At time of writing the Temple & Webster Group Ltd [ASX:TPW] share price trades at $12.46 up 5.68%.

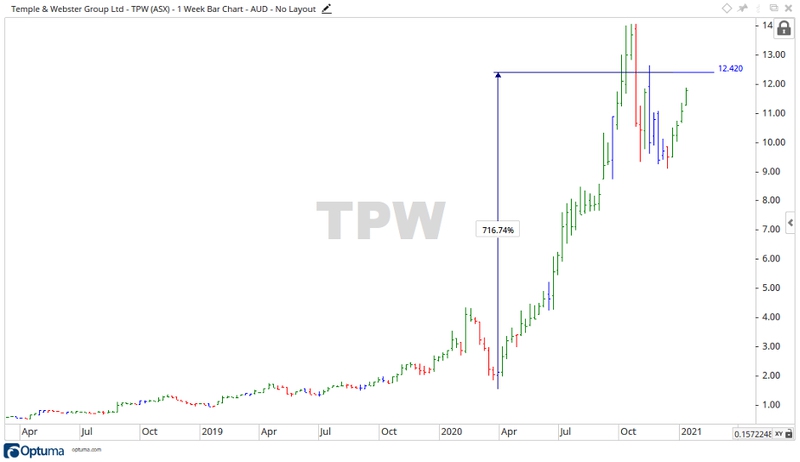

Throughout 2020 the company has shown impressive growth, rising more than 716%.

Source: Optuma

Temple & Webster and the pandemic

Most companies with a strong online presence saw profits rise throughout 2020.

COVID-19 forced governments to implement lockdowns and work from home orders for a lot of the year.

Along with these rules were the financial support tools of JobKeeper and a rise to the JobSeeker payments.

As unemployment rose, the financial support from the government seemed to plug the gap — which ramped up people spending online as they were stuck at home with not much else to do.

For companies like Temple & Webster, sales went through the roof.

Back in August, TPW announced:

- Full-year revenue of $176.3 million up 74% year-on-year (YoY)

- Active customers up 77% YoY

- First $2 million day in June

- FY21 has started strongly with YoY revenue growth of 161%

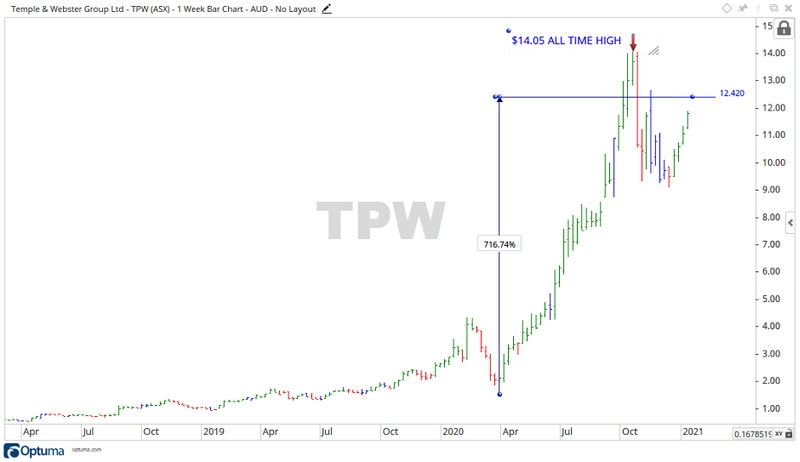

2020 proved to be a bumper year for the company with the TPW share price reaching an all-time high of $14.05 in October before retracing. See below:

Source: Optuma

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Temple & Webster and the people migration

The COVID-19 pandemic forced many people to work remotely from home.

Proving that going to an office everyday isn’t a requirement for many.

This appears to have led many to think ‘if I can work from home, then do I really need to live in or close to a city?’

By June 2020, Australia’s regional property market had increased by 3.4%, while its capital city counterpart had only grown by 1%.

With the need to be near an office no longer there and housing prices lower in regional areas compared to cities, people have started to make the move.

In Orange, NSW, local buyer’s agent Matt Ward from Aspect Buyers Agency says there has been an increase in demand for rural lifestyle blocks, particularly those closer to larger regional centres.

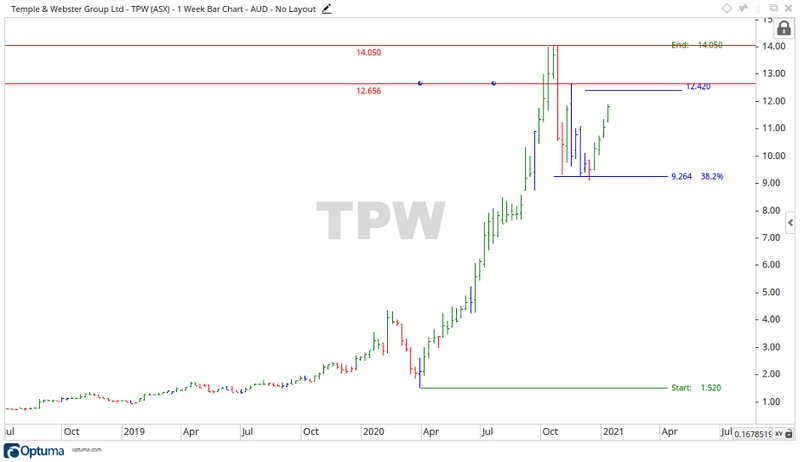

Source: Optuma

From the high in October, the price retraced just over 38.2% to $9.25 before heading up again.

A strong sign as it is less than a 50% retracement.

If the price continues up, then the levels of $12.65 and the all-time high of $14.05 may provide future resistance.

Should it fall back, then the level of $9.25 may become the focus.

As the pandemic continues, Australia’s population appears to still be in flux.

If people continue to up their lives and leave cities for the regional life, then the sales for Temple & Webster may continue to pour in.

Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Regards,

Carl Wittkopp,

For Money Morning

Comments