I’ll be handing over the reins today to my colleague and Fat Tail Tech expert, Charlie Ormond.

Charlie heads Alpha Tech Trader, an advisory service focusing on opportunities in Australia and overseas.

I thought it would be interesting to invite him in and get his take on how tech is making its mark on mining.

As Charlie points out, there’s an important convergence underway. Mining is set to collide head-on with tech in the months ahead.

That spells unique opportunities for the next generation of Aussie miners IF you’re willing to look in the right areas!

So with that, over to Charlie…

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

***

Cheap Aussie Miners Could Soon Be Strategic Assets

As someone deeply entrenched in the US technology landscape and news cycle, I thought it might be worth your time to get a perspective from the other side of the hill.

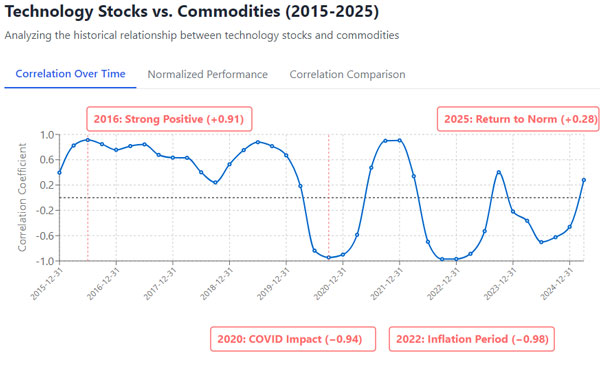

I say the ‘other side’ because commodities and technology stocks are traditionally at opposite ends of the market.

When one is in a bull market, the other is usually in the doldrums.

But it wasn’t always that way. For a decade after the 2007 Financial Crisis, commodities and the tech market were joined at the hip.

That positive correlation eventually broke down as the world economies tripped through successive bear markets around COVID and inflation, as you can see below:

| |

| Source: Fat Tail Investment — AI-Generated with data |

Now, it looks like we’re moving back into a market where the two are once again coupling.

The reasons for this are many-fold…

You could argue that it’s just part of the broader economic cycle.

Or maybe it signals the start of the next commodity supercycle?

In my opinion, the growing demand for commodities aligns with the need to power this tech boom.

Now, that probably isn’t news to you; we’ve all heard of AI’s insatiable power demands and the critical minerals needed to support it.

Every data centre, every autonomous vehicle, and every smart device requires these resources.

As AI continues its incredible growth, so will the demand for these minerals. Even if you hold a sceptical view of AI’s path, the trajectory of technology is undeniable.

So, if you believe these two sectors could continue strengthening their ties, then it’s important to consider their future… Side-by-side.

This has been on my mind recently as I’ve seen a constellation of news around this theme. And I believe it opens an exciting opportunity for Australian investors.

The idea revolves around these future-facing minerals and Trump’s desire to rewrite the rules of trade.

In this time of disruption, investors must grasp that critical minerals aren’t just commodities anymore; they’re strategic assets.

Critical Minerals: Our Trump Card

The global critical minerals trade is heating up with the demands from tech.

On one side sits America, flush with innovation but resource-poor. On the other sits China, holding a full house of processing capabilities.

And there, quietly observing from the corner with a hand full of aces, is Australia — with our red dirt holding some of the most valuable cards in the deck.

In recent months, we’ve seen a flurry of news surrounding Trump and critical minerals.

Since coming to office, Trump has continued to promote the idea of Greenland under the red, white, and blue flag. This is a pure geostrategic play to control its vast mineral wealth.

In late February, Ukraine and the US bickered over a deal to access Ukraine’s rare earth minerals as payment for its defence.

February also saw our own government attempt to use critical minerals as a bargaining chip to reduce the sting of steel and aluminium tariffs imposed by Trump.

In March, the Democratic Republic of Congo (DRC) offered the US a similar minerals-for-security deal. A move to thwart its growing domestic insurgency.

Also, this month, we saw Trump invoke wartime powers to increase the production of critical minerals. Meanwhile, China continues to boost its exploration programs to great success in the East.

These geopolitical games don’t have an end in sight. And now, it’s not just mining and tech executives talking about the importance of these minerals. It’s beginning to enter the broader public consciousness.

I think the next phase involves higher stock prices.

That makes now a great time for speculative investors to examine the list of potential miners in our own backyard and the US.

Investment themes to consider:

For investors, these trade shifts create both peril and promise. The peril lies in market volatility around moves like tariffs or export bans.

While the promise lies in China’s great demand or America’s desperate need for allies in its evolving resource strategy.

Here are some factors to consider in your hunt for rare earth and critical mineral stocks:

Trump Tariffs and the US Dollar:

Trump’s tariffs are distorting markets. Planes full of gold are flying into the US, and copper prices are soaring as traders attempt to front-run tariffs expected from the White House.

Similar signals are emerging around the administration’s desire to weaken the US dollar. This uncertainty and confusion could whipsaw trade and commodity pricing in the near term.

But for investors with a view on the horizon, these changes could be a boon, eventually shifting more US trade towards partners like Australia.

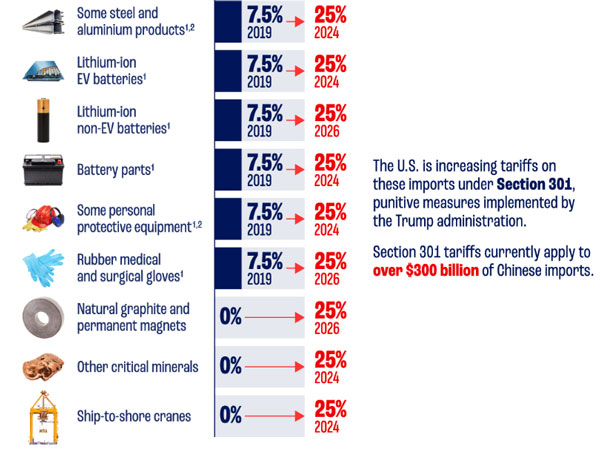

Here is a snippet of the tariffs the US imposed on China. Notice the natural graphite and lithium changes coming.

| |

| Source: Voronoi |

That could be a real tailwind for our domestic producers, many of whom sit at multi-year lows.

Yes, currently, many domestic miners export to China, but trade is rapidly shifting in Trump’s world.

And China is hardly a friend of our local producers.

The China Challenge: Price Manipulation and Market Control

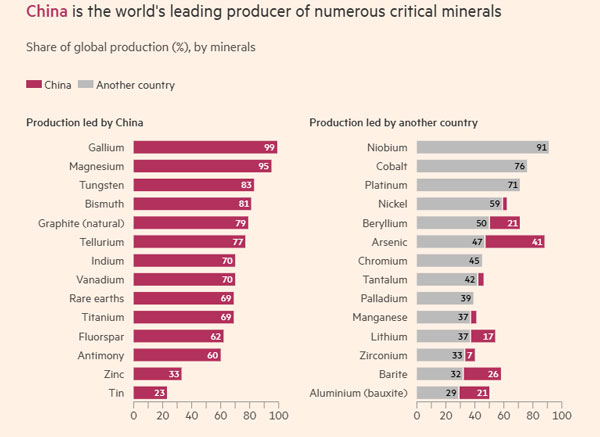

While America plots its trade revolution, China continues to dominate the critical minerals processing landscape. It refines nearly all the world’s rare earths and controls the lion’s share of lithium processing.

Just look at their stranglehold on global production in this realm, China is the world’s biggest producer of 30 of 44 critical minerals tracked by the US government.

| |

| Source: FT |

This gives Beijing extraordinary power to influence prices. We saw this in full force in 2022 when China issued a directive for producers to ‘guide product prices to return to rationality’ — causing rare earth prices to plunge by more than two-thirds with their oversupply.

Their price controls and dumping practices are hardly news to anyone following the sector, but now we can find new partners and saner prices. This is a huge opportunity for the future.

The forecasts for minerals demand are clear. Society and our tech will need more of these critical minerals in the future.

The US is loudly saying that it doesn’t want it from China. It wants it from security partners it can trust long term.

Australia also wants to reduce its reliance on China, and the government is supporting this through funding and subsidising local processing plants.

I think that’s a great opportunity for early investors.

Critical Minerals: Our Trump Card

So, what’s the strategy for investors looking to capitalise on this convergence of technology needs and geopolitical realignment?

Look for companies with strong government backing, clear partnerships with the US, and processing capabilities rather than mere extraction.

In the short term, demand can still come from China, while the government backing will allow them to fund their processing buildouts without overly diluting your shares.

In the longer term, strategic partnerships will ensure robust demand for domestic processing in the event of further splits in global trade.

While the sector may face volatility as geopolitical tensions evolve, the structural demand drivers from tech remain firmly in place.

For individual investors, this suggests opportunities in smaller, well-positioned miners that make attractive acquisition targets for larger players seeking to secure their supply chains.

With many stocks trading at multi-year lows despite improving fundamentals, the risk-reward here looks attractive for those with patience and conviction.

Regards,

|

Charlie Ormond,

Analyst, Crypto Capital and Alpha Tech Trader

Comments