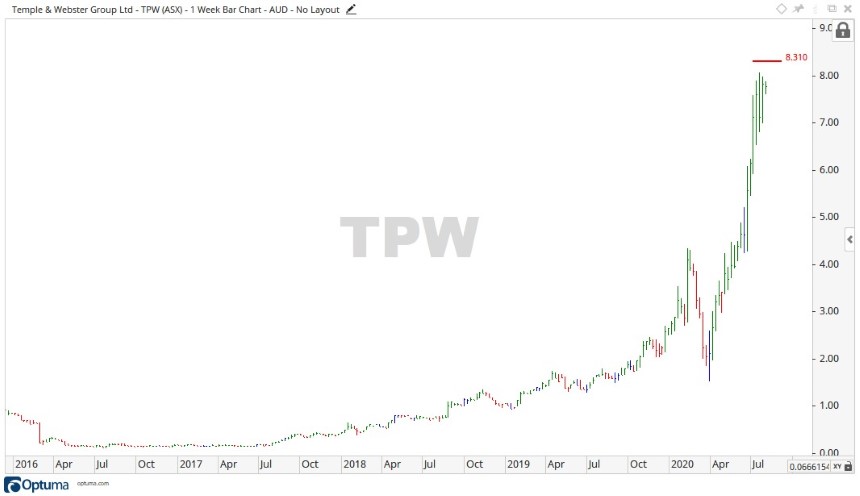

The share price of Australia’s leading online retailer of furniture and homewares, Temple & Webster Group Ltd [ASX:TPW], is up 6.81%. The TPW share price is now up to $8.31, at time of writing.

Recently announcing their full year financial results, the company is setting a string of all-time highs.

Source: Optuma

What’s happening at Temple & Webster

The onset of COVID-19 virus this year has created some bizarre business conditions. Some companies such as the airline industry have been severely punished by a near complete halt on international travel, while others have seen massive rewards.

Those in e-commerce and fintech are the big winners, and TPW can count themselves in that group right now.

In a recent market announcement, the company released their full year results, and despite the massive run up in share price, it appears to have exceeded expectations.

Here were the highlights:

- Full year revenue of $176.3m up 74% year on year (H2 revenue up 96% vs pcp; Q4 revenue up 130% vs pcp)

- EBITDA of $8.5m, versus $1.5m in the prior corresponding period

- Cash flow positive year with ending cash of $38.1m and no debt (excludes proceeds from recent $40m placement)

- Active customers up 77% year on year

- Trade and Commercial division up 68% YoY’

As you can see, the combination of the current situation of people being stuck at home and the boost in financial results is pushing the stock price of Temple & Webster higher.

Where to from here for Temple & Webster

At this stage, there looks to be no slowdown in the current pandemic, but there does appear to be one in the making for the overall economy of Australia.

The unemployment rate is hitting 7.4%, with nearly one million people out of work. At some point, you would think the spending on e-commerce may ease…

At the start of July, we looked at Temple & Webster when the price was sitting at $6.31.

Now with price at $8.31, some $2 higher it looks like that growth may just be tapering off.

Source: Optuma

The chart shows that price action moved sideways for a short time before popping up to the $8.31 resistance level.

If the momentum can power through this level, then the level of $8.90 may provide future resistance.

On the downside, should the level of $8.31 prove too much and turn the TPW share price away, then the levels of $7.61 and $6.30 may provide support to a future decline.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.