TLG is also planning a share purchase plan to raise a further $10 million.

To complete the placement, TLG issued 20 million new shares, or 6.5% of Talga’s existing ordinary shares on issue.

The issue price is a 15% discount to Talga’s last closing price.

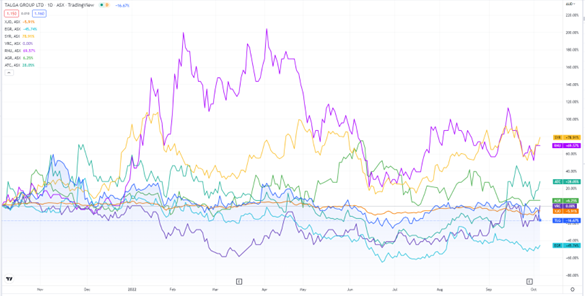

As a consequence, TLG shares were down roughly 13% in late Friday trade:

www.TradingView.com

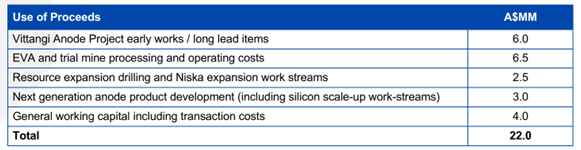

Talga’s $22 million institutional placement

The battery-tech metals miner announced commitments for its placement today, consisting of 20 million new fully paid ordinary shares, set at the price of $1.10 each to raise $22 million.

Talga reported that its unsubscribed funds raising saw strong support from a range of sophisticated, professional, and institutional investors, raising its pro-forma cash position to $27 million as at 30 September 2022.

The placement fine print included the following:

- ‘The placement of 20 million New Shares represents around 6.5% of Talga’s existing fully paid ordinary shares on issue

- ‘The Placement has a settlement date scheduled for Thursday 13th October, with New Shares to begin trading on the ASX on Friday the 14th October

- ‘Morgan Stanley Australia Securities Limited and Euroz Hartleys Limited will be jointly managing the placement, through facilitator UK-based Longspur Capital

- ‘Proceeds will be used to fund Talga’s Vittangi Anode Project, its Electric Vehicle Anode qualification plant, Niska expansion (including resource drilling and next generation anode development) and add to working capital’

Source: TLG

Talga’s Share Purchase Plan (SPP)

In addition to the Institutional Placement, Talga also announced that eligible shareholders in Australia and NZ can register to participate in a non-underwritten SPP to raise a further $10 million.

Talga’s shares will be offered at the same price as the placement outlined above, and the SPP funds will also be put to similar uses as previously outlined.

Participating shareholders can apply for up to $30,000 new shares via the SPP, which will be on offer from Friday, 14–28 October.

How Talga sees the future

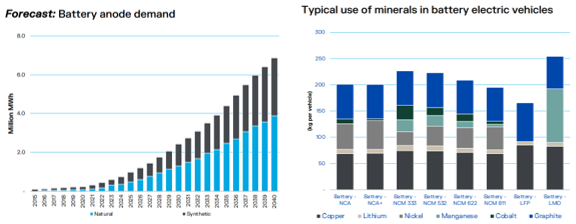

Along with the Institutional Placement and SPPS, the graphite miner also provided some insights as to how it views the future of its industry within a comprehensive Investor Presentation.

The battery minerals explorer said that due to rising energy and input costs for such commodities as needle coke and coal, for instance, it expects the production of synthetic graphite anodes to be a ‘fundamental catalyst for natural graphite anode demand’.

Graphite’s position as a sought-after commodity is especially strengthened through the necessity of it in the manufacturing of the everyday EV battery.

Talga said that natural graphite anodes are increasing in market share ‘due to favourable environmental footprint, lower cost profile and fast charge capability’ with silicon expected to enhance graphite components rather than replace them.

Source: TLG

The EV-battery race continues

The EV market is rapidly expanding, boosted further by government initiatives and funding programs supporting production across the globe.

Our energy expert, Selva Freigedo, thinks the global transition to EVs means the industry faces a supply crunch, which can send prices for battery materials soaring even higher in 2022 and beyond.

If you’d like to know more, why not check out Selva’s battery tech metals report.

You can find out more by accessing ways to play the EV-battery race, here.

Regards,

Kiryll Prakapenka

For Money Morning