I’ve been telling my readers for over a year now that we’re facing the biggest global real estate boom in recorded history — running from 2020–26.

So far, that’s played out.

UK house prices are 30% higher than their pre-2008 peak.

US house prices have had the biggest jump in more than 30 years of data.

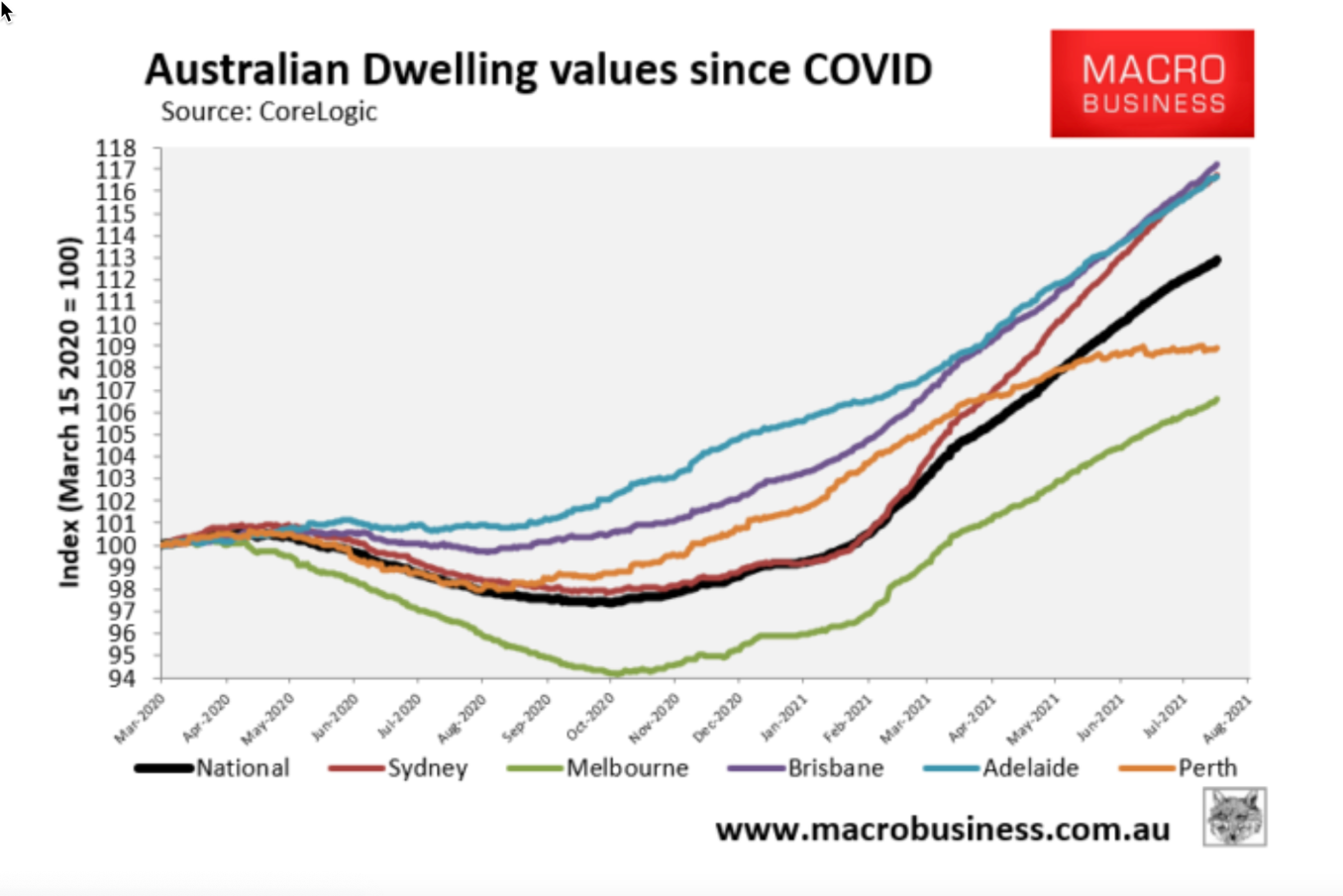

In Australia, there’s been an unprecedented, synchronised property boom across all regional and city markets.

|

|

|

Source: MacroBusiness |

One city on the chart above that’s lagging compared to other cities, however, is Perth.

I’ve been assisting a few buyers in Perth over recent weeks — so I do have some insights into why the market has been slower to take off.

Certainly slower than Sydney and Hobart, for example, that have already rocketed up 19.3% and 19.2%, respectively, over the past 12 months.

Part of this could be put down to Perth’s sales environment.

It is very different from the eastern capitals.

Auctions are rare in Perth.

Yet, they are the best way to instil FOMO (fear of missing out) into a population of property buyers.

Buyers in Melbourne and Sydney’s inner and middle-ring suburbs, for example, are used to being pitted against each other at auction.

Seeing properties sell on the street in an auction atmosphere is a little like being on the Wall Street stock exchange floor.

After missing out a few times, buyers gain sterling confidence that prices will continue to rise.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

They ‘up’ their budget to the max to ensure they don’t have to ride that roller coaster of emotion again. It’s extremely stressful for the uninitiated.

[Note: It works the opposite way when properties start to pass in — buyers flee in a panic of free-falling prices.]

Simply, auctions exacerbate a classic boom/bust market atmosphere.

Additionally, offers in the eastern states must often be unconditional to stand a chance of securing a property in a hot market.

The agents are sharks; they know how to jack prices higher.

Buyers in these states often complain of having to place ‘blind offers’ after being told another offer is on the table — but have no information of the price or terms.

In Perth, offers are commonly conditional on finance, building inspections, due diligence, and a host of other items.

It can take weeks for a sale to go unconditional.

In my experience, the agents don’t play the games we see in the eastern states.

The market moves at a slower pace compared to the bigger city markets in Australia.

Not to mention Perth’s recent downturn being fresh in memory. Investors are not rushing in all gung-ho.

Don’t be fooled, however.

Big gains are being made.

The city median may be lagging a little, but suburbs of Perth attracting the big dollars are rocketing ahead.

Take the affluent suburb of Attadale, for example, situated on the river, approximately 9km from Perth’s CBD.

It’s a tightly-held area.

Not many properties in this region come up for sale.

Those that do, generally sell for well over a million.

One that caught my eye the other week, however, was marketed as an entry level opportunity.

A dated property on 857sqm marketed at $1.4 million.

|

|

|

Source: Realestate.com.au |

Over 100 buyers rocked up to the first open home.

It was barely possible to move inside.

The agent got six offers after the open home.

He didn’t call back every buyer that had been through to see if another buyer wanted to offer more.

Again, very unlike what we witness from agents in the eastern states.

However, he got over $1.4 million, and the property is now formally ‘under offer’.

That doesn’t sound like much of a story, until you check the sales records.

This property was purchased just over a year ago (April 2020) for $1 million.

The owners bagged a $400K inflationary gain in a year!

These areas will peak out at some point.

The ripple will then spread to neighbouring regions in Perth and beyond.

If you want to hear me discuss this and more — check out a recent interview I did with Martin North here.

Best wishes,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.