The TechnologyOne Ltd’s [ASX:TNE] half-year results show profit after tax up 48% as SaaS revenue continues to grow.

TechnologyOne — one of Australia’s largest software as a service (Saas) companies — today released its HY FY21 results underpinned by continued demand for TNE’s SaaS ERP service.

The TNE share price jumped as much as 9% in early trade before settling to trade 2% higher at time of writing.

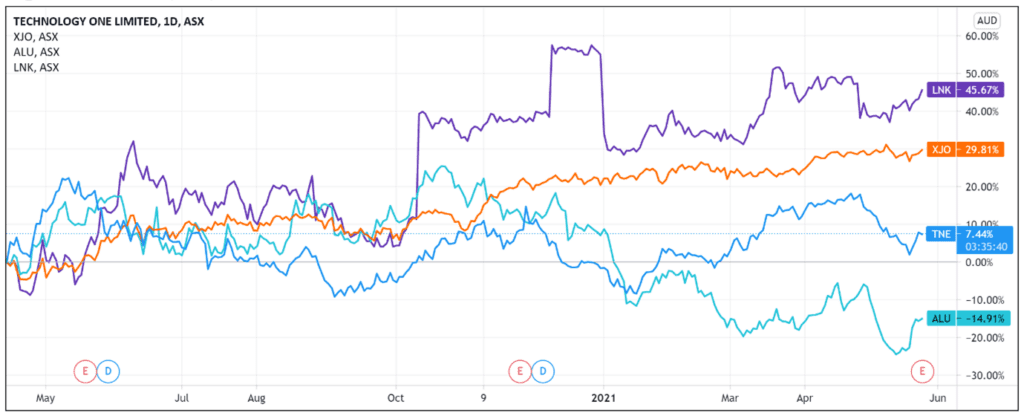

TechnologyOne shares are up 9% year-to-date but nonetheless down 5% over the last 12 months, underperforming the ASX 200 benchmark by 30%.

TechnologyOne’s half-year performance

For the half year ending 31 March 2021, TechnologyOne recorded profit after tax of $28.2 million, up 48% from the previous corresponding period.

TNE attributed the increase in part to ‘strong demand’ for its global SaaS ERP service, which was up 41%.

The SaaS revenue was boosted by a 21% rise in the number of large-scale enterprise SaaS customers, totalling 576.

TechnologyOne’s SaaS ERP software allows enterprise customers to run their enterprise business on ‘any device, anywhere at any time.’

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

According to the company, today’s release marks the 12th year of ‘record first half profit and revenue and record SaaS fees.’

Here are the other highlights:

- ‘SaaS Annual Recurring Revenue (ARR) of $155.8m, up 41%.

- ‘Revenue from our SaaS and Continuing Business of $140.6m, up 7%.

- ‘Total Revenue of $144.3m, up 5%.

- ‘Expenses of $107.4m, down 5%.

- ‘Cash and Cash Equivalents of $100.1m, up 20% from 31 March 2020.

- ‘Cash Flow Generation of ($2.9m) as expected, and will be strong over the full year.

- ‘Dividend of 3.82cps, up 10%.

- ‘R&D expenditure (before capitalisation) of $34.6m, up 14%, which is 24% of revenue.’

Some investors may spot that TNE’s SaaS Annual Recurring Revenue (ARR) of $155.8 million exceeds the company’s total revenue of $144.3 million.

This is because TechnologyOne’s SaaS ARR represents ‘future contracted annual recurring revenue at period end.’

TNE stated this is an unaudited, non-IFRS financial measure.

With total revenue up a modest 5% and R&D investment up 14%, the large profit gains came from lower expenses attributable to ‘significant efficiencies.’

A look at the company’s consolidated income statement shows total operating costs for the half year ending 31 March 2021 were $85.55 million compared to $95.01 million in H1 FY20.

The difference was largely attributable to a $10.97 million reduction in employee costs.

Interestingly, while TNE did post a 5% rise in total revenue and a 41% rise in SaaS ARR, its cash flow statement for the half-year period shows a 4.5% fall in customer receipts, with $142.98 million recorded in H1 FY21 and $149.79 million recorded in H1 FY20.

This contributed to a net cash inflow from operating activities of $18.57 million in the current period, down 26%.

TechnologyOne acknowledged that operating cash flow is ‘typically lower in the first half, however, will be strong over the full year.’

The software firm also emphasised that as it attracts more users to its platform, its margin will continue to grow.

Interim dividend

TechnologyOne today also declared an interim dividend on ordinary shares of 3.82 cents per share. This represents a 10% increase on the prior year.

The dividend is 60% franked, with the full amount of the dividend totalling $12.3 million.

For reference, TNE’s final dividend for the year ending 30 December 2020 was 9.41 cents and 8.78 cents in 2019.

Guidance and outlook for the TNE Share Price

TechnologyOne CEO Edward Chung wished to caution investors that ‘our first half result is not necessarily indicative of our full year.’

Mr Chung noted that as TNE’s SaaS business expands so, too, would TNE’s legacy licence fee business shrink.

This will have a ‘significant immediate impact’ on the firm’s profitability over the full year, but is a necessary pain as TechnologyOne pivots to its SaaS business and a recurring revenue model.

Mr Chung concluded by forecasting TNE SaaS ARR to grow more than 35% over the full year.

Long term, the software company expects its ARR to grow by about 15% a year once it winds down its legacy licence fee business.

TNE also forecasts total ARR to increase to more than $500 million by FY26. This is up from a current base of $233 million.

TechnologyOne’s full-year guidance includes net profit before tax for FY21 of $94.3m to $98.6m. This represents a 10–15% increase on FY20 underlying profit.

TechnologyOne has a market capitalisation of $2.8 billion and a trailing PE of 46.

Some investors may therefore prefer smaller stocks with potentially greater upside.

If you’re one of them, then I recommend reading Money Morning’s 2021 report on four high value small-cap stocks.

In the report, Money Morning’s market expert Ryan Clarkson-Ledward discusses four undervalued stocks that could potentially soar in 2021.

Regards,

Lachlann Tierney,

For Money Morning