1) If you ever sit there wondering just how high the US stock market can go or if it’s already a massive bubble, today’s Daily Reckoning Australia is for you.

A paper crossed my desk last week that shows just why US stocks keep soaring. It’s called money!

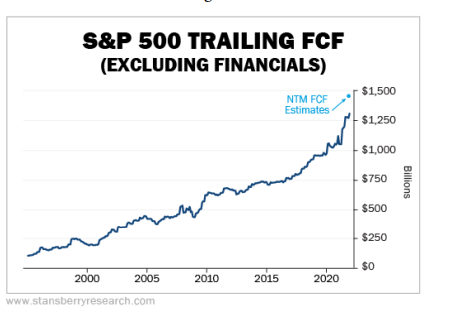

But it’s not QE or low interest rates. It’s the astonishing rise in free cash flow, mainly from US technology companies.

A colleague from Stansberry Research put together the following chart:

|

|

|

Source: Stansberry Research |

That’s the free cash flow of the US market growing over time. This has been the driving force behind the US bull market since 2009.

That’s the macro view. You can see the micro view in Google’s latest quarterly results. Their revenue grew 43%.

Think about that for a moment. Google is already an enormous company. It’s also been listed for years. And yet it’s still growing at high rates.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

And because it is a ‘capital-efficient’ business, a lot of that revenue turns into free cash flow.

This is the money Google can use to buy back stock, pay dividends, or reinvest in the business and new technologies.

Does this chart tell us where the US stock market goes from here? No.

But it’s a reminder to be a little cautious whenever you hear an extreme view that the US market is going to collapse tomorrow. Supportive foundations are there.

2) Money hitting the bank account — that’s what investors want to see over the long haul.

It’s why Warren Buffett says the stock market is a voting machine in the short term, but a weighing machine in the long term.

This is one reason I’ve told my subscribers to accumulate Real Estate Investment Trusts (REITs) in the last 12 months or so.

They pay out good dividends (from their earnings) and have lots of valuation and development upside if you look a few years out.

Here are the returns we’ve got so far:

- REIT 1 = 33%

- REIT 2 = 11%

- REIT 3 = 10%

- REIT 4 = 33%

There may even be something of an arbitrage (‘arb’) opportunity in this sector, between the ASX and the private market.

The Australian Financial Review reported last week:

‘Analysts Lou Pirenc and Andy Mac-Farlane also tipped further consolidation in the real estate investment trusts sector, given the “mispricing’’ of assets held by these trusts compared with the prices being paid for similar assets in the direct market…

‘Looking more broadly at the REITs, Mr Pirenc said Jarden was “quite positive on the sector overall”.

‘Demand for commercial property is exceptionally strong at the moment.’

The gist is that some commercial property investors are prepared to acquire real estate on a 3% yield. The ASX REITs I’ve gone over pay out 5–6%.

These high dividends (relative to the puny deposit and bond rates available) were one reason I keep banging the table about them.

I’m in the process of convincing our algorithm guru to data mine the sector to identify more opportunity here.

I’ll keep you posted if he discovers anything juicy!

Real estate stocks, in general, offer rich pickings at the moment. The sector has sold off recently due to interest rate volatility.

However, long term I remain very bullish indeed. One reason is that the Australian banks keep pumping out mortgage debt. This pushes more money into the market.

I said as much to a friend yesterday.

His partner is pregnant. He wanted to know if the Melbourne housing market was likely to go backwards anytime soon to help them get in cheaper.

It might slow. But there’s almost no chance of a big crash anytime soon. And even if there was, he wouldn’t be able to get a loan in that scenario.

Such is the web we weave. You can either be a victim or exploit it.

Regards,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.