Well, it’s been a good run I suppose.

A three-decade run to be exact…

From the early 1990s up until today, the property market has been a one-way ticket to riches for most Australians.

Not even the ferocity of the GFC in 2008 could put a halt to it.

This property price resilience was in stark contrast to the experience in the rest of the world. And it cemented the belief that Aussie house prices only ever went one way — up.

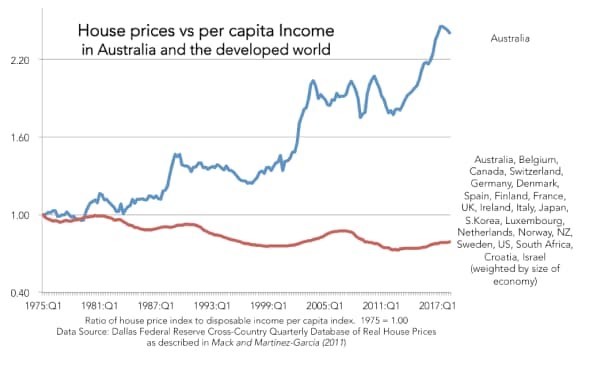

But as this amazing chart below shows, we’ve been living a distorted reality for far too long…

A warped reality

|

|

| Source: Dallas Federal Reserve |

This chart is a powerful example of how far out of whack we’ve let things get.

Compared to the average of comparable countries, property in Australia has become increasingly unaffordable.

Out of the 23 countries in this group, we have let the economic tether between incomes and property prices become too stretched.

Our uniquely generous treatment of property assets in both taxation and retirement policy has played a large part in this.

Few other countries allow negative gearing on investment properties to such an extent. And your principle residence isn’t just exempt from tax, it’s also exempt from any Centrelink age pension tests.

These factors have all combined over the years to push up house prices by a far greater degree than mere rises in income.

Though, the advent of double-income families and super-low interest rates have also played their part in pushing property values higher.

We’ve been conditioned to think this is all normal.

‘House prices always go up’ is what most people in Australia will tell you.

But the truth is clear: Australia is an outlier in this.

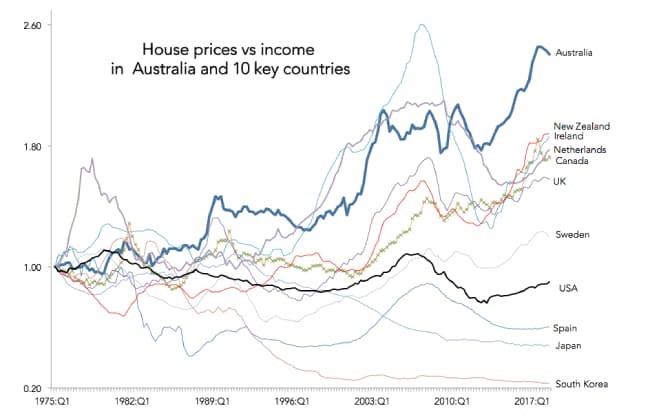

This chart shows the property price comparisons between countries and their incomes more clearly:

|

|

| Source: news.com.au |

See how other countries saw big dips in 2007/08 except Australia?

That has only thrown more fuel on the fire. We now look poised to pop further than anyone else.

In the GFC huge mortgage rate cuts from the RBA along with massive Australian (and Chinese) stimulus combined to stabilise property prices.

Back then, the cash rate fell from 7.25% to 3% in just seven months. Ammo we clearly don’t have this time round.

And, in what was already clearly a precarious time for property prices, an announcement last week could have signed the final death knell for property prices.

From here it could be a long way down.

Let me explain…

[conversion type=”in_post”]

Back to the good ol’ days

As reported in the AFR:

‘QBE has suspended lenders mortgage insurance (LMI) cover for all new loans taken out by borrowers working in industries hit hard by the pandemic, amid the economic fallout from COVID-19.

‘The insurer told the banks on Monday that a temporary embargo was in place on all new mortgage applications, including top-ups, refinances and cash-outs.

‘Mortgage applications requiring LMI from those in industries directly hit by COVID-19 will be declined by the insurer.

‘Mortgage applications requiring LMI from those working in industries directly hit by COVID-19, such as those working in gyms, beauty salons, tourism and hospitality industries, would be declined.’

Think about the implications of this for a moment.

These industries are significant employers. Tourism alone employs over 8% of Australia’s total workforce. Or 924,600 people.

Which means a whole swathe of people will now need at least a 20% deposit to qualify for a home loan. Back like it was when my Mum and Dad were buying their first home.

The other major LMI insurer in Australia is Genworth. And although they’re saying they’re not changing their policies for now, I’d be surprised if it was just ‘business as usual’ going forward.

Things have changed dramatically.

I mean, we’re about to see a huge ramp up in unemployment. Though figures will be masked by the government’s $130 billion Job Keeper program, the result is the same.

Banks will have to tighten up credit lending. They’ll have no choice under responsible lending provisions.

And the government no longer has the firepower to underwrite their lending, lest we risk losing our AAA credit rating.

Long story short, demand for property will fall.

And at the same time, the supply of houses is probably going to rise.

There will be forced sellers. Those people who have lost their jobs or were struggling already. That supply will rear up over 2020.

Then we’ll get the panic sellers. Those people probably in, or close, to retirement who want to offload their investment properties which are now more trouble than they’re worth.

This process could cause a cavalcade of selling over the next 12 months.

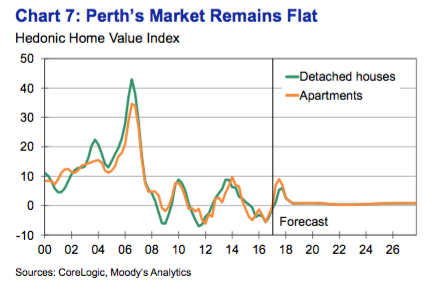

The best-case scenario is an orderly decline. Much like what happened to property prices in Perth after the mining boom came to an end in the GFC.

|

|

| Source: CoreLogic |

Property prices are down 21% from the 2007 peak, but at least it’s been a steady slide.

And I think those thinking it’ll be back to ‘normal’ soon are kidding themselves.

As even bank CEO Shayne Elliot warned over the weekend (as reported in the AFR):

‘Mr Elliott said the crisis could lead to a spike in unemployment and also make people more averse to taking on big debts, both of which could lead to declines for housing prices.

‘“I’m not going to give you a price prediction, but you’d have to think it was material,” he said. “It’s not going to be 2 or 3 per cent, it’s got to be a material [effect].”

‘“Australia in the future won’t look the same,” he said. “It won’t look the same because it will impact a whole generation of our customers, the way they think about technology, the way they think about borrowing, the way they think about employment, the way they think about frankly the capitalist system and democracy.”’

The dream run looks over…

Good investing,

Ryan Dinse,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the Australian Economy, Aussie Property Market and the most innovative stocks on the ASX. Learn all about it here.

Comments