Established miner Evolution Mining [ASX:EVN] has announced a big expansion. The $7.6 billion market cap gold miner will buy an 80% interest in the NSW Northparkes Copper-Gold Mine.

EVN will purchase the stake from the Chinese CMOC Group after winning an auction versus its rivals. The bold move expands Evolution’s operations and positions the company in the copper market.

Evolution’s stock is on hold, but last traded at $4.14 per share. The past 12 months have been strong for the miner, up 44.76% as gold prices remain high.

So what are the terms of the deal, and how will the company’s shares trade?

Source: TradingView

Acquisition and raise

The acquisition will include an upfront cash consideration of US$400 million and a contingent consideration of up to US$75 million.

To fund the deal, EVN will offer an AU$525 million underwritten institutional placement. Eligible shareholders will also be offered AU$60 million in non-underwritten shares.

The placement will be $3.80 per share, an 8.2% discount to the last close.

A new AU$200 million 5-year term debt facility will also be sought. The extra cash will assist with integration costs and general working capital.

Source: EVN Presentation 5-12-23

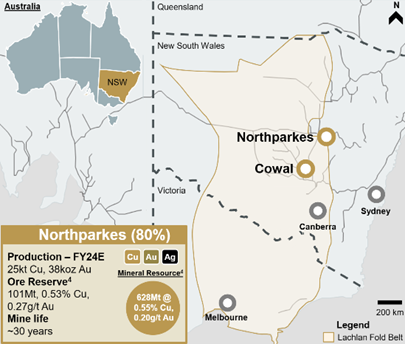

The remaining 20% interest in the Northparkes is owned by Sumitomo Metal Mining — an arm of CMOC— maintaining a joint venture.

Evolution has also agreed to enter an offtake agreement with another CMOC Group subsidiary, IXM. Under the deal, IXM will purchase the copper concentrates produced from mining.

Another rider on the deal seems to be Triple Flag Metal. EVN has agreed to assume the obligations of CMOC to deliver a percentage of their gold and silver to Triple Flags over the operation.

Commenting on the Transaction, Evolution’s Executive Chair, Jake Klein, said:

‘The acquisition of Northparkes represents a unique opportunity to add another quality asset to our portfolio, strengthening our positioning as a business that prospers through the cycle. Northparkes is a Day-1 cashflow producing asset with a ~30-year mine life, considerable upside and a well-established team that has a great track record and technical experience at the operation.’

An interesting part of the deal is EVN’s decision to acquire all the shares in CMOC’s Australian subsidiary, CMOC Mining Pty Ltd.

This approach cleverly avoids triggering any pre-emptive rights, simplifying the acquisition process. The deal will not require any regulatory approval to move forward.

Northparkes has a mine life of around 30 years with an ore reserve of 101 million tonnes at 0.53% copper and 0.27g/t gold.

Production estimates for FY24 are 24,000t copper and 38,000 ounces of gold.

Strategic implications of the deal

The deal is a big win for Evolution. While the details of the acquisition involve a lot of players, they are also secure. The many agreements give Evolution long-term partners and customers.

The purchase is also wise as it diversifies Evolution’s commodity portfolio. The gold-focused company now expects ~30% of its revenue in FY24 to come from copper.

The substantial copper asset complements its existing gold operations. Positioning the company to capitalise on the rising global demand for copper.

Its essential role in electrification and renewable energy technologies will drive this.

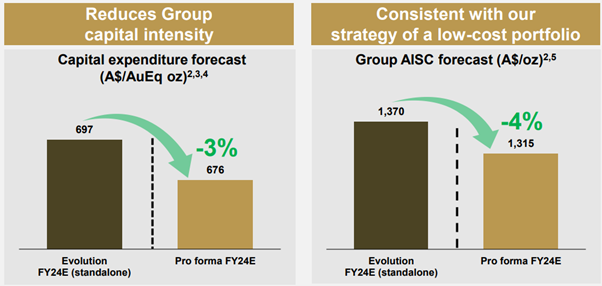

The Northparkes mine also has established infrastructure and a proven track record of production. The company estimates the deal will reduce its capital costs while raising production.

Source: EVN

This reduces the risks seen in new projects, such as exploration issues and infrastructure costs.

The mine’s existing ore reserves promise a sustainable production rate. EVN has forecasted a 5% increase in gold production and a 50% increase in copper. These ensure a steady revenue stream for Evolution.

The market’s response to this acquisition will be a crucial factor to watch. Investors will likely balance the long-term benefits against the costs and increased debt.

Shares will fall in the shorter term due to dilution. Given Evolution has a history of successful operations and expansions, the market could respond well.

Other players in the next mining boom

It’s not just Evolution moving into copper and other critical metals. Some of the biggest names are looking ahead to supply shortages.Top of Form

As governments and Energy giants like Origin look to move towards renewables, the demand for a new list of metals is about to explode.

But the crazy part is that demand is nowhere near catching up.

As miners invest in the future high demand of critical energy niches, they have the potential to outperform the market.

Our resident Geologist James Cooper has been watching the ASX miners to find a new breed of resource stocks that will lead the charge.

He reveals them in his latest stock report, ‘Three ASX Commodity Stocks for the New Age of Scarcity‘.

Regards,

Charlie Ormond

For Fat Tail Daily