We’ve seen this ‘beginning of the market end’ movie a few times in recent years.

There was 2015. Then came 2018. And, most recently, the short sharp hit in March 2020.

Each screening proved to be a tad premature.

Courtesy of its central banker benefactor, Wall Street found another gear (literally and figuratively).

Is this current case of the jitters the grand finale to the mother of all bubbles?

Drum roll, please…

Yes, it is.

The downward slope will be interspersed with the inevitable ‘buy-the-dip’ rallies.

But these are unlikely to be of a lasting nature.

This is a bubble that needed bursting.

We, as a society, have become too far removed from reality.

Crypto pyramid schemes. Meme stocks. Non-fungible tokens. Tech stocks trading on 100 times sales.

These are flights of fantasy indulged by people who have lost all bearing on real value.

We are headed into a bear market…and it’s likely to be brutal.

Trillions of dollars in paper profits are going to be shredded into confetti.

Destruction of wealth — on the scale I think we are going to see in the coming years — comes with personal and social consequences.

Who is going to foot the welfare bill?

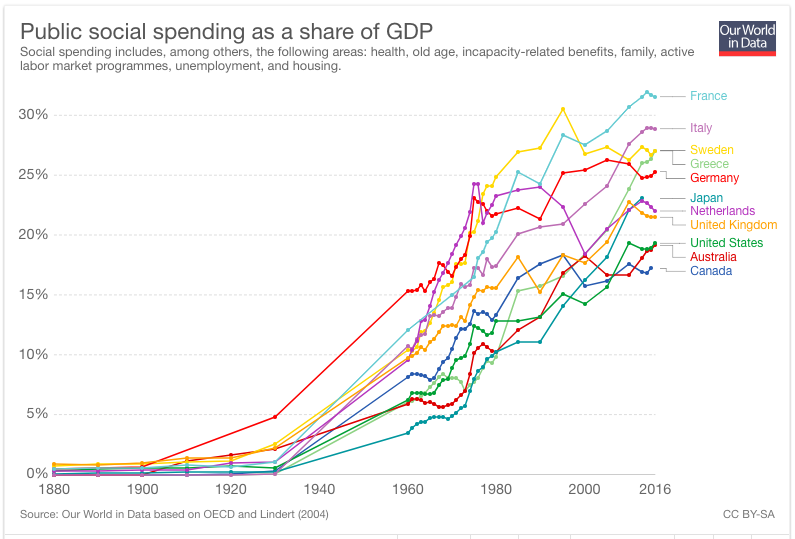

A picture paints a thousand words…

This rather depressing picture on the steady increase in public social spending (health, welfare, family benefits, public housing) tells you all you need to know about what governments have in store for future taxpayers.

Little by little, more of your earnings, savings, and investments are going to be seized to feed this growing monster.

|

|

|

Source: Our World in Data |

Governments, the world over, are embracing socialist agendas.

The once Holy Grail of a budget surplus no longer rates a mention.

Grandiose vote-buying schemes — financed by central bank money printing — are now the norm.

No politician in their right (or, should that be, left) mind would ever talk about lowering public social spending.

There’s no way any politician is willing or able to unwind nearly six decades of social conditioning.

Three (and possibly four) generations are hooked on some sort of government handout.

How much do we think we are entitled to welfare?

Remember in 2015 when PM Tony Abbott proposed a GP co-payment of $7?

Here’s a quick reminder (emphasis added):

‘The Abbott government’s GP co-payment has been killed off for good with Heath Minister Sussan Ley telling Coalition MPs “we are not pursuing it at all”.

‘Prime Minister Tony Abbott has made several attempts to wind back the widely loathed $7 fee — first announced in the 2014 May budget — in an attempt to mollify public concern.’

Sydney Morning Herald, 3 March 2015

If paying $7 to go to the doctor was ‘widely loathed’, what hope do we (as a society) have of voluntarily undertaking serious reform?

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

None. Zip. Doodah.

With the ‘Everything Bubble’ on the verge of bursting and creating an even bigger credit crisis than 2008/09, we are going to see governments (of all stripes) announce all sorts of rescue packages.

Rising unemployment. Lost retirement savings. Increased levels of personal and business bankruptcies.

All these negative factors will create highly charged political responses…played out for all the world to see on social media.

The public pressure on governments to do something — like they did with COVID — will be too great to resist.

The last great credit crisis — no, not the one in 2008 — was in the 1930s.

That was an entirely different generation with an entirely different mindset.

Our forefathers were far more independent and resilient. Government handouts were virtually non-existent, and there were no pouted poses being posted to publicise your woe-is-me plight.

The Depression generation just ‘sucked it up’.

Accepted their lot and made the best of a bad situation.

Not going to happen next time around. No way, Jose.

Our entrenched nanny state mentality means the cry will go up for ‘government to do something’.

And, believe me, they will do something. But as we know, a government solution is just another (bigger) problem in the making…one that requires an even bigger (more ridiculous) ‘solution’.

Doing nothing is not in a politician’s DNA.

And, thanks to central banks, the political class has the printing press to finance their most fanciful of social engineering programmes.

Quick quiz…who wrote this and when?

‘The welfare state is nothing more than a mechanism by which governments confiscate the wealth of the productive members of a society.’

Never a truer word was written by…Alan Greenspan in 1966.

Oh, the irony.

Welfare payments are a wealth transfer mechanism…taking from the productive to give to the unproductive.

That sounds harsh in this new age ‘touchy-feely, every kid gets a prize’ world we live in…but it’s the brutal, ugly truth.

In addition to the money being doled on social spending, there’s the cost of the bureaucracy to administer these payment schemes.

Paying for past and present government vote-buying initiatives is a very costly business.

For the long-term good of society, we need to wind back the welfare gravy train and tighten up the criteria on who qualifies as a worthy and genuine recipient of taxpayer money.

Oh, how I dare to dream.

Productivity will be encouraged. People will become more self-sufficient and less reliant on government. More money in the taxpayers’ hands and less in the government coffers will result in a better allocation of resources. There would be less bureaucracy.

All positives for a stronger economy…but there is one rather large obstacle on the path to this hoped-for economic nirvana.

The political class, the bureaucrats (who are too incompetent to make it in the private sector), and the grafting industries that have profited greatly from being on this wealth transfer gravy train will never put society’s intertest above their own.

What a different world it might have been if Greenspan had remained fast to his principles…then again, if he had, he most probably would not have been appointed chairman of the US Federal Reserve in 1987.

Greenspan’s long tenure as Fed chair shows us how well he learned to play the political game. Better than anyone before or after him.

Greenspan entrenched the Fed’s interventionist culture…openly supporting asset prices by making credit freely available. The Fed’s policies — indirectly — provided the government with the tax revenues to continually expand welfare programmes.

Greenspan’s blatant 180-degree about-face is why the ballooning welfare problem will never be addressed voluntarily.

Anyone who dares to endorse the Greenspan view of 1966 cannot survive in politics…the system will grind them into dust. There are just too many vested interests.

What cannot be achieved voluntarily is therefore destined to be done involuntarily.

In due course, the system will collapse under its own weight of over-promised entitlements.

That’s not going to happen anytime soon. Old habits die hard.

When the next Great Depression hits (in the coming years), central banks will print money (on a scale we have never seen before) to finance more handouts and bailouts.

Be prepared for the government to turn over every rock looking for a tax dollar to fund the interest bill on ballooning public sector debt.

With its lower tax regime, superannuation will still be the most attractive savings vehicle.

But there’s only so much blood the politicians can extract before the tax-paying patients become anaemic.

That’s when ‘adjustments’ to welfare programmes will be made.

And that’s when boomer retirees are going to be in the crosshairs of millennial politicians.

Those entering retirement and expecting an indexed Age Pension in the years to come should think again.

The concept of paying people an increased amount each year for 30 years or more is not sustainable. Tighter rules will be implemented.

Increase in the pension eligibility age. Tougher income and assets tests. The family home to be included in the Asset Test.

My suggestion is to look at building resilience and independence into your retirement plan.

In anticipation of a significant reversal in market fortunes, adopt a more defensive asset allocation.

Be prepared to wait patiently for the market to exhaust itself on the downside.

Then, when the market offers up a low-risk/high-reward proposition, consider increasing your allocation to beaten down equities.

In my opinion, we are at a major turning point in market history…think pre-October 1929.

The decisions retirees and pending retirees make in the near term, could have life-long repercussions.

With the prospect of a greater percentage of society becoming more dependent on government largesse, it’s never been more important to have financial independence.

The less dependence you have on the system, the greater the freedom you’ll have in the longer term.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.