The Tesserent Ltd [ASX:TNT] share price is up today after acquiring Secure Logic and extending its debt facility.

At time of writing, the of Tesserent Ltd [ASX:TNT] share price is flat, trading at 27.5 cents.

TNT is keeping investors busy with a string of announcements today.

The cybersecurity company released two big updates today — one concerning an extended debt facility and one concerning the acquisition of Secure Logic’s Managed Security Services business.

The news follows strong investor interest in TNT of late, as Australia beefs up its cybersecurity presence.

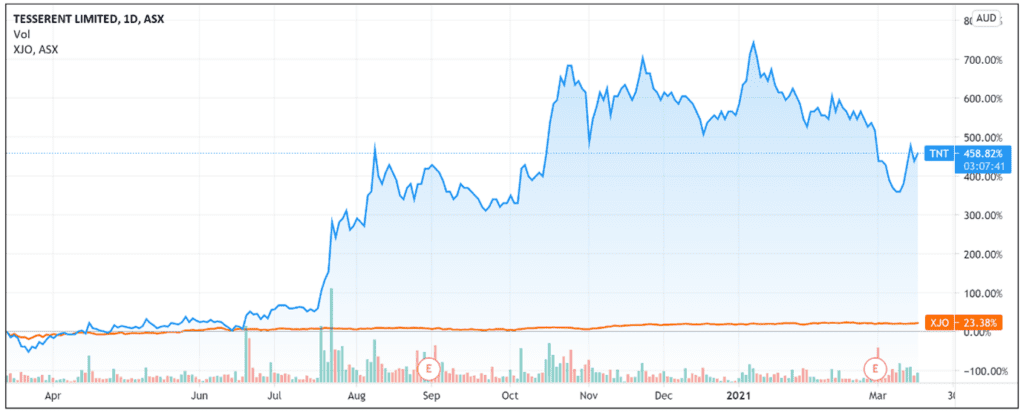

The TNT share price is up 540% over one year, although the recent tech sell-off saw the Tesserent share price down 14% YTD.

Let’s take a closer look at the company’s ASX announcements.

Source: Tradingview.com

Source: Tradingview.com

Tesserent acquires Secure Logic

Here’s a quick overview of the acquisition:

- TNT acquires Secure Logic’s Managed Security Services business

- Acquisition will deliver $9 million in recurring revenue and $4.2 million in sustainable EBITDA, according to the company

- TNT says the acquisition is set to strengthen TNT’s government division by new cross-sell opportunities

- The acquisition entails that earnings, cash flow, and EPS are ‘immediately’ accretive

- The acquisition establishes an exclusive strategic partnership to distribute its TrustGrid and AttackBound products across Australia and New Zealand

Secure Logic operates a 24/7 Security Operations Centre in Sydney, working mostly with NSW and federal government departments and agencies.

Four Innovative Aussie Small-Cap Stocks That Could Shoot Up

The firm also has further sales offices in Singapore, Kuala Lumpur, and Bangalore.

An accretive acquisition aims to integrate two companies to produce a combined value greater than the individual companies on their own.

A successful accretive acquisition depends on a smooth and effective integration.

TNT believes the integration will go that way, stating in the update that the acquisition will bring about ‘significant synergy benefits.’

Tesserent extends debt facility

TNT’s acquisition was no doubt aided by an influx of capital announced in today’s debt facility update.

The company entered a new agreement with its existing debt facility provider, PURE Asset Management (PURE), to increase TNT’s debt facility.

TNT’s capacity was raised by $20 million with the explicit aim to ‘fund near-term acquisitions in the pipeline.’

This means that TNT’s total debt facility is now $35 million, with the interest rate negotiated down from 8.9% to 8.5% per annum.

As part of the arrangement, TNT granted PURE 44,444,445 warrants exercisable at 45 cents.

TNT’s current cash balance is now over $5 million.

Tesserent share price outlook

As we covered last week, TNT posted impressive turnover growth in its FY21 half-yearly report.

TNT’s turnover grew by 500% YoY, totalling $36.5 million.

This was driven in part by five acquisitions over the relevant reporting period.

Commenting on the results, TNT stated that it is ‘on track to deliver … $150 million turnover run rate at June 20 2021.’

TNT chairman Geoff Lord commented that the Secure Logic acquisition ‘contributes to our FY21 $150 million turnover annualised run rate ambition.’

Secure Logic’s FY20 turnover of $9 million is solid but to meet its ambition, TNT will need to work hard to integrate all its acquisitions such that the integrated whole generates more revenue than its components would on their own.

As Chester Asset Management’s Anthony Kavanagh noted in Livewire Markets this January, ‘roll-ups can be hit and miss so we are taking the time to understand whether TNT can successfully execute on their integrations.’

Mr Kavanagh also pointed out potential local and international competitor risks.

According to Kavanagh, TNT could face competition from private equity-owned CyberCX, if CyberCX comes to market in the near term.

Mr Kavanagh concluded that while cybersecurity in the connected world will become increasingly important, he thinks ‘companies will gravitate towards industry leaders and trusted brand names’ like IBM [NYSE:IBM], Accenture Plc [NYSE:ACN], and the Big Four accounting firms.

If you’re looking for more tech-based stocks then I’d recommend our latest report, which delves into the heart of the budding AI sector across the ASX, including our top five picks that could follow in the wake of BrainChip.

For more information, and the names of those five stocks, click here.

Regards,

Lachlann Tierney,

For Money Morning