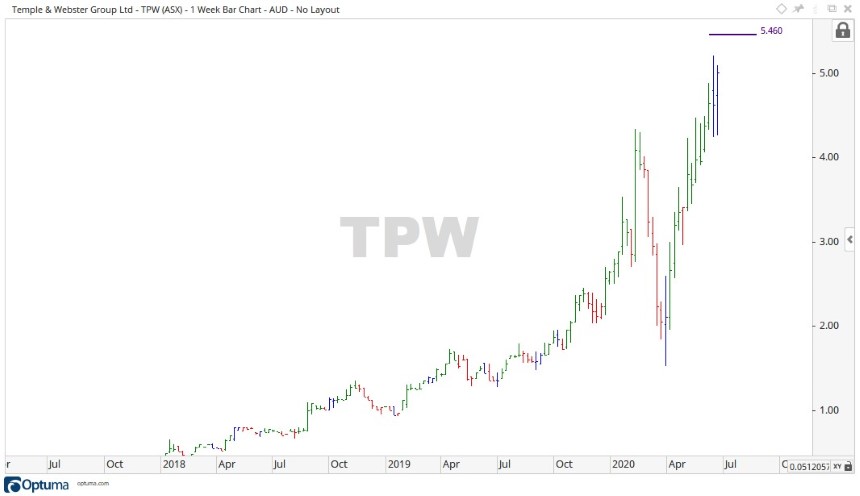

At the time of writing Australia’s leading online retailer of furniture and homewares, Temple & Webster Group Ltd [ASX:TPW], had shot up to create a new all-time high of $5.46, gaining over 8% from the previous day’s trade.

Source: Optuma

What’s caused the TPW share price to climb…

Temple & Webster run a business model which is a little different to most, in that it operates on the drop-ship model. Meaning when customers buy something, the product is sent directly from the supplier to the consumer, cutting out the need for Temple & Webster to have large warehouses and processing facilities.

This model gives the company a large degree of flexibility that its peers may not have.

Like all listed companies, currently Temple & Webster have not been able to escape the effects of COVID-19.

In February 2020, the company had made a new all-time high before plummeting 64.98%, coinciding with the effects on the market of COVID-19. Since then the company has not only recovered well but has gone on to new heights.

With many people at home and spending on setting up home offices and doing online shopping, this has benefited Temple & Webster well.

In an announcement in April 2020, co-founder Mark Coulter noted:

‘As a team we are proud that we have played a small part in being able to help Australians set up their homes during this crisis.

‘We also believe that many people who may not have shopped for their homes online before are experiencing the benefits of the channel, including convenience and value.’

Where to from here…

Temple & Webster released a business update on 18 June which outlined significant revenue growth, with the year to date being up 68% with on cash reserves of $29.2 million on 31 May 2020. Showing the company is in an extraordinarily strong position.

Looking at the technical side, from the low in March 2020, the TPW share price is now up over 295% to $5.46.

Source: Optuma

Should the price continue to the upside, levels of $5.80 and $5.50 may provide future resistance to the upside. On the downside if price were to fall, historical levels of $4.33 and $3.57 may come into play.

Source: Optuma

For more investable ideas that help to beat this pandemic, check out our ‘Coronavirus Portfolio’. A report that explains in detail how to make the most of this crisis. Including some crafty ways to navigate the choppy markets. Check it out for yourself, right here.

Regards,

Carl Wittkopp,

For Money Morning