Updated July 2024

Ever notice how everything is more expensive these days?

Rent…filling your car at the petrol station…groceries…

Just the other day, a box of cereal cost me $10!

Unfortunately, the cost-of-living crisis in Australia is worsening by the day.

While inflation has eased up a bit, the crisis is still far from over, ‘with some items still going up by double-digit figures’, says the Daily Mail.

The worrying part is that, according to my research, things could get worse in the future.

Not through inflation or a worsening economy…

But with a phenomenon called ‘deglobalisation’.

In today’s Fat Tail Daily article, I’ll unpack what this term means, how it will affect the lives of everyday Aussies, and the potential risks (and opportunities) in store for investors.

But before we can talk about deglobalisation, we need to talk first about its twin: globalisation.

What is globalisation?

No matter how bad the cost-of-living crisis gets, we’re still living in one of the most comfortable eras in history.

Everything is within easy reach these days.

You can buy Guatemalan coffee, Indian spices, Italian bucatini or Japanese electronics using only your smartphone…all at relatively affordable prices and delivered to your doorstep.

Talk about convenience!

You can thank globalisation for that.

But there’s more to this trend than just getting products from anywhere in the world at a moment’s notice.

Everything from energy and healthcare to entire economies relies on globalisation.

Consider the natural gas from the Persian Gulf that’s needed by China to fuel its gigantic manufacturing machine…

Or the iron ore from Australia that built China’s megacities and infrastructure projects.

Indeed, globalisation has given Western powers like Australia and the US instant access to cheap raw materials and goods…while feeding opportunities and ideas to third-world, developing countries.

It was a win-win scenario where everyone prospers.

But globalisation isn’t just responsible for our standard of living.

It also keeps us safe.

See, one of the less visible benefits of this economic trend is that it’s a powerful diplomatic weapon for preventing war. After all, trade connects nations and incentivises peaceful communication.

In other words, our modern world would hardly exist as we know it without globalisation.

The three great waves of globalisation

Most economic historians acknowledge there are THREE distinct phases of globalisation in the modern economy over the last 150 years.

The first began in 1870 and lasted 44 years.

Expanding railways and the emergence of international steamships set off a tidal wave of global trade.

It allowed established enterprises in Europe to trade readily with colonies in Africa, Asia and North America.

But all of this ended rapidly following the outbreak of the First World War.

This was the first major deglobalisation event.

Supply chains froze as Europe drowned in conflict. Nations became increasingly self-sufficient and restored manufacturing capacity.

No doubt, you can see some of the parallels emerging in today’s increasingly fragmented economy.

It wasn’t until the END of the Second World War, post-1940s, that global trade began to expand again.

Mass migration from war-torn Europe drove a global economic boom…riding well into the 1950s and 60s.

This was the SECOND great wave of globalisation.

North America entered a golden era at the time.

But that unprecedented phase of prosperity would end again in the early 1970s.

Geopolitical instability was rampant back then, thanks to the height of Russian and US hostilities, and the Vietnam conflict.

Again, the parallels today are uncanny.

From there, global trade remained fragmented for the next TWO decades…culminating with the 1987 ‘Black Monday’ stock market crash.

But from the ashes, the next major globalisation wave began to emerge by the early 1990s.

That wave continues today.

But with what’s happening in the world today, it probably won’t last for too much longer.

As the World Economic Forum noted in 2023, ‘There are strong signals that the era of globalisation is coming to an end’.

The cracks in globalisation are starting to show

Yet for most commentators and analysts, the end of globalisation is an unthinkable scenario.

The global trade network is far too interwoven…and impossible to break in a sophisticated modern economy.

A shift away from this economic paradigm would be catastrophic, to say the least.

Take China.

The country requires massive energy imports to sustain its position as a manufacturing behemoth.

According to the US Energy Information Administration, China’s crude oil imports averaged 11.4 million barrels per day in 2023.

That’s a sizeable 12% jump from 2022.

It’s the same dilemma for Europe.

Given energy sits at the heart of our modern economy, China and Europe stand to lose the most in a deglobalised economy.

Even our food supply could be threatened.

Few realise the important role America plays in feeding the planet.

More than just a dominant force across tech and finance, the US is also by far the world’s largest EXPORTER of food — reaching $196 billion in 2022, according to the US Department of Agriculture.

This also makes the US the world’s largest IMPORTER of fertiliser like potash, potassium and nitrogen.

If deglobalisation disrupts all that, a global food crisis is likely to happen.

Indeed, maintaining this supply is so crucial that the US continued to import record levels of fertiliser from Russia — the world’s biggest supplier — even as war broke out in Ukraine in 2022.

In fact, according to the United Nations’ Comtrade database, the US upped its Russian fertiliser imports by over 50%.

And in July 2022, the US Department of Treasury issued a fact sheet declaring the sale or transport of Russian fertiliser to the United States would be EXEMPT from trade embargoes.

Sanctions be damned when it comes to raw materials too important to lose!

(By the way, this is why I recommended the Canadian-based fertiliser play Nutrien [NYSE:NTR] to my readers in 2023. Read the rationale behind this pick here.

But who knows how long this fragile supply chain will remain intact?

Geopolitical conditions haven’t been this tense since the early 1970s.

Just look at what’s happening in Kyiv, Gaza, the Taiwan Strait, and the Strait of Hormuz…or the tensions between Russia, the US and China.

Our third and most prosperous globalisation event is deteriorating rapidly.

Weak global leadership and ineffective diplomacy could lead us to war and bring globalisation to a rapid end.

For most of the world, this promises tremendous disruption to trade and a comfortable way of life.

But for commodity-focused investors, it’s not all bad!

Deglobalisation could lead to a commodity boom

Historically, commodities did extremely well in past deglobalisations.

The reason is that the events leading to the demise of global trade helped foster higher prices.

For example, the 1970s deglobalisation witnessed record prices for copper and nickel.

But it was in 1914, shortly before the first major globalisation event, that history saw one of the greatest copper surges ever.

As tensions heightened and war loomed closer, nations spent more on boosting their military. This required massive amounts of metals like copper.

Indeed, according to data published by the US Federal Reserve, copper traded for almost $12,000/tonne (in real terms).

A price matched only at the height of the China-led infrastructure boom in 2011.

History shows that conflicts and war are the biggest drivers for higher commodity prices, especially critical metals like copper.

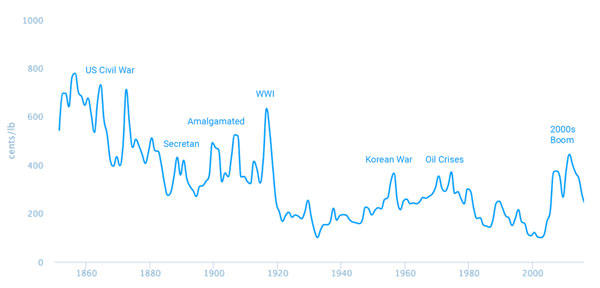

If you have any doubt about that, just take a look at the historical copper chart, below.

| |

| Source: USGS |

Note how copper prices spiked in line with major geopolitical tensions.

It’s why I have long held the belief that ‘Dr Copper’ is falsely used as an indicator of global growth. (Check out this article to read more about copper.)

As the chart above shows, copper tends to do better during times of conflict.

Now, on the chart above, you may have noticed the absence of a copper price spike during the Second World War.

That’s because, in 1942, the US government imposed price controls aimed at preventing runaway prices amid unprecedented demand.

The price of copper was fixed at $0.12 per pound.

The government also issued subsidies to high-cost mines to maintain continual operation.

But there’s another key driver for higher commodity prices that many miss.

And it could present a potentially lucrative investment opportunity.

A smart strategy to benefit from deglobalisation

One side effect of deglobalisation is that it will force nations to become self-sufficient as global trade breaks down.

Especially when it comes to securing critical metals (read my article here if you want to know more about this topic).

That means the West will be forced to source and process its raw materials AWAY from China.

But there’s a BIG problem.

China currently dominates the mining and processing of numerous key commodities — rare earths, lithium, graphite, steel, cobalt and copper, among many others.

Even when these minerals are mined elsewhere, they’re all sent to China to be processed.

It’s a ‘know-how that is unique worldwide’, says Hanns Gunther Hilpert of the German think tank SWP.

Take our country as an example.

Despite having the world’s largest reserves of commodities like gold and titanium, mining companies in Australia don’t actually do much of the processing and refining.

For example, according to Benchmark Intelligence, the country produced just 1.2% of the world’s refined lithium product in 2022…even though we’re responsible for a whopping two-fifths of global lithium mining!

The only solution is for Western countries to build fully integrated mining projects outside China.

This is already underway.

Some miners are already incorporating downstream capacity into feasibility studies.

The US also plans to spend $2 trillion over the next 10 years to bring manufacturing away from China and back to home soil.

Needless to say, this mad scramble could trigger a construction boom worldwide and require untold amounts of critical metals.

That could spell a huge payday for mining and resource companies. And investing in these stocks might be a good idea.

But I’m seeing a potentially smarter alternative:

Mining service stocks.

And I’m looking at one specific pick to benefit the most.

Presenting Mader Group [ASX:MAD]

Mader Group [ASX:MAD] is a traditional mining service company specialising in equipment maintenance.

I recommended this stock in January 2024 to the subscribers of my advisory service, Diggers and Drillers (click here if you’d like to learn more).

The company offers repair and servicing for virtually every piece of equipment that moves on a mining site.

Mader Group was established in Perth back in the glory days of the early 2000s resource boom.

But unlike many of its peers, the company navigated and survived the commodity ‘depression’ years from 2013 to 2019.

Today, it has grown a sizeable footprint in the niche field of mining maintenance.

See, breakdowns are a major threat for miners, and Mader’s business is built on keeping these operations running 24/7.

The company deploys specialist engineers and technicians across Asia, Africa and the Americas, repairing and maintaining diesel fleets, crushers, railway lines and processing facilities.

But Mader has its eyes set on significant growth in the years to come as miners shift towards full integration.

You see, the miners will need to build sophisticated infrastructure. And these facilities require specialised maintenance.

That means more potential business for Mader, leaving it with a larger pay cheque.

And despite a lacklustre performance for the sector last year, the company recorded strong growth.

In its latest quarterly, it reported $185.1 million in revenue. That’s up $49.8 million from this time last year. A sizeable 37% year-on-year increase.

As miners burn through cash in this high-cost operating environment, Mader’s earnings continue to surge, with no evidence of slowing down any time soon.

In its latest guidance, the company expects total revenue of $770 million for FY24. That would be a $161.2 million boost on FY23 or an annualised increase of 26%.

But can Mader continue growing?

It’s important to note the company already trades on a rather steep FY24 P/E multiple of 27.

No doubt, the outlook here rests squarely on activity in the mining sector.

But as capital makes its way into mine expansion and development, shifting downstream capacity AWAY from China…

…a new capital expenditure boom could be on the way.

That will deliver strong demand for service-based mining stocks on the ASX, like Mader.

Risks and opportunities

The biggest benefit of a service stock is that its revenue is not typically tied to a single commodity.

As long as commodities as a whole lift up, these stocks could see strong growth.

And with strong commodity demand from deglobalisation and the green energy transition, this could be a likely scenario.

But in Mader’s case, one key commodity could expose it to short-term risk.

You see, right now, 72% of the company’s current income is sourced from Australia-based operators.

Much of that is derived from iron ore clients — mostly from China. So, when China potentially loses in a deglobalised economy, its demand for iron ore could decrease.

And stocks tied to major iron ore projects, including Mader, could be affected.

Fortunately, the company is countering this by rapidly diversifying its client base.

In its latest quarterly, Mader delivered around $48.5 million over Q1 FY24 from North American contracts.

While that was just around one-quarter of its total revenue, it represented the company’s fastest-growing market. Up around 84% from last year.

US reshoring efforts are driving this shift.

For example, the US Inflation Reduction Act (IRA) requires American companies to untangle links with existing Chinese interests.

It means the world’s largest manufacturers will need to secure alternative sources of raw materials under law.

This is already having major impacts on the mining industry across the globe. Mader knows this.

Shifting into the North American market is a clear signal that the company is looking to tap into this future growth market.

And while the IRA could be a major problem for Australia’s iron ore miners, Mader still has plenty of time to deleverage itself while benefiting from historically high iron ore prices.

Your next steps

With the potential for deglobalisation growing by the day, no doubt Mader’s prospects will continue to shine brighter.

But it isn’t the only way to play this trend, by any stretch.

There are plenty of other Australian mining stocks with the same potential as Mader (such as this mining company).

How do I know this?

Well, I watch the mining sector daily, trying to spot investment opportunities like these that most people miss out on.

It also helps that I have decades of experience as an exploration geologist…and know quite a few insiders in the industry!

If you’re keen to hear more from me, I invite you to subscribe to Fat Tail Daily. You’ll get regular insights, ideas and news on the mining industry, straight to your inbox.

And I’m confident that you won’t hear about these things anywhere else — especially not in the mainstream media.

It’s not just mining…

You’ll also get some great content from my fellow editors, delving into various sectors from small-caps to crypto.

Best of all, it’s FREE, so there’s zero risk to join.

Or, if you’re looking for specific, actionable advice for investing in the mining industry, you can consider my premium advisory, Diggers and Drillers.

This is where I identify specific mining stocks in Australia that you can invest in, including alerts on when to buy and sell them, hopefully for maximum profits, or, if things don’t pan out as expected, for minimal loss.

It’s a more guided experience for serious investors, who are prepared to take on the volatility and added risk that comes with mining investment.

Click here to learn more about Diggers and Drillers.

Regards,

|

James Cooper,

Editor, Diggers and Drillers

Comments