Graphite stock Talga Group [ASX:TLG] jumped on Tuesday after signing a non-binding offtake term sheet with Swedish company ACC for its lithium-ion battery anodes.

Talga revealed it will provide ACC with 60,000 tonnes of lithium batteries supplies across a five-year term, to be finalised by the end of November.

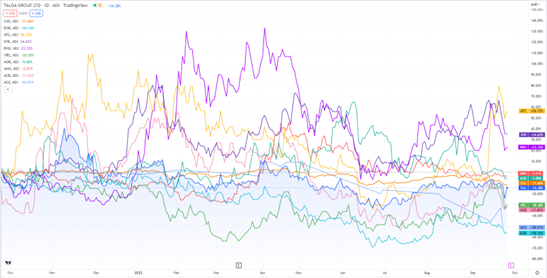

TLG was the best performing stock on the All Ords on Tuesday, rising more than 14% in late afternoon trade.

However, TLG shares are down 20% year to date.

Source: TradingView

Talga enters non-binding offtake agreement

Talga presented the possibility of a new era for its flagship Talnode-C Vittangi Anode Project today, with a potential new offtake partner in Swedish battery making company, Automotive Cells Company SE (ACC).

The two companies have organised a Term Sheet with Talga expected to supply 60,000 tonnes of Talnode-C to ACC over a five-year term.

Who is ACC?

ACC is a Swedish battery-producing company co-owned by world-leading vehicle manufacturing brands Mercedes-Benz and Stellantis.

Stellantis manufactures globally recognised automobile brands Alfa Romeo, Chrysler, Citroën, Fiat, Jeep, Peugeot, and Maserati.

It also owns battery company Saft, which is a subsidiary of TotalEnergies, a major player in the energy industry.

This is to be a legally binding obligation, put in effect with the intent to boost commercially reasonable efforts by both parties and to carry out necessary due diligence in bringing the binding agreement to official and effective status by the end of November this year.

Talga expects this agreement to ramp up production and supply volume across 2023 to 2025, even before the resource offtake, which is not to officially begin until 2026:

‘“The offtake term includes a floating price mechanism with a reference price to be agreed by the parties in the binding definitive agreement,” said Talga. “Which will be subject to standard conditions precedent for an offtake agreement of this nature.”

‘Talga’s mission to enable the world’s most sustainable batteries aligns well with ACC’s aim of accelerating the transition to cleaner, greener transport for all. ACC is currently establishing its first lithium-ion battery Gigafactory in France, with further Gigafactories planned in Germany and Italy to ramp-up total production capacity to 120GWh per annum in 2030.’

We’re focused on battery tech metals — here’s why

Vehicle manufacturers are securing supply chain deals like crazy.

Governments are throwing out initiatives and funding programs for support of battery production across the globe.

In the US, US$20 billion in low-interest loans are being handed out by the Biden Administration, the man himself has been campaigning to the public the importance of a renewable energy powered future, and how to get the US there.

Our energy expert, Selva Freigedo, says this global push to transition to EVs may result in a supply crunch.

And as there’s a new type of frenzy coming, the question is, how can you play it?

Regards,

Kiryll Prakapenka,

For Money Morning