And as I’ll explain shortly, the start of a chain reaction potentially leading to the break-up of the euro currency.

Big call, I know!

But if I’m right about this, the future will look very different. Not just for Europe but the entire world of money and markets.

Let me explain more…

Big consequences

OK, so what’s gone wrong this time?

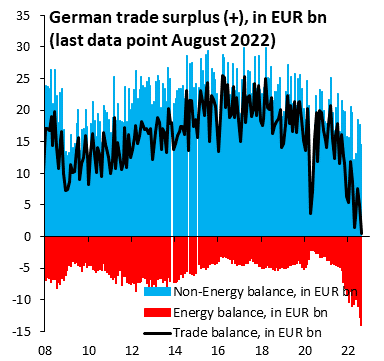

This chart explains it:

|

|

|

Source: IIF |

What you’re looking at is Germany’s trade surplus about to go negative (black line).

That means it’ll be importing more than it exports. Which essentially means it’s turning into a net spender rather than a net saver.

Why does that matter?

Well, German savings basically help fund their more debt-laden Eurozone neighbours. Countries like Spain, Portugal, Italy, and Greece.

In good times, this works out OK for all sides.

The payoff for Germany’s ‘generosity’ is that they get the benefits of a weaker currency (than, say, the Deutsche Mark would be), which helps make their exports competitive.

Meanwhile, their less fiscally responsible neighbours can use Germany’s strength (as a guarantor of last resort) to keep their own borrowing costs down.

This chart shows this might be all about to change…

Rocketing energy costs (as well as simply not having enough energy supply) are killing Germany’s manufacturing-based growth hub. This hurts their terms of trade and makes their exports uncompetitive.

It’s a double whammy.

And it means Germany can’t afford to carry the load for other countries for much longer.

As Robin Brooks, Chief economist at the IIF, noted:

‘The German trade surplus is gone. While Germany retools its growth model, it will draw down its fiscal space, so there will be less to go around for everyone else.

‘Europe hasn’t realized this yet, but structural reforms in labor & product markets are about to make a big comeback.’

In other words, Germany will be faced with a choice.

Use its savings to support its own economy?

Or to continue to fund its southern neighbours?

I think we know which option they’ll ultimately choose…

End of the World author Peter Zeihan also noted this important moment, tweeting:

‘Germany is rapidly shifting from the EU’s largest funder to a taker. I think it’s safe to say Europe is not prepared.’

But why is this such an existential threat to the euro currency?

Let’s move to that point next…

A major part of my new thesis for the next seven years

Last week I released a hypothetical timeline for Bitcoin [BTC] to reach US$1 million by 2030.

It may seem like an outlandish prediction, given where crypto markets sit right now.

But a collapse — or a structural shift in the euro currency — is a big driver behind this thesis. And that seems a more distinct possibility than most acknowledge.

As I predicted in the presentation:

‘2025 will be the year the euro experiment finally falls apart under the weight of member monetary imbalances.

‘Once more, I’m not going to get too deep into the quicksand of macroeconomics.

‘We’re looking at basic assumptions here.

‘And a basic assumption is Germany, facing an economic crisis of its own, refuses to support Italy, Spain, and other debtor nations.

‘This is how things look right now:

|

|

|

Source: ECB |

‘How long can frugal Germans support their big-spending EU partners?

‘Maybe when things are going well, they will happily do it.

‘But my prediction is by 2025, things will not be going well.

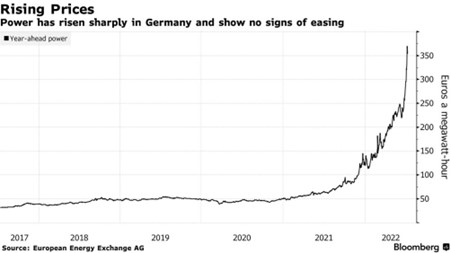

‘We’re seeing things start to unravel already, with surging energy prices providing the trigger point:

|

|

|

Source: Bloomberg |

‘German manufacturing is at a crisis point even today.

‘As Bloomberg pointed out:

|

|

‘As this plays out, what comes next?’

It’s funny, but in four short weeks after I wrote this, it doesn’t seem half as crazy now!

So…

What comes next?

The trillion-dollar question…

It’s a dog’s breakfast everywhere you look in Europe.

War on the doorstep, rising energy costs, debt costs soaring, and their most economically powerful member starting to weaken fast.

Even worse, I don’t think the Germans are going to get any help from their main ally, the US.

Indeed, just last Friday, a German minister was openly criticising the US over natural gas prices, saying:

‘Some countries, including friendly ones, sometimes achieve astronomical prices [for their gas]. Of course, that brings with it problems that we have to talk about.’

We’ll see how the US responds, but the OPEC decision to cut oil production last week won’t help matters.

And on the monetary front, the Federal Reserve clearly isn’t considering Europe at all in their decisions.

Fed member Christopher Waller said on Friday:

‘It’s not the Fed’s responsibility to tackle the issues of other countries.’

Meaning more rate hikes leading to a stronger US dollar — and all the big problems that’s causing in the rest of the world — look set to continue.

On a side note, economist Lyn Alden responded on Twitter to Waller’s comments, noting:

|

|

|

Source: Twitter |

It’s a great point…

I mean, why would any country — friend or foe — go back to investing in US debt after all this?

And what does that mean for the US reserve currency status long term?

Big questions that’ll play out over the next decade.

But back to the European situation.

Even within the block, tensions are starting to appear because of what Germany might do next.

As the Financial Times reported on Friday:

‘Spain and Belgium have issued warnings about the consequences of Germany’s huge fiscal stimulus package for the EU single market as the bloc attempts to muster a unified response to soaring energy prices.

‘The announcement of a €200bn fiscal stimulus package by Germany last week has prompted other EU member states to warn of unfair competitive distortions if individual states, particularly those with deep pockets, pursue large support measures.’

Can the Eurozone survive intact?

It’ll be hard.

History suggests European nations move further apart — to the political extremes — when tough economic times hit.

And the recent Italian election of far-right candidate Giorgia Meloni suggests that process is already underway ‘on the ground’.

Interesting times ahead…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: If I’m right on how this all plays out, we’re in the early stage of a monumental decade-long run for bitcoin.

Watch the full timeline presentation here and decide for yourself.