There’s something fishy about this stock market recovery. And today, we figure out what it might mean for you.

The source of the bad smell is simple. ASX bank stocks are not participating in the recovery from the COVID-19 crash. And that’s worrying.

The S&P/ASX 200 Banks Index (AXBAJD) is still down 30% from February highs. The ASX 200 is only down half as much.

European bank stocks are down 40%, while the broad STOXX Europe 600 is down 15%. More importantly, European bank stocks aren’t far from their COVID-19 crisis lows, while European stocks are trending up.

The Dow Jones Index is almost back at February highs, but the Dow Jones Bank Index is still down 30% and going nowhere fast.

REVEALED: The Pandemic Market Crash Is Far from Over. Find out more.

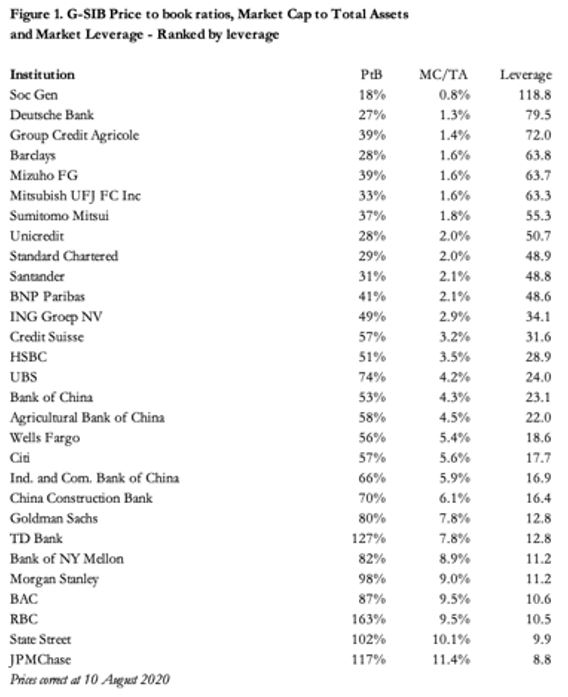

I realise you get the idea, but this blurry blotch of a table below makes the point in a far starker fashion. It comes from Goldmoney.com and Alasdair Macleod, who went on a long-term vendetta against the gold price manipulating banks. He’s been partially vindicated and now likes to point out his enemies are getting humiliated in the stock market. This table is how he’s chosen to do so:

|

|

|

|

As ever, his evidence is decent and specific. The table is showing you the price-to-book ratio of several large banks in the first column. The price being what the stock market values the bank at. And the ‘book’ being a reference to the accounting valuation which the banks report about themselves.

We won’t get into the age-old battle between accounting and finance here. It’s the divergence of the two that matters.

The point which the table makes is that financial markets are valuing banks at far, far less than the banks’ own accountants are. In the case of French bank Société Générale, the financial market price is a mere 18% of the value on the books.

We’ll get back to what Alasdair Macleod claimed this means below. For now, just consider that bank stocks are doing badly relative to other stocks, and badly relative to their own accounting figures.

Such divergences in sectors of the stock market are, of course, common. Some commodities have underperformed badly too, for example. And so, the stocks that dig and drill them up are also doing badly relative to the rest of the ASX 200.

But what does it tell us when bank stocks are underperforming? It must mean something.

As ever, it depends who you ask. But I’m not sure you’ll like anyone’s answers…

First up is an obvious one. COVID isn’t finished with the bankers yet.

This makes intuitive sense. The lockdown was a glorious one for many of us, as insensitive as that may sound. Defaults, evictions, and unemployment were practically banned. House prices are surging in the US and UK, strangely enough.

And so, the reckoning is yet to hit the banks. Ironically, that’ll happen at the end of the lockdowns, just when everyone expects a return to normality. Bankruptcies and layoffs take time. Bank failures broke out years after US subprime began to go wrong.

If the cost of COVID is yet to hit banks, then you’d expect their stocks to underperform. Financial markets look at the future, while accountants consider the past. Simple.

But there’s another argument to do with the banks’ revenue side. The COVID crisis has forced the central banks to…well, the list of what they’re up to these days is so long I’ve lost track.

Most of the policies are bad for banks, which is ironic given the initial purpose of central banks was to help banks through crises. But these days, they manage the economy at the expense of banks. How? Promising to keep interest rates low for a long time, for example.

Banks make money by borrowing for short periods of time (yes, your deposit is a loan to the bank) and lending for long periods of time. Their profit margin is the difference between long- and short-term interest rates. So, when the central banks promise interest rates will stay low for long, bank profitability takes a hit.

There is plenty of irony in this too. Because central banks are promising such low interest rates to entice people to borrow. But if the lenders won’t make much money from it, they won’t lend as much…

In other words, a lending boom happens when banks can make money from it, which the central banks are preventing.

Looming in support of this explanation is Japan’s experience over the last 30 years. They’ve tried the low interest rate path for a very long time now, without success. The problem is, there’s now so much debt that any increase in interest rates will cause trouble for all the overindebted borrowers. Japan’s banks are stuck, and now other global banks are joining the interest rate morass.

If you believe in this explanation, it suggests a lot about the world in coming years. For example, if interest rates really do remain stuck near zero, neither a borrower nor a lender be. Never mind a saver!

My own attempt to get a mortgage has failed miserably thanks to dodgy cladding. But the offer was on the table. Interest only at 1.35% for two years. That was before the Bank of England cut rates…

With inflation higher than my interest only payment, you can see why banks are struggling to appear profitable.

What about Alasdair Macleod’s explanation for the low bank share prices? He’s worried about a banking crisis. And thinks investors are too: ‘[…] investors appear to think this bank [Société Générale] is most likely bankrupt, its share price little more than a call option bet on its survival.’

In other words, buying SocGen shares is like punting on the bank not going bust, more than anything…and the low share price suggests the probability of going bust is high.

A major bank going bust sounds mortifying. But the greater fear is what this’ll do to governments. They’re already stretched dealing with their own COVID-19 policies. A bank bailout now would tip things over the edge, triggering the doom loop where banking systems and governments drag each other under.

But here’s the key takeaway from the lack of a bank stock recovery, as I see it. Banks are tied to the real economy in ways that other firms aren’t. They’re a bellwether for overall economic health in ways that the likes of Apple and Tesla shares can never be. That’s because banks tend to diversify into home lending, corporate lending, and government lending. If bank stocks are underperforming, the overall story of the economy is not a good one.

Let me put it like this. The stock market indices of the world may be recovering. But that tells you less about the economy and its prospects than the banks’ stocks do. And they aren’t doing nearly so well.

Again, Japan provides the textbook example. Economic underperformance and bank stock underperformance go hand in hand there. Europe joined a growing list of evidence about 10 years ago, depending on which nation you look at.

Australian investors need to consider this growing pile of evidence from overseas and look at their own portfolios. If prolonged economic underperformance is possible, and banks stocks suffer if it happens, then buying Aussie banks based on them catching up to the rest of the stock market is a mistake.

Until next time,

|

Nickolai Hubble,

Editor, The Daily Reckoning Australia

PS: Discover why this gold expert is predicting a HUGE spike in Aussie gold stock prices. Download your free report now.

Comments