Oil, gas and power exploration companies Talon Energy [ASX:TPD] and Strike Energy [ASX:STX] announced they’ve officially received multiple key regulatory approvals for their joint venture Walyering gas project.

The companies expect construction may take around six weeks, with first production to commence in April, with gas sales to shortly follow.

Talon also announced today a share purchase plan for $2 million shares at 14.5 cents each.

STX shares fell more than 5% by Tuesday afternoon, selling for 37 cents a share at the time of writing.

Meanwhile, Strike’s JV partner shares took a 6.6% hit after shares were revalued at 14 cents a share.

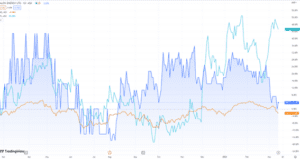

Strike is up 35% in the last full year, but Talon has plunged as far as 30%:

www.TradingView.com

Talon and Strike’s Walyering update

Power project partners Talon and Strike Energy have received the awaited key regulatory approvals for their shared joint venture Walyering, their gas project in WA.

This approval includes a cleared pathway to begin constructing the gas field and facility, and pushes along the companies expectations of achieving saleable gas by next month.

The JV partners have also received an environmental plan (EP) for the construction and the commissioning of their project, as well as works approvals, and a pipeline of licencing.

The companies expect construction may take around six weeks, with first production to commence in April, leading to the first gas sales shared by the two energy corporations.

Strike noted that there are minor risks to the start-up schedule, which are within integration and connection to the APA-owned Parmelia Gas Pipeline, and final quality assurances for the upstream facility.

Strike has now forecast gross upstream costs, including the production facility and the finalising of the existing well, at around $19.2 million. An additional $3.8 million in costs for connecting and metring to the APA Parmelia Gas Pipeline has also been tacked on.

The company said there have been cost increases linked to completing the well, as well as further increases to the scope associated with improving reliability at the facility. APA’s connections have also inflated the company’s original cost expectations.

Source: STX

Talon’s share buy-back

In addition to the project update, Talon also announced a share buyback for $2 million shares in a purchase plan, valuing shares at 14.5 cents each.

Earlier in March, Talon announced it had firm commitments from intuitional and sophisticated investors for a placement of 82,758,621 fully paid ordinary shares to raise $12 million, which were arranged at the same price per share.

Shareholders will be able to purchase up to $30,000 worth of shares, representing a discount of 14.9% to the VWAP (volume-weighted average price) over the last five trading days.

Talon will not be placing a shortfall under the offer, nor is the plan underwritten.

Shares will be issued as soon as possible after the closing date of 4 April.

Australia set to profit from the drilling boom

The wider energy industry is making massive bull market-like gains in the face of recession, interest rates, and wider market sentiment.

It’s almost like an alternate universe, the universe of booming drillers.

More of these booms are marked to happen for every single metal that can be found on the periodic table.

It’s been described as a ‘new golden age’ for junior explorers — and for investors who get in early.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

Yes, it’s very possible. Many are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

You may need a little help from our commodities expert James Cooper.

He’s found six ASX mining stocks that are heading to top the charts.

Regards,

Mahlia Stewart

For The Daily Reckoning