I know you think the gold price is going up. But it isn’t.

I know it looks like the gold price is on a tear. But it isn’t.

This chart has the Aussie dollar gold price up about $800 an ounce since 2017.

|

|

| Source: Goldprice.org

|

So why am I being snarky about the gold price not rising?

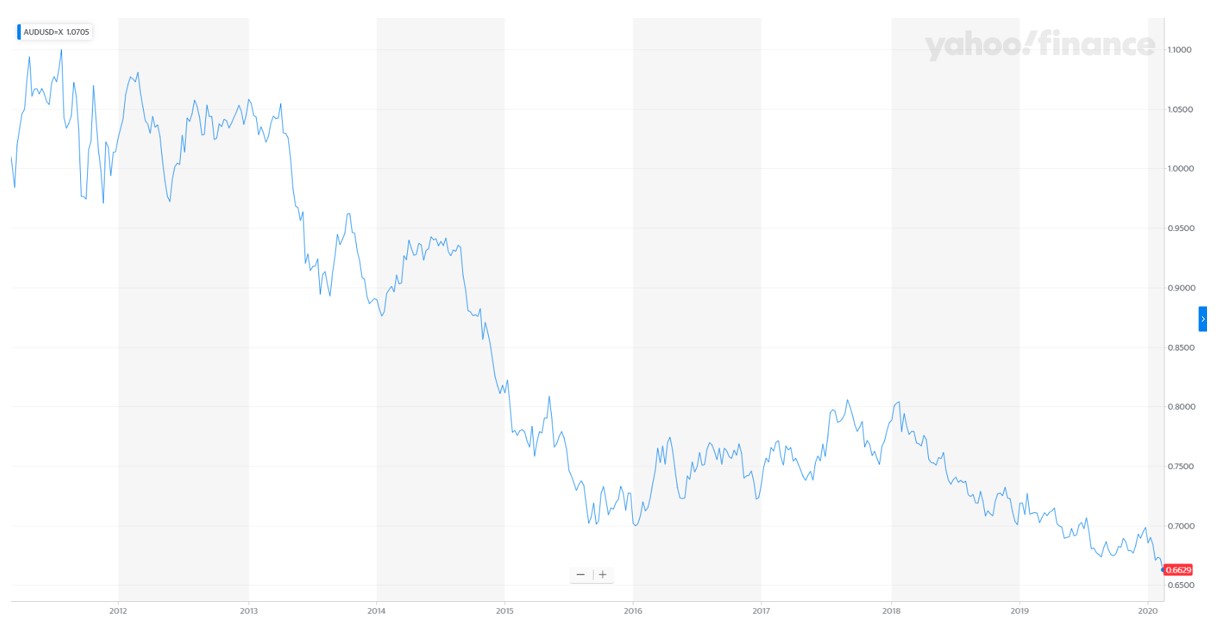

Is it because the Aussie dollar has plunged? It’s lost a third of its value since peaking in 2011…

AUD/USD

|

|

| Source: Yahoo Finance |

Well, the currency plunge has lit a fire under the Aussie dollar gold price, for sure. The US dollar gold price isn’t up nearly as much. But it is up too…

Only it isn’t. Not really.

No, you’ve got it all wrong, dear reader. The gold price isn’t going up at all. It’s the value of money that’s falling. The value of the numbers you use, whether they’re online, printed on cotton, or plastic.

Gold is money — it doesn’t change. It is the constant against which all other things are measured.

I know that sounds abstract, vague, useless, and just plain wrong. ‘Try and buy a beer with your gold then, Nick,’ I hear you say. There’s no need to write me that email. I’ve already got enough of ‘em.

But did you know the word ‘cash’ used to mean gold? People who used to go to the bank to get their cash out were getting their money out of the bank — their gold, not banknotes.

Banknotes were credit — an IOU that promised you real money: gold. Check out what’s written on many of those banknotes even today. You’ll find the words ‘Promises to pay the bearer,’ or something similar, on most notes. That’s a historical remnant of what banknotes used to be. Not money, but promises to pay real money — gold. They’ve just removed the key word in the sentence, making it meaningless.

Why the distinction between gold and money? Because fiat money — money that only has value by government decree — is dangerously flawed. Just think about how many dollars, yen, and euro have been created in the past decade. QE has flooded the world with fiat. While the gold supply has only gradually expanded at a consistent pace.

So, let me ask you, which of the two is really changing value? Not gold, it’s money that’s changing.

Why does all this matter to you?

Because, ever since we’ve departed from the belief that gold is money, and started pretending our fiat money is real money — that our bank notes are cash and that gold is a barbarous relic — the world has been a bungled financial mess.

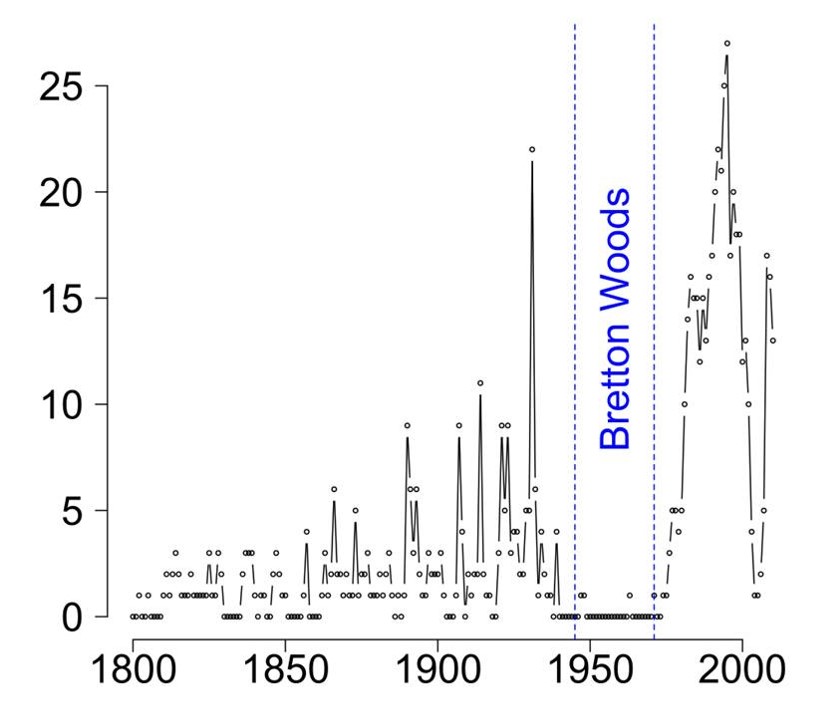

This chart, using data from Reinhart and Rogoff’s book This Time Is Different, was put together by David Eddy. It shows the number of banking crises over the years. And it highlights a particular era when gold was money under the Bretton Woods system.

|

|

| Source: David MC Eddy & This Time is Different, Reinhart and Rogoff |

Before and after the Bretton Woods system, banking crises are the norm. But during Bretton Woods, banking crises were few and far between.

Now there could be plenty of reasons for this. It’s not like the Bretton Woods system was the only thing that changed during that time.

But it’s worth noting that this is exactly what advocates of gold as money would expect.

Gold’s stability prevents the sorts of credit booms and busts which fiat money encourages. The credit booms and busts that become possible when the definition of money is controlled by academics, politicians, bureaucrats, economists, and public servants instead of just the gold supply.

I’m writing to you today for a simple reason.

If you believe that the fiat financial world is overstretched, that debt is overwhelming our economy, that money printing doesn’t lead to long-term stability, that banks are fragile and that we’ve lost our way, then you are probably wondering what happens next.

You’ll find the answer.

It isn’t a new answer. It’s an old one. A very old one. Older than the Rosetta Stone, in fact.

And it likely involves a return to gold as money. A return to the financial stability of the past.

The only question is whether you will follow the golden rule before or after the event: he who has the gold makes the rules. Because when the world’s political leaders reconvene once more — for the sixth time in 98 years — to rework the global currency system, those with the gold will make the rules.

And they’ll stand to benefit from the new system.

If the new currency system emulates Bretton Woods, the value of gold will have to soar to reflect the amount of money printed since the end of Bretton Woods.

If the world turns to a new arbitrary fiat currency system, the price of gold will soar to reflect the risks and instability of doing so.

One man has his ear to the door where these decisions will be made. That’s how he predicted the Brexit vote, Trump’s election and past financial crises. And now, he’s literally written the book on what’s about to happen.

If you want to understand the coming currency reset, you need to understand the previous five resets first, then the possible currency systems that the global elites could turn to, and lastly their implications for your investments. But, most of all, you need a man on the inside, telling you how things are unfolding.

I’d like to introduce you to the man who will guide you through all that, and more.

| Until next time, |

|

| Nick Hubble, PS: Wall Street Insider Shares His Wealth Preservation Tactics. Click here to learn more |