journey, but this is still high potential tech.

Biotech investors are still skittish to cut cheques…

The broader sector faces genuine capital starvation.

These companies are dying for nice chunky raises.

But that’s exactly why opportunities exist.

It’s been well documented in biotech circles that Big Pharma faces a massive patent cliff through to 2030.

Sixty-nine blockbuster drugs worth $236 billion in sales are coming off patent.

This should eventually create the conditions in capital markets that enable small-cap biotechs to return to form.

Patience is a financial virtue

What ties these sectors together is simple.

They’re unfashionable.

They’re complicated.

And they require patience.

But that’s precisely what creates the opportunity.

While momentum chasers pile into the latest tech or gold play, these sectors are quietly setting up for their own recovery cycles.

The key is identifying companies within these unloved sectors that can survive and thrive despite the headwinds.

Companies with strong balance sheets, clear catalysts, and management teams that understand how to navigate difficult periods.

And this is crucial: they also need tight capital structures to ward off dilution risk.

For me, this is the most important factor when looking at investments in small-caps and micro-caps.

Don’t know what I mean by capital structure?

Best Wishes,

Callum Newman,

Australian Small-Cap Investigator and Small-Cap Systems

***

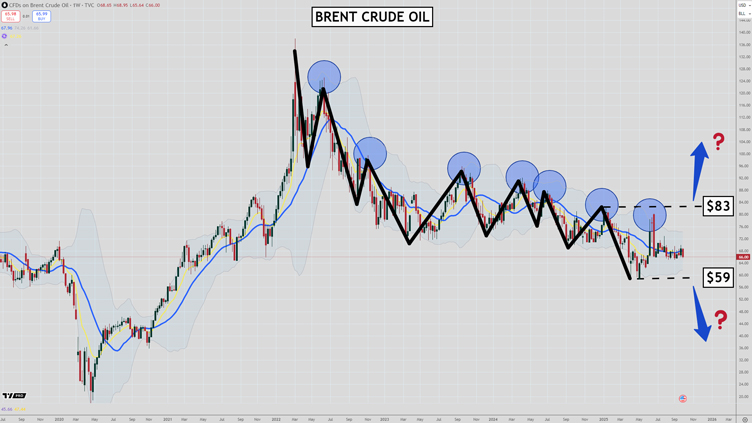

Murray’s Chart of the Day – Brent Crude Oil

Source: TradingView

I haven’t mentioned the oil price for a while because it has been stuck in no-man’s land.

After a three and a half year bear market, traders are looking for a bottom, but the charts remain bearish.

I have traced out major down waves during the bear market that began in early 2022.

The blue circles make it clear that each rally has topped out below the last. Lower highs and lower lows are one definition of a downtrend.

If we see a continuation of the downtrend and prices head below the low of the bear market near US$59.00, the next leg down could be a doozy.

Based on the above chart the price of Brent crude oil will need to head above US$83.00 to shift the bearish picture in a major way.

That is the high of the most recent up-wave in the downtrend.

So there are clear lines in the sand we can observe moving forward.

I remain bullish on oil long-term, but the time isn’t right to be loading up on exposure just yet.

I would prefer to see a collapse below US$59.00, which could set up a great buying opportunity.

Regards,

Murray Dawes,

Retirement Trader and International Stock Trader

Comments