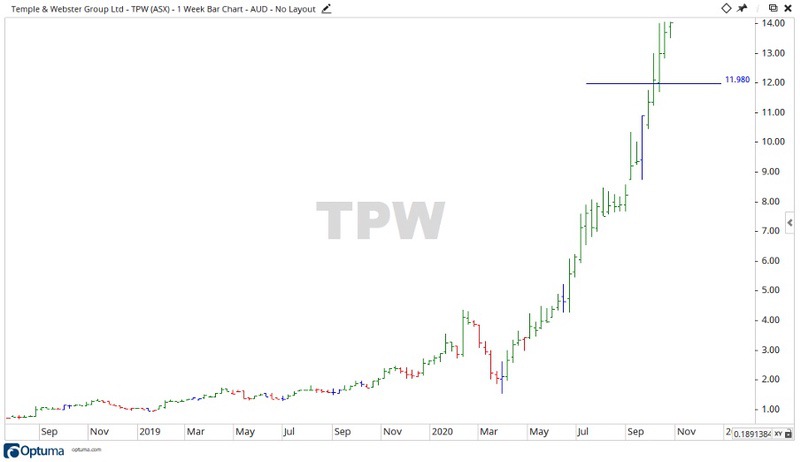

The Temple & Webster Group Ltd [ASX:TPW] share price is taking a dive, down 14.61% to trade at $11.98 at the time of writing.

2020 proved to be a year some could only dream of in the fintech and online retail space.

The knock-on effect of the COVID-19 pandemic is people stuck at home working and shopping online.

For TPW this meant strong growth in sales and their market cap is now over the $1 billion-mark.

But it appears nothing goes up forever.

Source: Optuma

What’s been happening at Temple & Webster?

Being locked inside for large parts of the year due to the COVID-19 pandemic forced people to work and, in many cases, shop remotely.

This created dire circumstances for traditional businesses such as Sydney Airport [ASX:SYD] or Crown Resorts Ltd [ASX:CWN] — as people were not allowed to leave their homes.

On the other side of the coin, businesses that operated online such as Temple & Webster experienced an explosion in growth.

In a recent AGM announcement, the company spoke about its outstanding results for the year, a bean counter’s dream:

- ‘A record full year revenue of $176.3m up 74% on the year before. This growth accelerated during the year, with the second half growing 96% and the fourth quarter up 130% vs the prior comparable period (“pcp”).

- ‘Accelerated operational leverage delivered 483% growth in EBITDA to $8.5m v the pcp with adjusted EBITDA margins improving from 2.5% in FY19 to 5.3% in FY20.

- ‘During the second half the company received approval from the iOS store for the launch of Temple & Webster’s first mobile app, which is now live in the app store and is being piloted to understand usage before pushing further into this space.’

Where to from here for Temple & Webster?

The conditions that created the huge boom for the company may be the exact same thing that pushes them back down in the future.

With the COVID-19 pandemic being reined in, normal brick-and-mortar businesses are hoping to open back up soon.

This could create a more competitive environment for the business, with less of a captive audience available.

Source: Optuma

The TPW share price fell away in recent trading. Should the decline continue, then the levels of $11 and $10.34 may provide future support.

With Christmas just around the corner, the TPW price may be able to turn and move north again. Should the price move back up, then the levels of $13.31 and the most recent all-time high of $14.05 may come into play.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.